Odoo的税收引擎非常灵活,它可以支持多种不同的税别,包括:增值税(VAT)、环境污染税、联邦/州/城市税、保留额、代扣所得税等等。在多数国家,系统已经预先配置了正确的税种。

该章节详细的介绍了如何在特定情景中定义新的税。

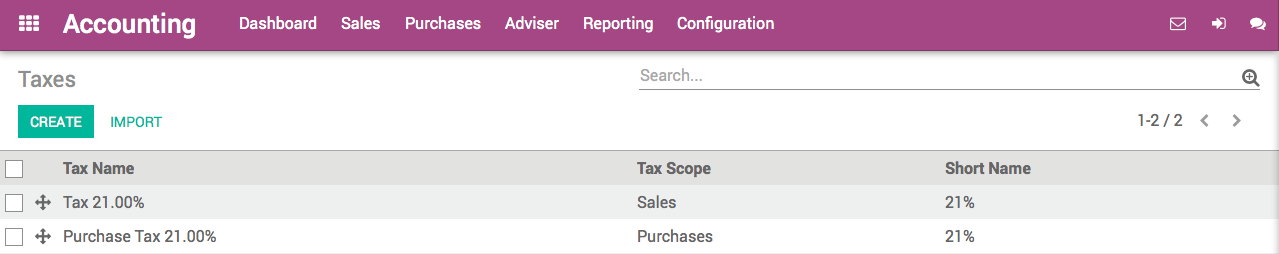

进入 ,菜单中可以看到全部税种,使用:销售税和购置税。

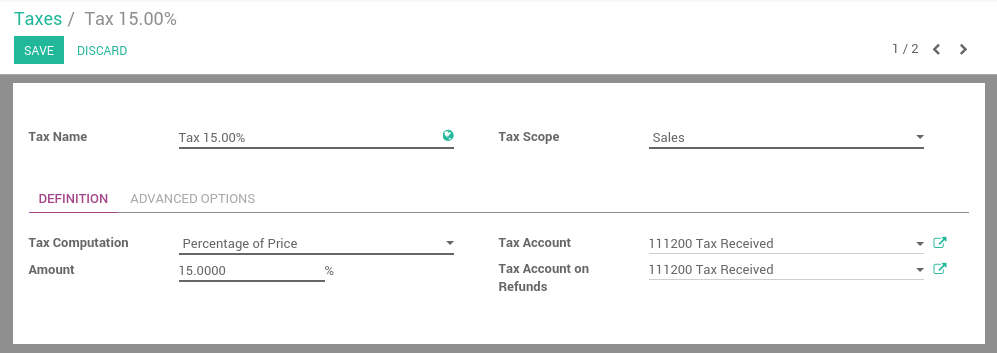

选择一个范围:销售、购置或无(例如:废弃税种)。

选择一种计算方法:

- Fixed: eco-taxes, etc.

- Percentage of Price: most common (e.g. 15% sales tax)

- Percentage of Price Tax Included: used in Brazil, etc.

- Group of taxes: allows to have a compound tax

如你使用Odoo做帐,请设定税款帐户(即税款日记帐条目所在位置)。这一字段是可选的,如不填写,Odoo则将税收日记帐条目存放在收入帐户上。

小技巧

如不想使用某种税种,不可简单删除,因为此税种很可能用于多种发票上。为防止用户继续使用这一税种,可以将*税收范围*设置为*无*。

注解

如需高级税务系统,可以安装**account_tax_python**模块,用Python代码定义新的税种。

高级配置

- Label on Invoices: a short text on how you want this tax to be printed on invoice line. For example, a tax named "15% on Services" can have the following label on invoice "15%".

- Tax Group: defines where this tax is summed in the invoice footer. All the tax belonging to the same tax group will be grouped on the invoice footer. Examples of tax group: VAT, Retention.

- Include in Analytic Cost: the tax is counted as a cost and, thus, generate an analytic entry if your invoice uses analytic accounts.

- Tags: are used for custom reports. Usually, you can keep this field empty.