Odoo’s tax engine is very flexible and support many different type of taxes: value added taxes (VAT), eco-taxes, federal/states/city taxes, retention, withholding taxes, etc. For most countries, your system is pre-configured with the right taxes.

This section details how you can define new taxes for specific use cases.

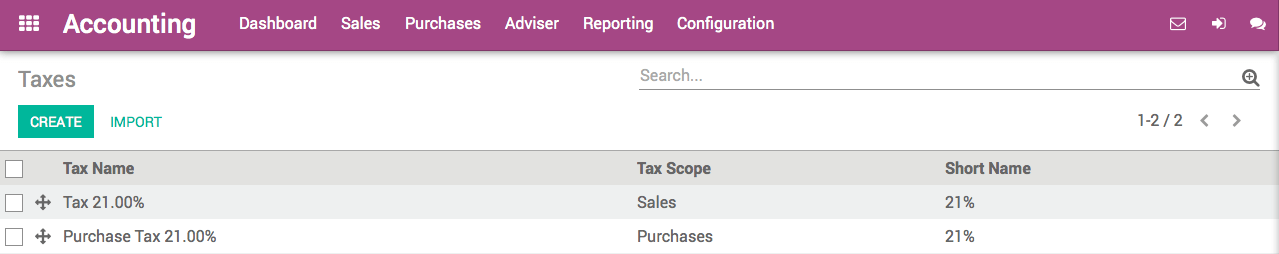

- Go to . From this menu, you get all the taxes you can use: sales taxes and purchase taxes.

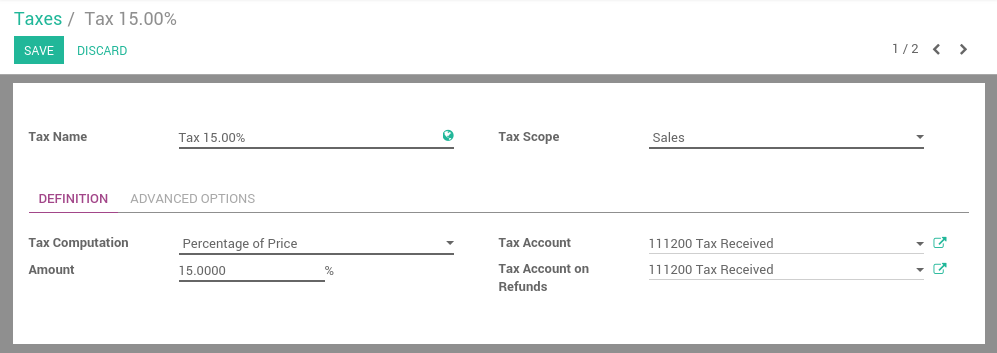

- Choose a scope: Sales, Purchase or None (e.g. deprecated tax).

Select a computation method:

- Fixed: eco-taxes, etc.

- Percentage of Price: most common (e.g. 15% sales tax)

- Percentage of Price Tax Included: used in Brazil, etc.

- Group of taxes: allows to have a compound tax

- If you use Odoo Accounting, set a tax account (i.e. where the tax journal item will be posted). This field is optional, if you keep it empty, Odoo posts the tax journal item in the income account.

Tip

If you want to avoid using a tax, you can not delete it because the tax is probably used in several invoices. So, in order to avoid users to continue using this tax, you should set the field Tax Scope to None.

Note

If you need more advanced tax mechanism, you can install the module account_tax_python and you will be able to define new taxes with Python code.

Advanced configuration

- Label on Invoices: a short text on how you want this tax to be printed on invoice line. For example, a tax named “15% on Services” can have the following label on invoice “15%”.

- Tax Group: defines where this tax is summed in the invoice footer. All the tax belonging to the same tax group will be grouped on the invoice footer. Examples of tax group: VAT, Retention.

- Include in Analytic Cost: the tax is counted as a cost and, thus, generate an analytic entry if your invoice uses analytic accounts.

- Tags: are used for custom reports. Usually, you can keep this field empty.