完成付款且无发票过期(本例为标准税)之情形时,应支付现金基本税。基于现金基本税向管理部门申报收、支法在某些国家和一定条件下是合法的。

示例:你在财政年度的一季度销售产品,在财政年度的第二季度收到付款。在收付实现制下,你要管理部门支付的税款应在第二季度支付。

怎样配置收付实现税?

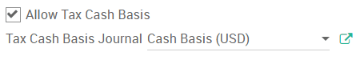

首先要到以下路径中激活设置:menuselection:会计->配置->设置->允许税收收付实现,接着系统会要求你定义一个税收收付实现日记账。

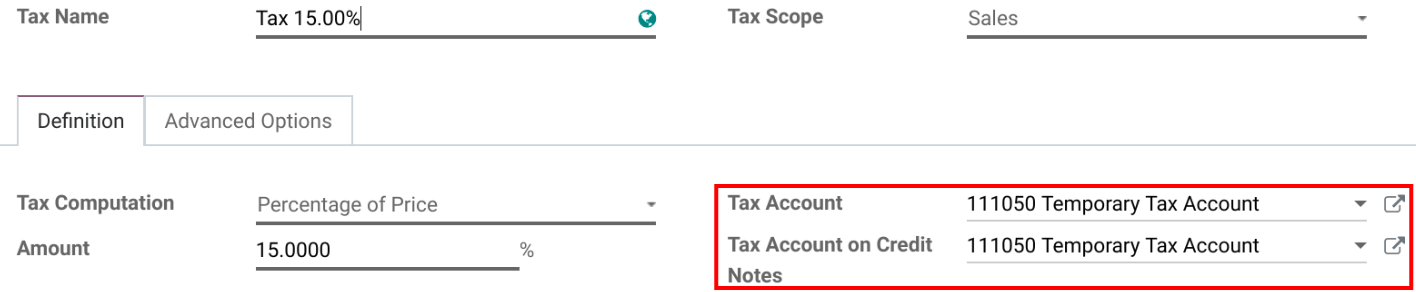

Once this is done, you can configure your taxes in . At first set the proper transitional accounts to post taxes until you register the payment.

In the Advanced Options tab you will turn Tax Due to Based on Payment. You will then have to define the Tax Received account in which to post the tax amount when the payment is received and the Base Tax Received Account to post the base tax amount for an accurate tax report.

收付实现税对我的会计系统将造成何种影响?

举个例子,你取得了100美元的销售收入,附带15%的收付实现税。当你验证客户发票时,以下科目会被创建到你的会计系统中:

| 客户发票日记账 | |

|---|---|

| Debit | Credit |

| 应收15美元 | |

| Temporary Tax Account $15 | |

| 收入帐户100美元 |

几天后,你收到付款:

| 银行日记账 | |

|---|---|

| Debit | Credit |

| 银行115美元 | |

| 应收15美元 |

当你对比发票和付款时,生成了以下条目:

| 税率现金收付制日记账 | |

|---|---|

| Debit | Credit |

| Temporary Tax Account $15 | |

| 税收帐户15美元 | |

| 收入帐户100美元 | |

| 收入帐户100美元 |

小技巧

The last two journal items are neutral but they are needed to insure correct tax reports in Odoo with accurate base tax amounts. We advise to use a default revenue account. The balance of this account will then always be at zero.