哥伦比亚¶

Odoo’s Colombian localization package provides accounting, fiscal, and legal features for databases in Colombia - such as chart of accounts, taxes, and electronic invoicing. The localization has the following prerequisites when using the DIAN Own Software solution with Odoo:

Be registered in the RUT (Registro Único Tributario) with a valid NIT.

Have a valid digital signature certificate approved by the ONAC.

Register and get enabled by completing the certification process required by the DIAN.

更多内容

For more information on how to complete the certification process for the DIAN module, review the following webinar

Documentation on e-invoicing’s legality and compliance in Colombia

配置¶

模块安装¶

安装 下列模块,以获得哥伦比亚本地化的所有功能:

名称 |

技术名称 |

说明 |

|---|---|---|

哥伦比亚 - 会计 |

|

默认 财务本地化套装。该模块为哥伦比亚本地化添加了基本会计功能:会计科目表、税金、预扣款和身份证明文件类型。 |

Electronic invoicing for Colombia with DIAN |

|

This module includes the features required for integration with the DIAN as its own software, and adds the ability to generate electronic invoices and support documents based on DIAN regulations. |

哥伦比亚 - 会计报告 |

|

This module includes accounting reports for sending certifications to suppliers for withholdings applied. |

哥伦比亚电子发票 - 使用 Carvajal |

|

This module includes the features required for integration with Carvajal. Adds the ability to generate the electronic invoices and support documents, based on DIAN regulations. |

哥伦比亚 - 销售点 |

|

This module includes Point of Sale receipts for Colombian localization. |

公司信息¶

To configure your company information:

Access your company’s contact form:

Go to the Contacts app and search for your company or;

Go to the Settings app, activate the developer mode, and in the Companies section, click Update Info. Then, in the Contact field, click on the company name.

Configure the following information:

公司名称。

Address: Including City, Department, and ZIP code.

Identification Number: Select the Identification Type (NIT, Cédula de Ciudadanía, Registro Civil, etc.). When the Identification Type is NIT, the Identification Number must have the verification digit at the end of the ID prefixed by a hyphen (

-).

Go to the Sales & Purchase tab and configure the Fiscal Information:

Obligaciones y Responsabilidades: Select the fiscal responsibility for the company. (O-13 Gran Contribuyente, O-15 Autorretenedor, O-23 Agente de retención IVA, O-47 Regimen de tributación simple, R-99-PN No Aplica).

Gran Contribuyente: If the company is Gran Contribuyente, enable this option.

Fiscal Regimen: Select the Tribute Name for the company (IVA, INC, IVA e INC, or No Aplica)

Commercial Name: If the company uses a specific commercial name and it needs to be displayed in the invoice.

小技巧

The data configured in the Fiscal Information section is printed in the valid fiscal PDF reports.

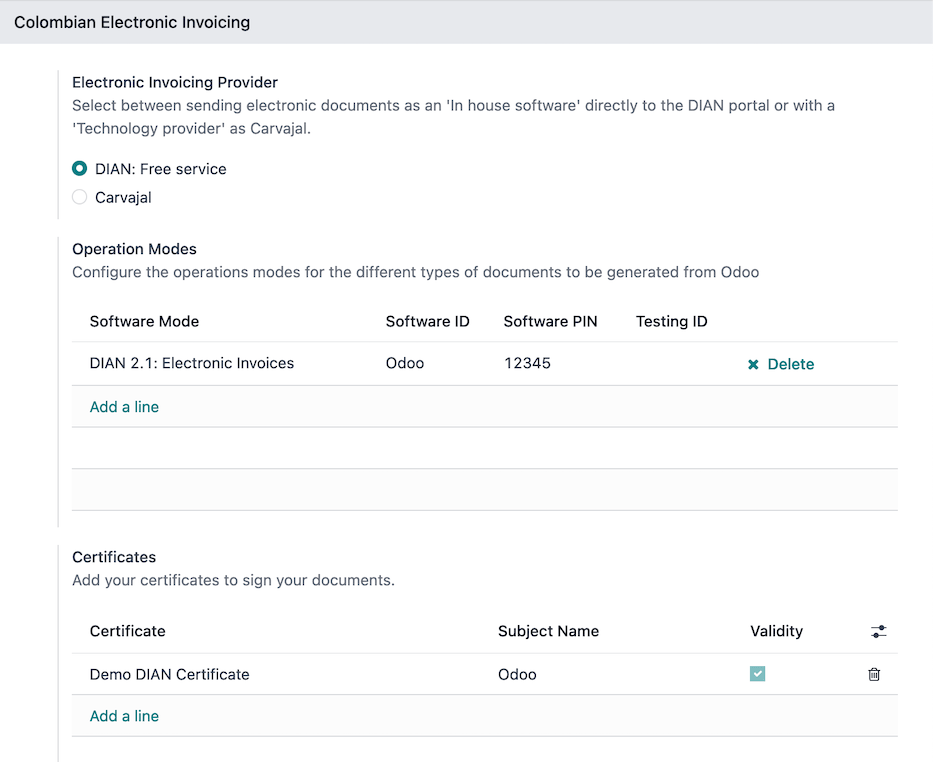

Electronic invoicing credentials and DIAN environment¶

To configure the user credentials to be used to connect with the DIAN’s web service and the DIAN environment, navigate to and scroll to the Colombian Electronic Invoicing section. Then, follow these steps:

Select DIAN: Free Service as the Electronic Invoicing Provider.

Configure the Operation Modes for the respective types of documents (electronic invoices or support documents) to be generated from Odoo. Click Add a line, then fill in the fields:

Software Mode: the type of document to be generated with the operation mode.

Software ID: the ID generated by DIAN for the specific operation mode.

Software PIN: the PIN selected in the operation mode configuration in the DIAN portal.

Testing ID: the testing ID generated by DIAN and obtained after testing the operation mode.

Configure the available Certificates to sign the electronic documents. Click Add a line, then fill in the fields:

Name: the name of the certificate.

Certificate: upload the certificate file in PEM format. In the Private Key field that appears on the screen, select an existing private key or create a new one. To do so, enter a key name and select Create and edit. Then, in the Create Private Key wizard, upload a valid Key file and click Save & Close.

Configure the DIAN environment; the DIAN electronic invoicing module offers three different DIAN environments to connect with:

认证环境:该环境用于通过 DIAN 认证流程,并从 Odoo 获得 启用 状态以开具发票。要激活该环境,请同时启用 测试环境 和 启动认证程序 复选框。

测试环境:该环境允许在 DIAN 测试门户中重现电子发票流程和验证。要激活它,只需启用 测试环境 复选框。

正式运营环境:激活正式运营数据库以生成有效的电子文档。要激活它,请禁用 测试环境 和 激活认证流程 复选框。

注解

在多公司数据库中,每家公司都可以拥有自己的证书。

更多内容

有关使用 Carvajal 解决方案的电子发票配置,请观看以下视频:Configuración de Facturación Electrónica - Localización de Colombia。

主数据¶

联系人¶

Configure the following fields on the contact form:

Identification Number (VAT): Select the identification number type and enter the identification number. If the identification number type is NIT, the identification number must include the verification digit at the end, prefixed by a hyphen (

-).Fiscal Information fields in the Sales & Purchase tab.

产品¶

Access the product’s form via and ensure that either the UNSPSC Category field (found in the Accounting tab) or the Internal Reference field (in the General Information tab) is configured.

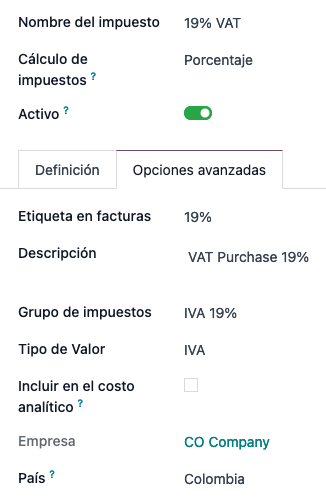

税率¶

要创建或修改税种,请转到 并选择相关税项。

If sales transactions include products with taxes, configure the Value Type field in the Advanced Options tab. Retention tax types (ICA, IVA, Fuente) are also included. This configuration is used to display taxes correctly on the invoice.

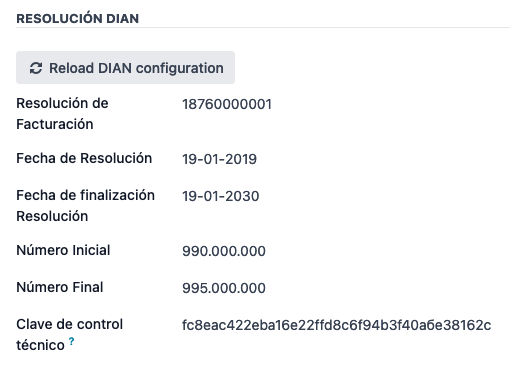

销售日记账¶

Once the DIAN has assigned the official sequence and prefix for the electronic invoice resolution, the sales journals related to the invoices must be updated in Odoo. To do so, navigate to and select an existing sales journal or create a new one with the Create button.

On the sales journal form, enter the Journal Name and Type, then set a unique Short Code in the Journals Entries tab. Then, configure the following data in the Advanced Settings tab:

Electronic invoicing: enable UBL 2.1 (Colombia).

Invoicing Resolution: resolution number issued by DIAN to the company via their test set.

Resolution Date: initial effective date of the resolution.

Resolution End Date: end date of the resolution’s validity.

Range of Numbering (minimum): first authorized invoice number.

Range of Numbering (maximum): last authorized invoice number.

Technical Key: control key received from the DIAN portal test set or from their web service in case of the production environment.

When the database is configured for the production environment, instead of configuring these fields manually, click the Reload DIAN configuration button to obtain the DIAN resolution information from the DIAN web service.

重要

The short code and resolution of the journal must match the ones received in the DIAN portal test set or from the MUISCA portal.

The invoice sequence and prefix must be correctly configured when the first invoice is created. Odoo automatically assigns a prefix and sequence to the following invoices.

采购日记账¶

一旦 DIAN 为与供应商账单相关的*支持文件*指定了正式序列和前缀,就需要在 Odoo 中更新与其支持文件相关的采购日记账。该过程类似于配置 销售日记账。

更多内容

有关使用 Carvajal 解决方案支持文档期刊的更多信息,请查阅`Documento Soporte - Localización de Colombia video <https://www.youtube.com/watch?v=UmYsFcD7xzE&list=PL1-aSABtP6ABxZshems3snMjx7bj_7ZsZ&index=8>`_。

会计科目表¶

作为本地化模块的一部分,:doc:`会计科目表</applications/finance/accounting/get_started/chart_of_accounts>`是默认安装的,会计科目自动映射为税金、默认应付账款和默认应收账款。哥伦比亚的会计科目表基于 PUC(Plan Unico de Cuentas)。

主要工作流程¶

电子发票¶

以下是哥伦比亚本地化电子发票主要工作流程的细目:

用户创建发票。

Odoo 会生成合法的 XML 文件。

Odoo 生成带有电子签名的 CUFE(发票电子代码)。

Odoo 向 DIAN 发送通知。

DIAN 验证发票。

DIAN 接受或拒绝发票。

Odoo 会生成带有二维码的 PDF 发票。

Odoo 会将所附文档(包含发送的 XML 文件和 DIAN 验证响应)和有效 PDF 压缩成

.zip文件。The user sends the invoice (

.zipfile) via Odoo to the acquirer.

开票创建¶

注解

发票验证前的功能工作流程**不会**改变电子发票带来的主要变化。

Electronic invoices are generated and sent to both the DIAN and the customer. These documents can be created from the sales order or manually generated. To create a new invoice, go to , and select Create. On the invoice form, configure the following fields:

Customer: customer’s information.

Journal: journal used for electronic invoices.

电子发票类型:选择文件类型。默认情况下,选择 Factura de Venta。

发票行:指定正确纳税的产品。

重要

When creating the first invoice related to an electronic invoicing journal, it is required to

manually change the sequence of the invoice to the DIAN format: Prefix + Sequence.

For example, format the sequence from SETP/2024/00001 to SETP1.

完成后,点击 确认。

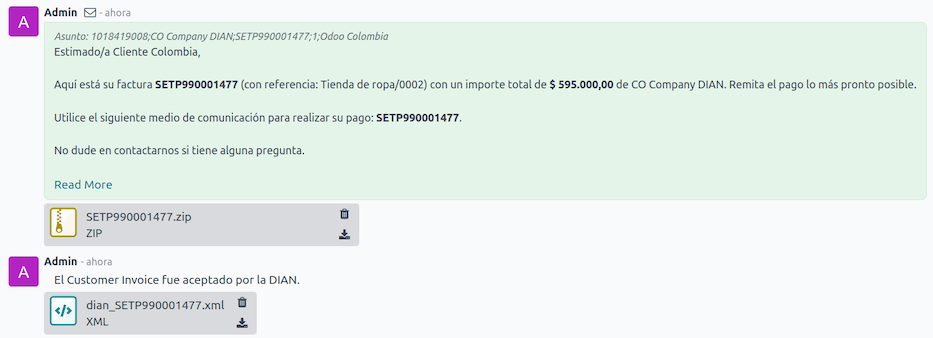

Electronic invoice sending¶

After the invoice confirmation, click Print & Send. In the wizard that appears, make sure to enable the DIAN and Email checkboxes to send an XML to the DIAN web service and the validated invoice to the client fiscal email and click Print & Send. Then:

The XML document is created.

The CUFE is generated.

The XML is processed synchronously by the DIAN.

If accepted, the file is displayed in the chatter and the email to the client with the corresponding

.zipfile.

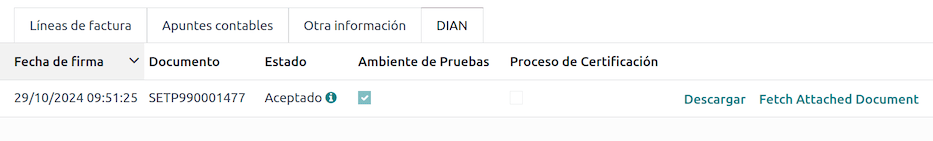

The DIAN tab then displays the following:

Signed Date: timestamp recorded of the XML creation.

Status: Status result obtained in the DIAN response. If the invoice was rejected, the error messages can be seen here.

Testing Environment: To know if the document sent was delivered to the DIAN testing environment.

Certification Process: To know if the document was sent as part of the certification process with the DIAN.

Download: To download the sent XML file, even if the DIAN result was rejected.

Fetch Attached Document: To download the generated attached document file included in the delivered

.zipfile to the client.

贷记单¶

贷记单的流程与发票相同。要参照发票创建信用证,请转到 。在发票上点击 添加贷记单,然后填写以下信息:

贷记方式:选择贷记方式的类型。

部分退款: 部分退款时使用此选项。

全额退款:如果贷记票据为全额,请使用此选项。

全额退款和新发票草稿:如果贷记单已自动验证并与发票对账,则使用此选项。原始发票将作为新的草稿被复制。

原因:输入贷记的原因。

逆转日期:选择是否要为贷方票据设置一个特定日期,或者是日记账分录日期。

使用特定日记账:为贷记单选择日记账,如果想使用与原始发票相同的日记账,则将其留空。

退款日期:如果选择了特定日期,请选择退款日期。

审核完毕后,点击 逆转 按钮。

借记单¶

借记单的创建过程与贷记单类似。要参照发票创建借记单,请转到 。在发票上点击 添加借记单 按钮,然后输入以下信息:

原因:键入借记的原因。

借记日期:选择特定选项。

复制行:如果您需要用发票的相同行数登记借记票据,请选择此选项。

使用特定日记账:选择借记单的打印点,如果要使用与原始发票相同的日记账,则将其留空。

完成后,点击 创建借记单。

供应商账单支持文件¶

有了主数据、凭证和为供应商账单相关支持文档配置的采购日记账,您就可以开始使用*支持文档*了。

供应商账单的支持文件可通过采购订单或手动创建。进入 并填写以下数据:

供应商:输入供应商信息。

账单日期:选择账单日期。

日记账:选择与供应商账单相关的支持文件的日记账。

已开票行:指定正确纳税的产品。

审核完成后,点击 确认 按钮。确认后,将创建一个 XML 文件并自动发送给 Carvajal。

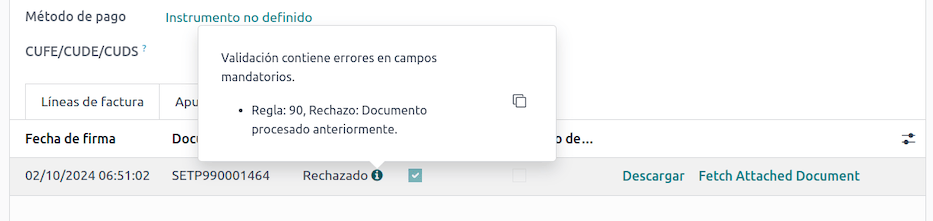

Common errors¶

During the XML validation, the most common errors are related to missing master data. In such cases, a validation error message is displayed and sending is blocked.

If the invoice was sent and set as Rejected by the DIAN, the error messages are visible by clicking the (info circle) icon next to the Status field in the DIAN tab. Using the reported error codes, it is possible to review solutions to apply before re-sending.

After the master data or other issues are corrected, it is possible to reprocess the XML again. Do so by following the electronic invoice sending flow.

财务报表¶

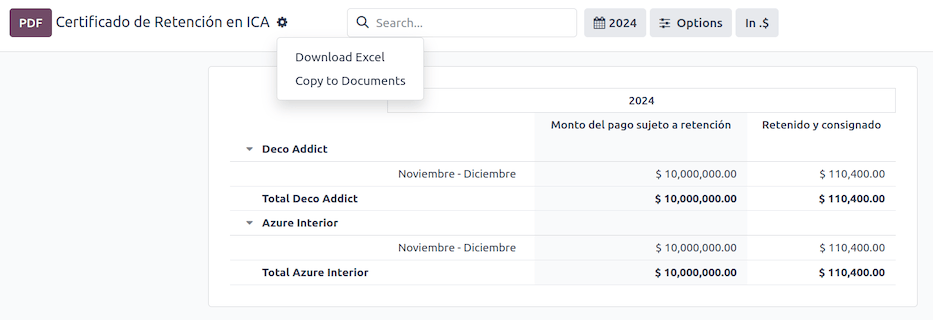

Certificado de Retención en ICA¶

该报告是向供应商提供的哥伦比亚工商业税(ICA)预扣证明。该报告可在 下找到。

Click the (gear) icon to display options to Download Excel and Copy to Documents.

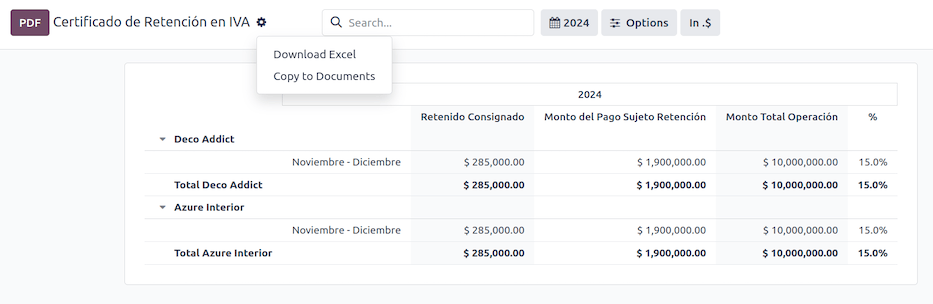

Certificado de Retención en IVA¶

该报告出具关于从供应商预扣增值税金额的证明。该报告可在 下找到。

Click the (gear) icon to display options to Download Excel and Copy to Documents.

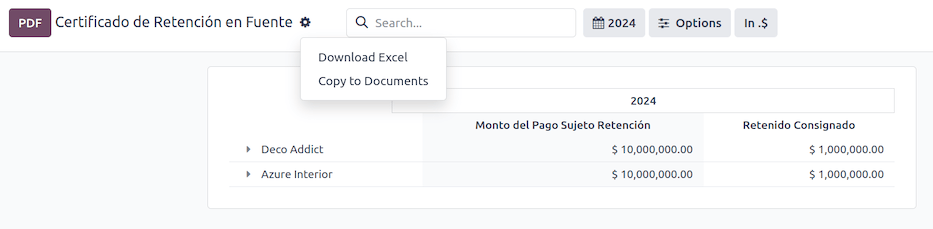

Certificado de Retención en la Fuente¶

该证书用于向合作伙伴发放预扣税款。该报告可在 下找到。

Click the (gear) icon to display options to Download Excel and Copy to Documents.