厄瓜多尔¶

With the Ecuadorian localization, it is possible to generate electronic documents using XML, fiscal folio, electronic signature, and direct connection to tax authority SRI.

The supported documents are invoices, credit notes, debit notes, purchase liquidations, and withholdings.

The localization also includes automation to easily predict the withholding tax to be applied to each purchase invoice.

词汇表¶

Here are some terms that are essential to the Ecuadorian localization:

SRI: Stands for Servicio de Rentas Internas, which is the government organization that enforces the payment of taxes in Ecuador.

SRI certificate: Document or digital credential issued by the SRI that is crucial for compliance with Ecuadorian tax laws.

EDI: Stands for Electronic Data Interchange, which refers to the electronic transmission of documents.

RIMPE: Stands for Regimen Simplificado para Emprendedores y Negocios, which is the type of taxpayer qualified for SRI.

配置¶

模块安装¶

安装 下列模块,以获得厄瓜多尔本地化的所有功能:

名称 |

技术名称 |

说明 |

|---|---|---|

厄瓜多尔 - 会计 |

|

默认 财政本地化包,为厄瓜多尔本地化添加了会计功能,这些功能代表了公司在厄瓜多尔运营所需的最低配置,符合:abbr:`SRI(国内税务局)`规定的指南。模块安装会自动加载:会计科目表、税种、文件类型、税务支持类型。此外,还可自动生成 103 和 104 表格。 |

厄瓜多尔会计 EDI |

|

Includes all the technical and functional requirements to generate and validate Electronics Documents, based on the technical documentation published by the SRI. The authorized documents are: Invoices, Credit Notes, Debit Notes, Withholdings and Purchase liquidations. |

厄瓜多尔会计报告 |

|

包括生成表格 103 和 104 的所有技术和功能要求。 |

厄瓜多尔 - ATS 报告 |

|

包括生成 ATS 报告 XML 文件的所有技术和功能要求,可随时上传到 DIMM Formularios。 |

厄瓜多尔网站 |

|

包括从网站销售生成自动电子发票的所有技术和功能要求。 |

厄瓜多尔销售点 |

|

包括从 POS 销售生成自动电子发票的所有技术和功能要求。 |

注解

In some cases, such as when upgrading to a version with additional modules, it is possible that those modules may not be installed automatically. Any missing modules can be manually installed.

Configure a company or individual contact¶

The following fields should be completed for localization purposes on the contact form:

Name: Enter the company or individual’s name.

Address: The Street sub-field is required to confirm electronic invoices.

Identification Number: For a company, enter the Ruc. For individuals, enter the Cedula or Passport number.

SRI Taxpayer Type: Select the contact’s SRI taxpayer type.

Phone: Enter the company or individual’s phone number.

Email: Enter the company or individual’s email. This email is used to send electronic documents, such as invoices.

注解

The SRI Taxpayer Type indicated on the contact form determines which VAT and profit withholding taxes apply when using this contact on a vendor bill.

电子文档¶

To upload information for electronic documents, go to , and scroll to the Ecuadorian Localization section.

Configure the following information, starting with the Electronic Invoicing section:

公司法定名称

Regime: Select whether the company is in the Regular Regime (without additional messages in the RIDE) or is qualified as in the RIMPE Regime.

Special Taxpayer Number: If the company is qualified as a special taxpayer, complete this field with the company’s corresponding tax contributor number.

Forced to Keep Accounting Books: Enable this option if needed.

Withholding section:

Consumables: Enter the code of the default withholding tax used when purchasing goods.

Services: Enter the code of the default withholding tax used when purchasing services.

Credit Card: Enter the code of the default withholding tax used when purchasing with credit cards.

Withhold Agent Number: Enter the company’s withholding agent resolution number, if applicable.

SRI Connection section:

Certificate file for SRI: Select the company’s SRI certificate. Click SRI Certificates to upload one, if necessary.

Use production servers: Enable this option if electronic documents are used in the production environment; leave it disabled if the testing environment is used instead.

Withholding accounts section:

Sales Tax Base Account: Enter the company’s sales tax base account.

Purchase Tax Base Account: Enter the company’s sales tax purchase account.

重要

When using the testing environment, EDI data is sent to test servers.

注解

The values entered in the Consumables and Services withholding fields are used as default values for domestic only when no withholdings are set up on the SRI Taxpayer Type.

The entered Credit Card withholding value is always applied when a credit or debit card SRI payment method is used.

增值税预扣税¶

注解

This configuration applies only if the SRI recognizes the company as a withholding agent. If not, skip this step.

To configure a VAT withholding, go to .

Configure the Name of the taxpayer type, the Goods VAT Withholding, and the Services VAT Withholding.

小技巧

If the Taxpayer Type is Rimpe, configure the Profit Withhold percentage.

打印机点¶

Printer points need to be configured for each type of electronic document used, such as customer invoices, credit notes, and debit notes.

To configure printer points, navigate to .

For each electronic document, click New, and enter the following information on the journal form:

Journal Name: Enter in this format:

[Emission Entity]-[Emission Point] [Document Type], e.g.,001-001 Sales Documents.Type: Refers to the journal type; select Sales.

Once the Type is selected, complete the following fields:

Use Documents?: Enable this option if legal invoicing (invoices, debit/credit notes) is used, as this is the standard configuration. If not, select the option to record accounting entries unrelated to legal invoicing documents, such as receipts, tax payments, or journal entries.

Emission Entity: Enter the facility number.

Emission Point: Enter the printer point.

Emission address: Enter the address of the facility.

In the Journal Entries tab, under the Accounting information section, fill in the following fields:

Default Income Account: Enter the default income account.

Dedicated Credit Note Sequence: Enable this option if credit notes should be generated from this printer point (i.e., the journal).

Dedicated Debit Note Sequence: Enable this option if debit notes should be generated from this printer point (i.e., the journal).

Short Code: Enter a unique 5-digit code for the accounting entry sequence (e.g., VT001).

Customer invoices, credit notes, and debit notes need to use the same journal as the Emission Point, whereas the Entity Point should be unique per journal.

Finally, in the Advanced Settings tab, check the Electronic invoicing checkbox to enable sending XML/EDI invoices.

更多内容

预扣税¶

To define a withholding journal, go to . For each withholding journal, click New, and enter the following information:

Journal Name: Enter this format:

[Emission Entity]-[Emission Point] [Document Type], e.g.,`001-001 Withholding`.Type: Refers to the journal type. Select Miscellaneous.

Withhold Type: Select Purchase Withhold.

Once the Type and Withhold Type are selected, complete the following fields:

Emission Entity: Enter the facility number.

Emission Point: Enter the printer point.

Emission address: Enter the address of the facility.

In the Journal Entries tab, under the Accounting information section, fill in the following fields:

Default Account: Configure the default income account.

Short Code: Enter a unique 5-digit code for the accounting entry sequence (e.g.,

WT001).

Finally, in the Advanced Settings tab, check the Electronic invoicing checkbox to enable sending XML/EDI invoices.

Purchase liquidations¶

A specific journal must be created for purchase liquidations. Go to . Click New, and enter the following information:

Journal Name: Enter this format:

[Emission Entity]-[Emission Point] [Document Type], e.g.,001-001 Purchase Liquidations.Type: Refers to the journal type. Select Purchase.

Once the Type is selected, complete the following fields:

Purchase Liquidations: Tick this checkbox to enable purchase liquidations.

Use Documents?: Enable this option if legal invoicing (invoices, debit/credit notes) is used, as this is the standard configuration. If not, select the option to record accounting entries unrelated to legal invoicing documents, such as receipts, tax payments, or journal entries.

Emission Entity: Enter the facility number.

Emission Point: Enter the printer point.

Emission address: Enter the address of the facility.

Short Code: Enter a unique 5-digit code for the accounting entry sequence (e.g.,

PT001).

Finally, in the Advanced Settings tab, check the Electronic invoicing checkbox to enable sending XML/EDI invoices.

配置主数据¶

会计科目表¶

The chart of accounts is installed by default as part of the set of data included in the localization module. The accounts are mapped automatically in Taxes, Default Account Payable, Default Account Receivable.

Ecuador’s chart of accounts is based on the most updated version of the Superintendency of Companies, which is grouped into several categories and is compatible with NIIF accounting.

可根据公司需要添加或删除账户。

产品¶

If products have any withholding taxes, they must be configured on the product form.

Go to . On the General Information tab, specify both Purchase Taxes and Profit Withhold.

税率¶

The localization module automatically creates and configures taxes. If new taxes need to be created, it is recommended to base them on the configuration of the existing ones.

To manage taxes, navigate to . Depending on the tax type, the following options may be required for additional configuration:

Tax Name: Follows a specific format depending on the tax type:

- For IVA (Value-Added Tax):

IVA [percent] (104, [form code] [tax support code] [tax support short name])Example:IVA 12% (104, RUC [tax support code] IVA) - For Income Tax Withholding codes:

Code ATS [percent of withhold] [withhold name]Example:Code ATS 10% Retención a la Fuente

Tax Support: Configure only for the IVA tax. This option is used to register purchase withholdings.

Code ATS: Configure only for income tax withholding codes, as it is necessary to register a withholding.

In the Definition tab:

Tax Grids: Configure the code of a 104 form if it is an IVA tax, and the code of a 103 form if it is an income tax withholding code.

文件类型¶

Some accounting transactions like customer invoices and vendor bills are classified by document types. These are defined by the government fiscal authorities, which in this case is the SRI.

To access or configure document types, go to .

Each document type can have a unique sequence per journal where it is assigned. As part of the localization, the document type includes the country in which the document is applicable; also the data is created automatically when the localization module is installed.

The information required for the document types is included by default and doesn’t need to be changed.

工作流¶

Once a company’s database is configured, documents can be registered to enable workflows across Odoo’s applications, such as Accounting, Inventory, and Sales.

销售文档¶

客户应收¶

Customer invoices are electronic documents that, when validated, are sent to SRI. These documents can be created from your sales order or manually.

They must contain the following data:

Journal: Select the option matching the customer invoice’s printer point.

Document Type: Type the document type in this format:

(01) Invoice.Payment Method (SRI): Select how the invoice will be paid.

客户贷记单/退款单¶

The customer credit note is an electronic document that, when validated, is sent to SRI. A validated (posted) invoice is necessary to register a credit note.

On the invoice, click Credit note and complete the following information in the Credit note window:

Reason: Type the reason for the credit note.

Journal: Select the journal for the reversal.

Document Type: By default, (04) Credit Note is selected.

Reversal date: Set the date for the reversal.

Then, click Reverse to first review the invoice or click Reverse and Create Invoice.

注解

When creating the first credit note, select Reverse and assign the first credit note

number or by default Odoo assigns NotCr 001-001-000000001 as the first credit note number.

Once the credit note is created, modify Product and Quantity if needed. Make sure the correct Customer, Journal, and Document Type are specified, and the products listed on the Invoice Lines tab are configured with the correct taxes.

To validate, click Confirm.

客户借记单/缴款通知¶

The customer debit note is an electronic document that, when validated, is sent to SRI.

A validated (posted) invoice is necessary to register a debit note. Select the related invoice to issue a debit note in the Invoices list view, click Actions and select Create Debit Note. Then, complete the following information in the Create Debit Note window.

Reason: Enter the reason for the debit note.

Debit note date: Set the debit note date.

Copy lines: Select this option to register a debit note with the same lines of invoice.

Use Specific Journal: Select the printer point for your credit note, or leave it empty to use the same journal as the original invoice.

Then, click Create Debit Note.

The debit note amount can be changed, if desired.

客户预扣¶

The Customer withholding is a non-electronic document issued by the client in order to apply a withholding to a sale.

A validated (posted) invoice is necessary to register a customer withholding. On the invoice, click Add Withhold and complete the following information in the Customer withholding window:

Document Number: Enter the withholding number.

Withhold Lines: Select the taxes that the customer is withholding.

在验证预扣税款之前,请检查每种税款的金额是否与原始文件相同。

采购文件¶

供应商发票¶

:doc:`供应商账单 <…/accounting/vendor_bills>`是公司采购时供应商签发的非电子单据。供应商账单可以根据采购订单创建,也可以手动创建。

重要

必须创建供应商账单日记账才能创建供应商账单文件。

创建供应商账单日记账¶

要创建新日记账,请转到 并点击 新建。

然后,配置以下内容:

选择 采购 作为 类型。

不要 勾选 :guilabel:`采购清算`复选框。

添加 默认费用科目。

配置供应商账单¶

要配置供应商账单,请务必填写以下厄瓜多尔特定字段:

文件类型:输入此文件类型:

(01)发票。文件编号:输入文件编号。

付款方式(SRI):选择支付供应商账单的方式。

重要

创建采购预扣时,请确认基数(基本金额)是否正确。如果需要编辑 供应商账单 中的税额,请点击 编辑。或从 日记账项目 标签,点击 编辑 并设置所需的调整。

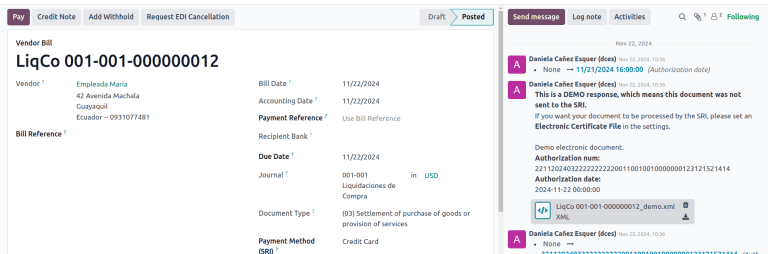

采购清算¶

采购清算 是一份电子文件,一经验证,即发送至 SRI。

当公司进行采购,但供应商由于以下一个或多个原因没有提供发票时,公司就会开具发票:

非厄瓜多尔居民提供服务。

外国公司在厄瓜多尔无居留权或设施的情况下提供服务。

从未注册 RUC 的自然人处购买商品或服务,这些人无法开具销售收据或客户发票。

必须向依赖关系中的员工(全职员工)提供购买商品或服务的报销。

合议机构成员在行使其职能时提供了服务。

在这些情况下,必须创建采购清算日记账。

创建采购清算日记账¶

要创建新日记账,请转到 并点击 新建。

然后,配置以下内容:

选择 采购 作为 类型。

勾选 采购清算 复选框。

添加 默认费用科目。

创建采购清算¶

这类电子文档可以从*采购订单*创建,或从*供应商账单*表单手动创建。采购清算必须包含以下数据:

供应商:输入供应商信息。

日记账:选择带有正确打印点的 采购清算 日记账。

文件类型:输入此文件类型`(03)采购清算`

文件编号::输入文件编号(序列)。只需输入一次,序列将自动分配给后续文件。

付款方式(SRI):选择发票将如何支付。

产品::指定具有正确税费的产品。

信息审核完毕后,验证 采购清算。

采购预扣¶

*采购预扣*是一种电子文档,验证后会发送给 SRI。

在登记 采购预扣`之前,需要处于已验证状态的发票。在发票上,点击 :guilabel:`添加预扣 并在 预扣 窗口中填写以下字段:

文件编号:输入文件编号(序列)。只需输入一次,该序列将自动分配给下一个文件。

预扣数据行:根据产品和供应商配置自动显示税项。检查税项和税收支持是否正确。如果不正确,请编辑并选择正确税项和税收支持。

Then, validate the Withholding.

注解

Tax support types must be configured on the Vendor Bill. To do so, go to the tax applied on the Vendor Bill and change the Tax Support there.

A withholding tax can be divided into two or more lines, depending on whether two or more withholdings percentages apply.

Example

The system suggests a VAT withholding of 30% with tax support 01. VAT withholding of 70% can be added in a new line with the same tax support. Odoo allows it if the base total matches the Vendor Bill’s total.

Expense reimbursement¶

Expense reimbursements apply to the following cases:

Individual: reimbursement to an employee for miscellaneous expenses (e.g. purchase liquidations)

Legal Entity: reimbursement for incurred expenses, such as representation expenses (e.g. hiring a lawyer)

To enable an expense reimbursement, make sure a purchase liquidation journal has been created for an individual or a vendor bills journal for a legal entity.

注解

In the vendor bills journal, be sure the following necessary configurations are set for a legal entity:

选择 采购 作为 类型。

不要 勾选 :guilabel:`采购清算`复选框。

添加 默认费用科目。

Next, to create a reimbursement, create a vendor bill using the purchase liquidation or vendor bills journal. On the vendor bill, configure the following fields:

Vendor: This field should be an employee.

Document Type: Verify that this field is accurately populated from the journal.

Payment Method (SRI): Select a payment method.

Reimbursement Lines tab: Click Auto Fill Invoice Lines to automatically populate the invoice lines or add the expenses line by line, and provide the following details for each expense:

Partner or authorization number

日期

Document Type

Document Number

Tax Base

Tax

Then, click Confirm Vendor Bill and Process Now. The XML and authorization number for the purchase liquidation are recorded, and the purchase withholding created from this vendor bill includes the reimbursement information.

电子商务¶

The ATS Report module enables the following:

Choose the SRI Payment Method for each payment method’s configuration.

Customers can manually input their identification type and number during eCommerce checkout.

Automatically generate a valid electronic invoice for Ecuador at the end of the checkout process.

在线支付¶

要启用在线支付,请添加相关的 支付机构 并配置必要的 付款方式。必须为每种方法设置 SRI 支付方法。

注解

要从电子商务销售中正确生成电子发票,必须添加 SRI 支付方式。选择**付款方式**,访问其配置菜单和字段。

自动开票¶

要在结账流程后生成发票,请导航至 并激活 发票 部分下的 自动发票 选项。

小技巧

发票的电子邮件模板可在 自动发票 选项下的 发票电子邮件模板 字段中修改。

重要

用于开具发票的销售日记账在 日记账 菜单的优先顺序中排在第一位。

电子商务工作流程¶

标识类型和编号¶

在结账过程中,购买的客户可以选择标明其身份类型和编号。结账完成后,需要这些信息才能正确生成电子发票。

注解

验证的目的是确保 身份号码 字段填写完整且位数正确。对于 RUC 识别,需要 13 位数字。对于 Cédula,需要 9 位数字。

完成结账流程后,将生成确认发票,可手动或异步发送至 SRI。

销售点电子发票¶

确保 厄瓜多尔销售点模块 (l10n_ec_edi_pos) 已安装 以启用以下功能和配置:

在每种付款方式配置中选择 SRI 付款方式。

在 POS 上创建新联系人时,手动输入客户的识别类型和识别号码。

Automatically generate a valid electronic invoice for Ecuador at the end of the checkout process.

付款方式配置¶

要 为销售点 创建付款方法,请进入 。

开票流程¶

标识类型和编号¶

P0S 收银员可以 为客户 创建新联系人,该客户在打开的 POS 会话中要求开具发票。

厄瓜多尔销售点模块 在联系人创建表单中增加了两个新字段:识别类型 和 :guilabel:` 税号`。

注解

由于识别码长度因识别类型而异,Odoo 会在保存联系表单时自动检查 税号 字段。要手动确保长度正确,请了解 RUC 和 公民身份 类型分别需要 13 位和 10 位数字。

电子发票:匿名终端客户¶

当客户不要求提供电子发票时,Odoo 会自动将客户设置为 最终消费者 并生成电子发票。

注解

如果客户因为退货而要求开具贷记单,贷记单应使用客户的真实联系信息。贷记单不能开给*最终消费者*,可以直接在 POS 会话中管理。

电子发票:特定客户¶

如果客户要求为其购物开具发票,可以选择或创建一个包含其财务信息的联系人。这样就能确保在生成发票时,提供准确的客户详细信息。

注解

如果客户因退货而要求开具贷记单,可以直接在 POS 会话中 管理贷记单和退货流程。

财务报表¶

在厄瓜多尔,公司需要向 SRI 提交财务报告。Odoo 支持公司使用的两种主要财务报告: 103**和104。

要获取这些报告,请进入 。 点击 报告 图标,选择 103 (EC) 或 104 (EC)。

报告 103¶

此报告提供特定期间内所得税预扣的详细信息,可按月度或半年度报告。它包括有关基数、税额和税码的信息,可用于 SRI 报告。

报告 104¶

此报告提供特定期间内的增值税和增值税预扣的详细信息,可按月度或半年度生成。它包括有关基数、税额和税码的信息,可用于 SRI 报告。

ATS 报告¶

安装 ATS 报告 (l10n_ec_reports_ats) 模块以启用以 XML 格式下载 ATS 报告的功能。

注解

厄瓜多尔 ATS 报告,模块取决于之前安装的 会计 应用程序和 厄瓜多尔 EDI 模块。

配置¶

要发出电子文件,请确保按照 电子发票 部分中的说明配置公司。

在:abbr:`ATS(Anexo Transaccional Simplificado)`中,Odoo 生成的每份文档(发票、供应商账单、销售和采购预扣、贷记单和借记单)都将包括在内。

供应商应付¶

生成供应商账单时,需要登记供应商发票上的授权号码。要执行此操作,请前往 并选择账单。然后,在 授权号码 字段中输入供应商发票上的号码。

贷记和借记单¶

手动或通过导入生成贷记单或借记单时,必须将此单据与被其修改的销售发票相关联。

注解

在下载 ATS 文件之前,请记住在文件中添加所有必要信息。例如,必要时在文件上添加 授权编号 和 SRI 付款方式。

XML 生成¶

要生成 ATS(简化交易附件) 报告,请前往 。为所需的 ATS 报告选择一个时间段,然后点击 ATS。

下载的 XML 文件已准备好上传到 DIMM Formularios。

注解

下载 ATS(简化交易附件) 报告时,如果文档缺少或包含不正确的数据,Odoo 会生成一个警告弹窗提醒用户。不过,用户仍然可以下载 XML 文件。