德国¶

会计¶

会计科目表¶

Both SKR03 and SKR04 charts of accounts are supported in Odoo. When you create a new Odoo Online database, SKR03 is installed by default.

Verify which is installed by going to and checking the Package field under the Fiscal Localization section.

警告

Selecting another package is only possible if you have not created an accounting entry. If one was posted, a new company or database must be set up to select another package. In addition, all journal entries will need to be created again.

财务报表¶

The following German-specific reports available on Odoo Enterprise:

资产负债表

利润损失

Tax Report (Umsatzsteuervoranmeldung)

欧洲共同体(EC)销售列表

欧盟专用报表

Exporting entries from Odoo to DATEV¶

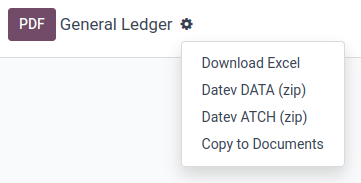

Provided that one of the German fiscal localization packages is installed, you can export your accounting entries from Odoo to DATEV from the general ledger.

Two types of exports are needed: first the DATEV ATCH export, then the DATEV DATA export.

注解

Both are needed at different stages to transfer the data correctly to DATEV, as DATEV works with two interfaces, one for clients (DUO - DATEV Unternehmen Online) and one for tax advisors (DATEV Rechnungswesen).

1. DATEV ATCH¶

进入 ,点击 )按钮,并选择 Datev ATCH (zip)。

通过 DATEV Belegtransfer 软件 上传下载的 ZIP 文件。

如果您的电脑上没有安装 DATEV Belegtransfer 软件,请咨询您的税务顾问。

警告

DATEV ATCH ZIP 文件包括与 Odoo 发票或账单相关联的文件(报告)。对于客户发票,文件必须是通过使用 打印和发送 按钮生成的。对于供应商账单,文件必须是通过电子邮件别名收到或使用 上传 按钮上传的。

DATEV ATCH ZIP 文件

ZIP 文件包含两类文件:

总分类账上所选期间的单个发票/账单文件(PDF、JPEG 等),以及

一个

document.xml文件,用于为每个文件生成唯一的 ID(GUID)。

这些唯一 ID 至关重要,因为它们允许 DATEV 自动将文件链接到单个日记账项,这些日记账项将在下一步与 DATEV DATA 文件一起导入。

2. DATEV DATA¶

进入 ,点击 )按钮,并选择 Datev DATA (zip)。

将下载的 ZIP 文件传输给您的税务顾问。他们应将 ZIP 文件导入 DATEV Rechnungswesen。

请向您的税务顾问咨询他们需要这些文件的频率。

DATEV ATCH ZIP 文件

ZIP 文件包含三个 CSV 文件:

包含与客户相关的所有信息的

EXTF_customer_accounts.csv文件、包含所有供应商相关信息的

EXTF_vendor_accounts.csv文件,以及the

EXTF_accounting_entries.csvcontaining all journal items for the period defined on the general ledger, as well as the unique IDs (GUID) so that the journal items can be linked to the files inside the DATEV ATCH ZIP file.

GoBD 合规¶

**GoBD**是*Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff*的缩写。简而言之,这是一份关于正确管理和存储电子形式的账簿、记录和文件以及数据访问的指南,与德国税务机关、纳税申报和资产负债表相关。

这些原则由联邦财政部(BMF)于2014年11月编写并发布。自2015年1月起,这些原则已成为规范,并取代了以前公认的与基于计算机的会计相关的做法。由于数字化解决方案(云托管、无纸化公司等)的发展,联邦财政部在 2019 年和 2020 年 1 月对其中一些内容进行了修改。

重要

Odoo 已通过**GoBD 合规性**认证。

了解与会计软件相关的 GoBD¶

The GoBD is binding for companies that have to present accounts, which includes SMEs, freelancers, and entrepreneurs, to the financial authorities. As such, the taxpayer himself is the sole responsible for the complete and exhaustive keeping of fiscal-relevant data (above-mentioned financial and related data).

Apart from software requirements, the user is required to ensure internal control systems (in accordance with sec. 146 of the Fiscal Code):

access rights control;

segregation of duties, functional separating;

entry controls (error notifications, plausibility checks);

reconciliation checks at data entry;

processing controls; and

measures to prevent intentional or unintentional manipulation of software, data, or documents.

The user must distribute tasks within their organization to the relevant positions (control) and verify that the tasks are properly and completely performed (supervision). The result of these controls must be recorded (documentation), and should errors be found during these controls, appropriate measures to correct the situation should be put into place (prevention).

Data security¶

The taxpayer must secure the system against any data loss due to deletion, removal, or theft of any data. If the entries are not sufficiently secured, the bookkeeping will be regarded as not in accordance with the GoBD guidelines.

预订最终发布后,将无法再通过应用程序进行更改或删除。

如果在云端使用Odoo,则提供定期备份服务。此外,可以在外部系统下载和备份定期备份数据。

If the server is operated locally, the user is responsible for creating the necessary backup infrastructure.

重要

在某些情况下,数据必须保留十年或更长时间,因此始终保存备份。如果您决定更换软件提供商,则更为重要。

软件编辑的责任¶

Considering GoBD applies only to the taxpayer, the software editor can by no means be held responsible for the accurate and compliant documentation of their users’ financial transactional data. It can merely provide the necessary tools for the user to respect the software-related guidelines described in the GoBD.

Ensuring compliance through Odoo¶

The keywords, when it comes to GoBD are: traceable, verifiable, true, clear, and continuous. In short, you need to have audit-proof archiving in place, and Odoo provides you with the means to achieve all of these objectives:

- 追溯性和可验证Each record in Odoo is stamped with the creator of the document, the creation date, the modification date, and who modified it. In addition, relevant fields are tracked. Thus, it can be seen which value was changed by whom in the chatter of the relevant object.

- 完整性All financial data must be recorded in the system, and there can be no gaps. Odoo ensures that there is no gap in the numbering of the financial transactions. It is the responsibility of the user to encode all financial data in the system. As most financial data in Odoo is generated automatically, it remains the responsibility of the user to encode all vendor bills and miscellaneous operations completely.

- 价格准确性Odoo ensures that, with the correct configuration, the correct accounts are used. In addition, the control mechanisms between purchase orders and sales orders and their respective invoices reflect the reality of the business. It is the responsibility of the user to scan and attach the paper-based vendor bill to the respective record in Odoo. Odoo Documents helps you automate this task.

- 及时预订和记录保存由于Odoo中的大多数财务数据都是由交易对象生成的(例如,开票是在确认时记账的),Odoo确保开箱即用的及时记录保存。用户有责任及时对所有传入的供应商账单以及杂项操作进行编码。

- 订购Financial data stored in Odoo is, per definition, ordered and can be reordered according to most fields present in the model. A specific ordering is not enforced by the GoBD, but the system must ensure that a given financial transaction can be quickly found by a third-party expert. Odoo ensures this out-of-the-box.

- 不变性散列通过德语Odoo本地化,Odoo的标准配置方式是,无需任何进一步的自定义即可遵守不可更改性子句。

GoBD export¶

在财政控制的情况下,财政当局可以请求对会计系统的三个级别的访问(Z1,Z2,Z3)。这些级别从直接访问接口到在存储设备上移交财务数据不等。

In the case of a handover of financial data to a storage device, the GoBD does not enforce the format. It can be, for example, in XLS, CSV, XML, Lotus 123, SAP-format, AS/400-format, or else. Odoo supports the CSV and XLS export of financial data out of the box. The GoBD recommends the export in a specific XML-based GoBD format (see “Ergänzende Informationen zur Datenträgerüberlassung” §3), but it is not binding.

Non-compliance¶

In the event of an infringement, you can expect a fine and a court order demanding the implementation of specific measures.

POS¶

Technical security system¶

The Kassensicherungsverordnung (The Act on Protection against Manipulation of Digital Records) requires that electronic record-keeping systems - including the point of sale systems - must be equipped with a technical security system (also called TSS or TSE).

Odoo提供了一项在“fiskaly <https://fiskaly.com>”的帮助下兼容的服务,这是一种基于云的解决方案*。

重要

由于此解决方案是基于云的,因此需要有效的互联网连接。

注解

The only VAT rates allowed are given by fiskaly. You can check these rates by consulting fiskaly DSFinV-K API: VAT Definition.

配置¶

:ref:“安装<一般/安装>” 德国-门店收银 (“l10n_de_pos_cert”)和 德国 - 餐厅类型门店收银认 (“l10n_de_pos_res_cert”)模块。

小技巧

如果未列出这些模块,则 更新应用列表。

Create a technical security system and link it to a POS¶

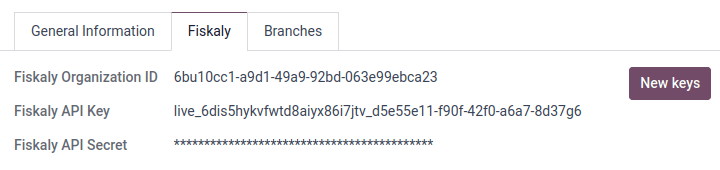

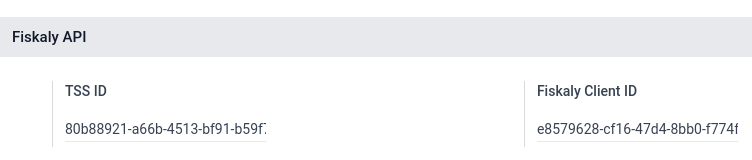

To use a point of sale in Germany, first create a TSS by going to , selecting the Point of Sale to edit, then checking the Create TSS box under the Fiskaly API section.

Once the creation of the TSS is successful, you can find the:

TSS ID, which refers to the ID of your TSS on fiskaly’s side, and

Fiskaly Client ID, which refers to your POS on fiskaly’s side.

DSFinV-K export¶

Whenever you close a PoS session, the details of the orders are sent to the DSFinV-K service of fiskaly.

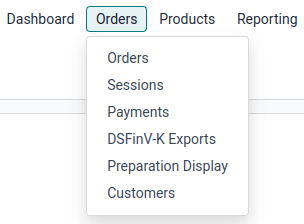

In case of an audit, you can export the data sent to DSFinV-K by going to .

这些字段是必填字段:

Start Datetime: export data with dates larger than or equal to the given start date

End Datetime: export data with dates smaller than or equal to the given end date

Leave the Point of Sale field blank to export the data of all your points of sale; specify one if you want to export data for this specific POS only.

When an export is successfully triggered and is being processed, the State field should mention Pending. Click Refresh State to check if it is ready.