乌拉圭¶

介绍¶

With the Uruguayan localization, you can generate electronic documents with its XML, fiscal folio, electronic signature and connection to tax authority Dirección General Impositiva (DGI) through Uruware.

The supported documents are:

e-Invoice, e-Invoice Credit Note, e-Invoice Debit Note;

e-Ticket, e-Ticket Credit Note, e-Ticket Debit Note;

Export e-Invoice, Export e-Invoice Credit Note, Export e-Invoice Debit Note.

The localization requires an Uruware account, which enables users to generate electronic documents within Odoo.

词汇表¶

The following terms are used throughout the Uruguayan localization:

DGI: Dirección General Impositiva is the government entity responsible for enforcing tax payments in Uruguay.

EDI: Electronic Data Interchange refers to the sending of electronic documents.

Uruware: is the third-party organization that facilitates the interchange of electronic documents between companies and the Uruguayan government.

CAE: Constancia de Autorización de Emisión is a document requested from the tax authority’s website to enable electronic invoice issuance.

配置¶

模块安装¶

Install the following modules to get all the features of the Uruguayan localization:

名称 |

技术名称 |

说明 |

|---|---|---|

Uruguay - Accounting |

|

The default fiscal localization package. It adds accounting characteristics for the Uruguayan localization, which represent the minimum configuration required for a company to operate in Uruguay according to the guidelines set by the DGI. The module’s installation automatically loads: chart of accounts, taxes, documents types, and tax supported types. |

Uruguay Accounting EDI |

|

Includes all the technical and functional requirements to generate and validate Electronics Documents, based on the technical documentation published by the DGI. The authorized documents are listed above. |

注解

Odoo automatically installs the base module Uruguay - Accounting when a database is installed

with Uruguay selected as the country. However, to enable electronic invoicing, the Uruguay

Accounting EDI (l10n_uy_edi) module needs to be manually installed.

公司¶

To configure your company information, open the Settings app, scroll down to the Companies section, click Update Info, and configure the following:

公司名称

Address, including the Street, City, State, ZIP, and Country

Tax ID: enter the identification number for the selected taxpayer type.

DGI Main Branch Code: this is part of the XML when creating an electronic document. If this field is not set, all electronic documents will be rejected.

To find the DGI Main Branch Code, follow these steps:

From your DGI account, go to .

Select .

Open the generated PDF to get the DGI Main Branch Code from the Domicilio Fiscal Número de Local section.

After configuring the company in the database settings, navigate to and search for your company to verify the following:

the company type is set to Company.

the Identification Number Type is RUT / RUC.

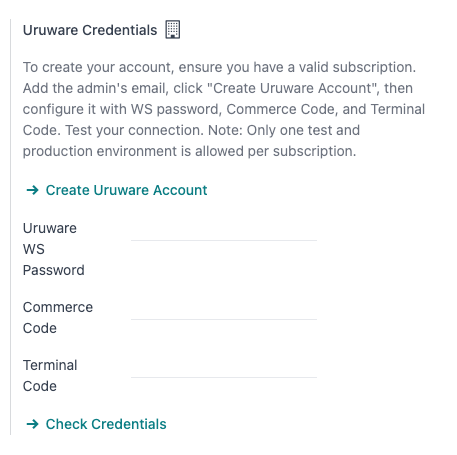

Set up a Uruware account¶

To set up a Uruware account, follow these steps:

Verify that you have a valid Odoo subscription.

Locate the Uruware credentials settings by navigating to the .

Scroll down to the Uruguayan Localization section and select the environment (Production or Testing).

Click on Create Uruware Account.

Upon doing so, an email is sent to the address associated with your Odoo subscription with the password to enter Uruware’s portal and set up your account.

小技巧

The email with the credentials is not immediate; it might take up to 48 hours for the account to be created.

The company’s Tax ID needs to be set up to be able to create an Uruware account.

The password sent expires after 24 hours. In this case, reset it by using the Forgot Password link in Uruware’s portal.

注解

This action will create an account with Uruware with the following information:

Legal name (razón social)

RUT from the company

Username (the Odoo subscription email or

RUT.odoo. For example:213344556677.odoo)Odoo database link

为确保正确创建账户,请添加上述信息中缺失的内容。

创建账户并收到包含凭证的电子邮件后,请直接在 Uruware 的 测试门户 或 `生产门户 <https://prod6109.ucfe.com.uy/Gestion/>`_中配置账户:

使用电子邮件中的账户凭据登录到相应的(测试 或`正式运行 <https://prod6109.ucfe.com.uy/Gestion/>`_)门户。

在 Uruware 的门户网站上,需要采取以下步骤才能从 Odoo 开具发票:

填写并更正公司信息。

添加数字证书。

Add your CAEs for each document-type you plan to issue.

Configure the format of the PDF to be printed and sent to your customers.

重要

Be sure to configure two accounts, one for testing and one for production. The certificate is needed in both environments, but CAEs are only needed in production.

Electronic invoice data¶

要配置电子发票数据,需要配置环境和凭证。要执行此操作,请导航至 并向下滚动至 Uruguayan 本地化 部分。

首先,选择 UCFE 网上服务 环境:

正式运行:用于正式运行数据库。在这种模式下,电子文档通过 Uruware 发送到 DGI 进行验证。

测试:用于测试数据库。在这种模式下,可以测试直接连接流,文件通过 Uruware 发送到 DGI 测试环境。

演示:文件在演示模式下自动创建和接受,但**不会**发送到 DGI。因此,在此模式下不会出现拒绝错误。每个内部验证都可以在演示模式下进行测试。请避免在正式运行数据库中选择此选项。

注解

使用 演示 模式不需要 Uruware 帐户。

然后,输入 Uruware 数据:

Uruware WS 密码

商业代码

终端代码

注解

配置 :ref:`Uruware 账户 <l10n_uy/uruware-account>`后,可从 Uruware 门户获取此数据。

要获取 Uruware WS 密码,请访问 ,并在 验证器和其他信息 选项卡中找到 WS 密码。

要获取 商业代码,请访问 。

要获取 终端代码,请访问 。

主数据¶

会计科目表¶

默认安装 会计科目表 作为本地化模块中数据集的一部分,在税项、默认应付账款和默认应收账款中自动映射账目。

可根据公司需要添加或删除账户。

更多内容

联系人¶

要创建联系人,请导航至 并选择 新建。然后输入以下信息:

公司名称

地址:

街道:确认电子发票所需的信息。

城市

州/省

ZIP

国家/地区:确认电子发票所需的信息。

标识码:

类型:选择标识类型。

数量:确认电子发票所需的信息。

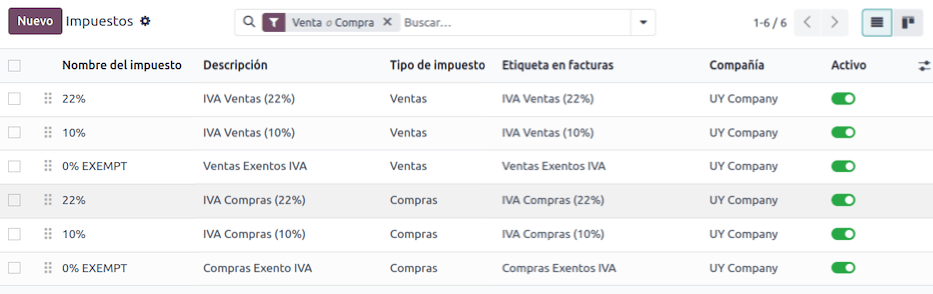

税率¶

作为乌拉圭本地化模块的一部分,税项将根据其配置和相关财务账户自动创建。

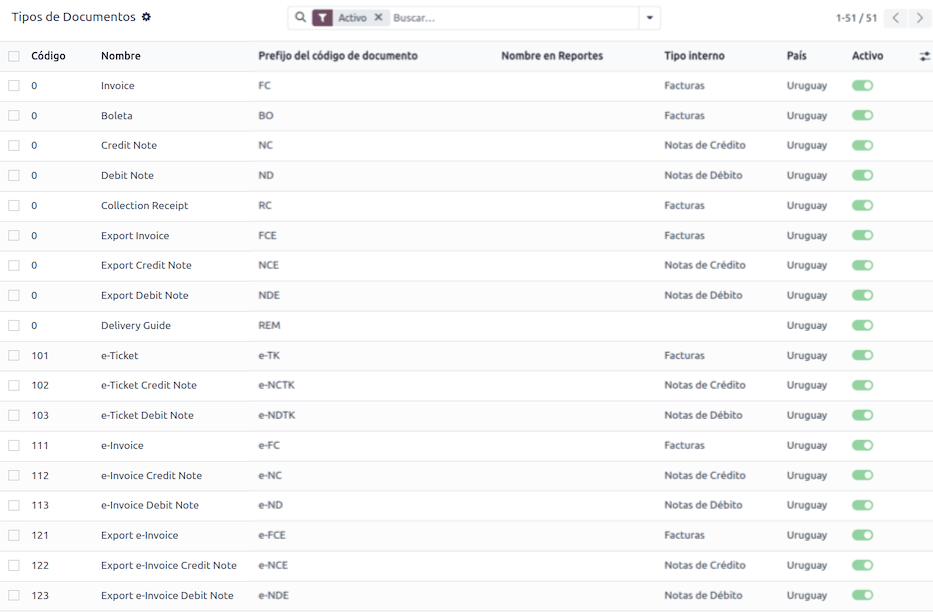

文件类型¶

有些会计交易,如 客户发票 和 供应商账单,是按文件类型分类的。这些都由政府财政部门定义,在本例中由 DGI 定义。

每种文档类型都可以为其指定的每种日记账创建唯一的序列。数据在安装本地化模块时自动创建,默认情况下包含文件类型所需的信息。

要查看本地化中包含的文档类型,请导航至 。

注解

In Uruguay, CAEs must be uploaded in Uruware. Sequences (and PDFs) are received in Odoo from Uruware, based on their CAEs. CAEs are only used in production. When testing, only a range of sequences used in Uruware need to be set.

销售日记账¶

To generate and confirm an electronic document that will be validated by DGI, the sales journal needs to be configured with the following:

Invoicing Type: by default Electronic option is set. This is necessary to send electronic documents via web service to the Uruguayan government through Uruware. The other option, Manual, is for open invoices previously stamped in another system, for example, in the DGI.

Use Documents?: Activate this option if this journal will use documents from the list of document types in Odoo.

工作流¶

Once you have configured your database, you can create your documents.

销售文档¶

客户应收¶

Customer invoices are electronic documents that, when validated, are sent to DGI via Uruware. These documents can be created from your sales order or manually. They must contain the following data:

客户:输入客户信息。

Due date: to compute if the invoice is due now or later (contado or crédito, respectively).

Journal: select the electronic sales journal.

Document Type: document type in this format, for example,

(111) e-Invoice.Products: specify the product(s) with the correct taxes.

注解

每种文件类型都有特定的贷记单和借记单(例如,文件类型 (111) 电子发票`有一个 :guilabel:`(112) 电子发票贷记单)。

客户贷记单/退款单¶

客户贷记单 是一份电子文档,经验证后通过 Uruware 发送到 DGI。要注册贷记单,必须有一张已验证(已入账)的发票。在发票上点击 贷记单 按钮进入 创建贷记单 表格,然后填写以下信息:

原因:输入贷项通知单的原因。

日记账:选择必须是电子版且 使用文档 选项已激活的日记账。

文件类型:选择贷记单类型。

撤销日期:输入该日期。

客户借记单/缴款通知¶

客户借记单 是一个电子文档,在验证后通过 Uruware 发送到 DGI。要注册借记单,必须有一张已验证(已入账)的发票。在发票上点击 )图标,选择 借记单 选项进入 创建贷记单 表格,然后填写以下信息:

原因:键入借记的原因。

日记账:选择必须是电子版且 使用文档 选项已激活的日记账。

复制行:勾选复选框,将发票行复制到借记单。

借记单:输入日期。

注解

确认发票以创建具有内部参考的发票。要通过 Uruware 将文档发送到 DGI,请点击 发送和打印 并选择复选框 创建 CFE。文件处理完毕后,Uruware 将提供法律文件序列(编号)。确保 Uruware 中有可用的 |CAE|。

注解

经过验证的 PDF 文件是按照乌拉圭政府(DGI)的规范从 Uruware 中提取的。

附录和披露¶

*附录*和*披露*是添加到电子文档中的附加注释和评论,可以是强制性的,也可以是可选的。要创建新的附录,请转到 ,然后点击 新建。

输入以下信息:

名称:附录或强制披露的名称。

类型:选择备注类型,这会将其添加到 XML 中的特定部分。

是否为图例:如果文本是强制性披露信息,请选择此框;如果是附加信息,请留空。

内容:添加附录或披露的完整文本。

Leyenda 和产品中的附加信息¶

要将 leyenda 或附加信息添加到产品和 XML,需要将预配置的附录和披露添加到发票行中的产品。在该行指定产品的 披露 字段中添加 leyenda。

Leyenda 和其他信息¶

要在电子发票和 XML 中添加*附录*或其他信息,请访问发票,转到 其他信息 选项卡,并在 附录和披露 字段中选择所需的附录。在此添加的附录和披露信息将显示在 XML 中,并在 PDF 文档中清晰可见。

这适用于以下类型的*附录*:

文档

发行人

接收方

附录

注解

要在电子文档中添加临时备注,请使用 条款和条件 字段。这些信息将在发票附录中发送,但不会保存到以后的文档中。