香港¶

重要

继续之前,确保已安装 香港 - 薪酬管理 (l10n_hk_hr_payroll) 模块。

创建员工¶

转到 应用程序,然后点击 新建。然后,配置以下字段:

在 工作信息 选项卡下

工作时间: :guilabel:`香港标准 40 小时/周`选项 必须 选择。

在 私人信息 选项卡下

姓、名、中文名:员工姓名。

私人地址:员工的地址。

银行账号:员工的银行账号。

当前租金:员工的租金记录(如果适用租金津贴)。

自动付款类型: BBAN、SVID、EMAL 等。

自动付款参考号:自动付款参考号。

身份证号码:员工的香港身份证。

性别:员工的性别。

重要

对于 银行账号 账户,应在进一步处理前将其设置为 信任 账户。

为此,请点击 银行账号 字段旁边的右箭头按钮。点击切换按钮,将 汇款 设置为 信任。

注解

要填充 当前租金 内容,请点金 历史 按钮。然后,点击 新建。填写相关详细信息并保存租房记录。保存记录后,租赁合同 状态 将显示(在右上角),并可设置为 进行中。

在 HR 设置 选项卡下:

Volunteer Contribution Option: select either Only Mandatory Contribution, With Fixed %VC, or Cap 5% VC.

MPF 宏利帐户:账户号码(如果适用)。

管理合同¶

创建新员工后,点击员工记录上的 合同 智能按钮,或导航至 。

注解

每名员工只能同时激活 一份 合同,但员工在受雇期间,可以为其分配连续的合同。

以下对于订立合同至关重要:

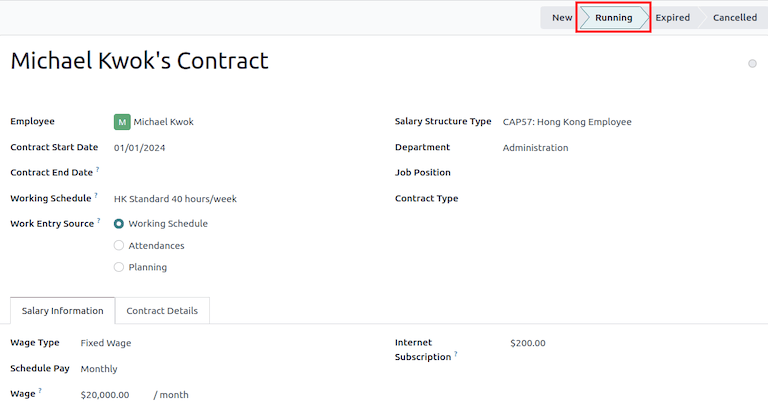

薪资结构类型:设置为 CAP57:香港员工。

合同开始日期:开始雇佣日期。

工作安排:设置为 :guilabel:`香港标准 40 小时/周`(来自员工记录)。

工作条目来源:选择 工作安排、考勤 或 计划。此字段决定工资单中工作条目的核算方式。

guilabel:

工作安排:根据员工的工作安排自动生成工作条目。出勤:工作条目根据 出勤 中记录的签到/签退时间段生成。

规划:工作条目仅由已规划班次生成。

在 薪资信息 选项卡下

工资类型:为全职或兼职员工选择 固定工资,或为按小时支付工资的员工选择 小时工资。

Schedule Pay: the frequency of payslip issuance.

Wage: Monthly or Hourly depending on the Wage Type.

Internet Subscription: this is an optional field to provide additional internet allowance on top of the current salary package.

重要

Timesheets do not impact work entries in Odoo.

Once all information has been setup, set the contract status to Running by clicking the Running button in the top-right of the page.

生成工资单¶

Once the employees, and their contracts, are configured, payslips can be generated in the Payroll app.

Odoo provides four different salary structures under CAP57 regulation:

CAP57: Employees Monthly Pay: to process the monthly employee salary.

CAP57: Payment in Lieu of Notice: to process final payment upon contract termination using ADW.

CAP57: Long Service Payment: applicable to employees with more than five years of service upon contract termination.

CAP57: Severance Payment: applicable to employees with more than two years of service upon contract termination.

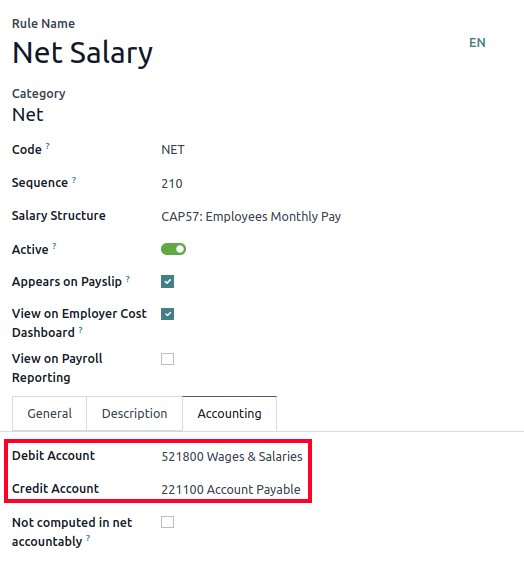

Before running the payslips, the accounts used in the salary rule can be adjusted by navigating to .

Odoo can create pay runs in two ways: via batch or individual payslips.

工资单批次¶

这种工资单生成方法适用于定期付款,因为可以同时管理多个员工的工资单。转到 。

点击 新建。

输入 批次名称 (例如,

2024 - 一月)和 时间 (例如,01/01/2024-01/31/2024)。点击 生成工资单。

选择此批次要使用的 薪资结构 名称。部门筛选器允许批次只适用于特定的员工组。

点击 生成。

自动创建 工资单 智能按钮。

接下来,点击 创建草稿条目 生成每张工资单的 其他信息 选项卡中的日记账分录草稿。弹出 确认 窗口询问 您确定要继续吗?点击 :guilabel:`确认,创建日记账分录。

单个工资单¶

进入 。

This method of payslip generation is commonly used to handle non-recurring payments (e.g. CAP57: Payment in Lieu of Notice, CAP57: Long Service Payment or CAP57: Severance Payment).

点击 新建。

Select an Employee. When selected, the Contract is filled out automatically.

Add a pay Period.

Select a salary Structure (e.g. CAP57: Employees Monthly Pay).

The Worked Days & Inputs tab automatically compute the worked days/hours and time off leaves that are applicable.

Additional payslip items can be added at this time (e.g. Commissions, Deductions) under the Other Inputs section.

Click on Compute Sheet button to generate the payslip lines. This button updates the Salary Computation tab.

注解

If the work entry for an employee was amended, click the (gear) icon, then click Recompute Whole Sheet to refresh the payslip’s Worked Days & Inputs tab.

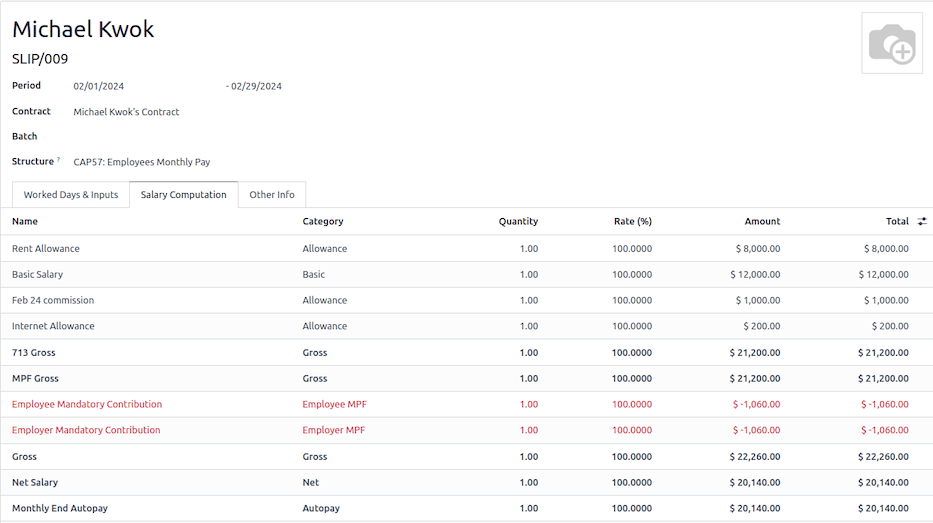

The Salary Computation tab shows the detailed breakdown of the computation, based on the salary rules configured for each structure type.

Rent Allowance: amount derived from the employee’s active rental record.

Basic Salary: amount of base salary provided (after rent allowance deduction).

713 Gross: net payable amount considering Commission, Internet Allowance, Reimbursements, Back-pay, Deduction, etc.

MPF Gross: net payable amount from 713 gross after consideration of additional allowances, deductions, and end-of-year payment.

Employee Mandatory Contribution: employee MPF Contribution.

Employer Mandatory Contribution: employer MPF Contribution.

Gross: net payable amount from MPF gross after consideration of MPF deductions.

Net Salary: final payable amount to be paid to the employee.

重要

There are no MPF contributions for the first month. Both employee and employer contribution starts on second month.

Under the Other Inputs section in Worked Days & Inputs tab, there are additional manual input types:

Back Pay: additional salary payout can be included under this category.

Commission: the commission earned during the period can be manually entered here.

Global Deduction: a lump-sum deduction from the entire payslip.

Global Reimbursement: a lump-sum reimbursement to the entire payslip.

Referral Fee: the additional bonus offered for any form of business-related referral.

Moving Daily Wage: to override the ADW value used for leaves computation.

Skip Rent Allowance: if set, the rental allowance is excluded from the current payslip.

Custom Average Monthly Salary: to override the average monthly salary used for end-of-year payment (rule is only applicable to payslips generated in December).

Lieu of Notice Period (Months): only applicable to CAP57: Payment in Lieu of Notice salary structure. By default, the final payout is set as 1-month. Use the Count field under the Other Inputs section to set a different notice period duration.

Once the payslips are ready, click on Compute Sheet, followed by Create Draft entry to generate a draft journal entry found in the Other Info tab of the payslip.

向员工支付薪酬¶

Once the draft journal entries have been posted, the company can now pay the employees. The user can choose between two different payment methods:

From the employee’s payslip (), once the payslip’s journal entry has been posted, click Register Payment. The process is the same as paying vendor bills. Select the desired bank journal and payment method, then later reconcile the payment with the corresponding bank statement.

For batch payments (), once all draft journal entries from the batch are confirmed, click Mark as Paid to post the payment journal entry. Then create a payment in the Accounting app, and reconcile accordingly.

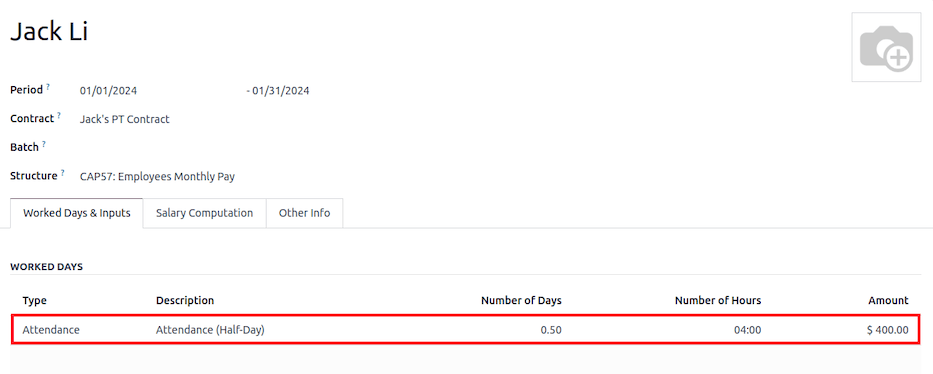

出勤率和小时工资¶

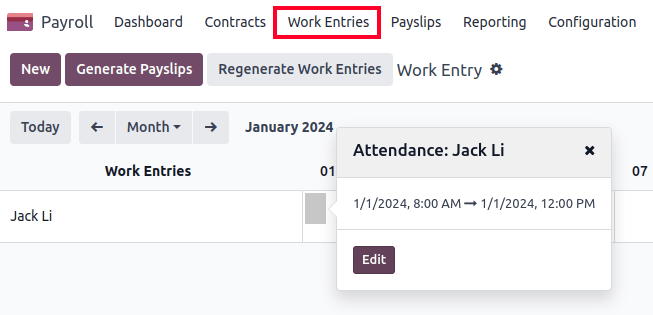

To configure the contract for an employee paid hourly using the Attendances app for hours tracking, navigate to . Create a new contract. It is important to remember to set the Work Entry Source as Attendances, and Wage Type as Hourly Wage.

使用 考勤 应用程序记录员工登记的工时:

转到 。

员工可通过自助终端模式办理签到/签退手续,时间将自动记录。

在 中,查看从 生成的出勤工作条目。

Next, generate the payslips and process the payment.

休假与薪酬管理¶

工作记项类型和休假类型,在 休假 和 薪酬管理 应用程序之间完全整合。香港-薪酬管理 模块安装时,有几项香港特定的默认休假类型和工作记项,会一并自动安装。

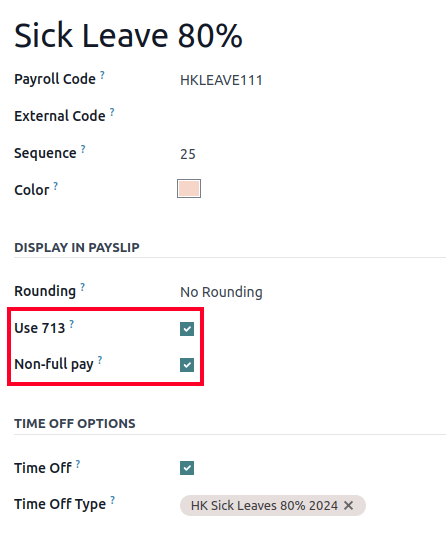

前往 ,点击 新建。

设置工作记项类型时,有两个复选框需要考虑:

使用 713:将此休假类型纳入为 713 计算的一部份。

非全薪工资:即 ADW(每日平均工资) 的 80%。

更多内容

了解 713 条例规定¶

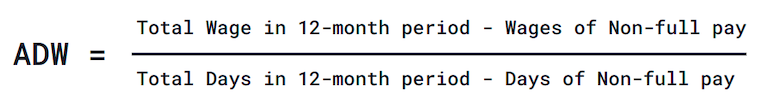

香港 - 薪酬管理 模块符合第 713 号条例,该条例涉及 每日平均工资 的计算,以确保员工获得公平报酬。

“每日平均工资” ADW 的计算方法如下:

ADW(每日平均工资) 每日平均工资,等于 12 个月期间的总工资减去非全额支付的工资,然后除以 12 个月期间的总天数减去非全额支付的天数。¶

注解

对于 “418” 规定,目前未有自动为员工分配 法定假期 的功能。新任员工一旦满足 “418” 规定的要求,您便需在 休假 应用程序,为他们手动分配休假。

注解

生成工资单之前,确保状态为 已完成 以验证结果。

期间 |

天 |

工资 |

佣金 |

总计 |

每日平均工资 |

休假价值 |

|---|---|---|---|---|---|---|

一月 |

31 |

$20200 |

$0 |

$20200 |

$651.61 ($20200/31) |

无 |

二月 |

28 |

$20200 |

$5000 |

$25200 |

$769.49 ($45400/59) |

无 |

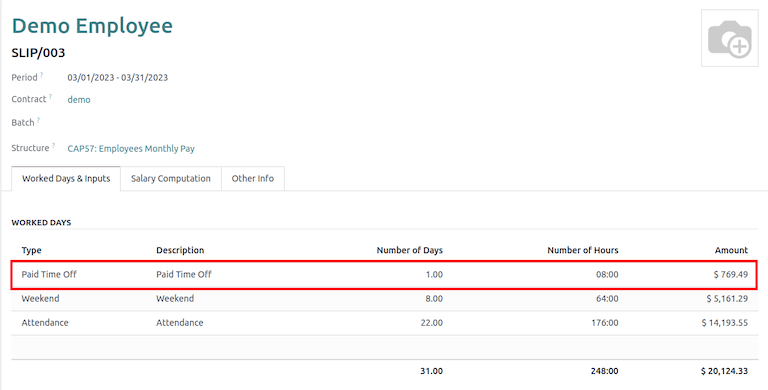

三月(1 天年假) |

31 |

$20324.33 |

$0 |

$20324.33 |

$730.27 ($65724.33/90) |

$769.49 |

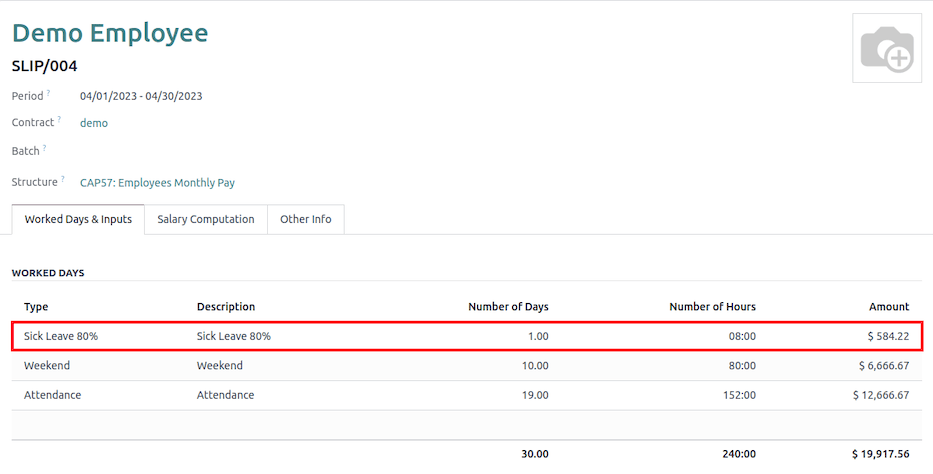

Apr (One Day 80% Sick Leave) |

30 |

$20117.56 |

$0 |

$584.22 ($730.27*0.8) |

Example

下面是演示 713 条例逻辑的示例:

一月:生成月工资为 20200 美元的工资单。 ADW(平均日工资)始终根据过去 12 个月的累积值计算。

二月:生成类似的工资单,但为 佣金 新增 其他输入类型。

三月:在三月申请 一次 带薪年假。迄今为止,休假的工资补偿基于 ADW(平均日工资)。

四月:申请在四月份休 1 天非带薪假。由于这是一次非带薪假期,因此会相应计算 平均日工资。

注解

The value of ADW is computed in the backend, and not be visible to the user.

生成报告¶

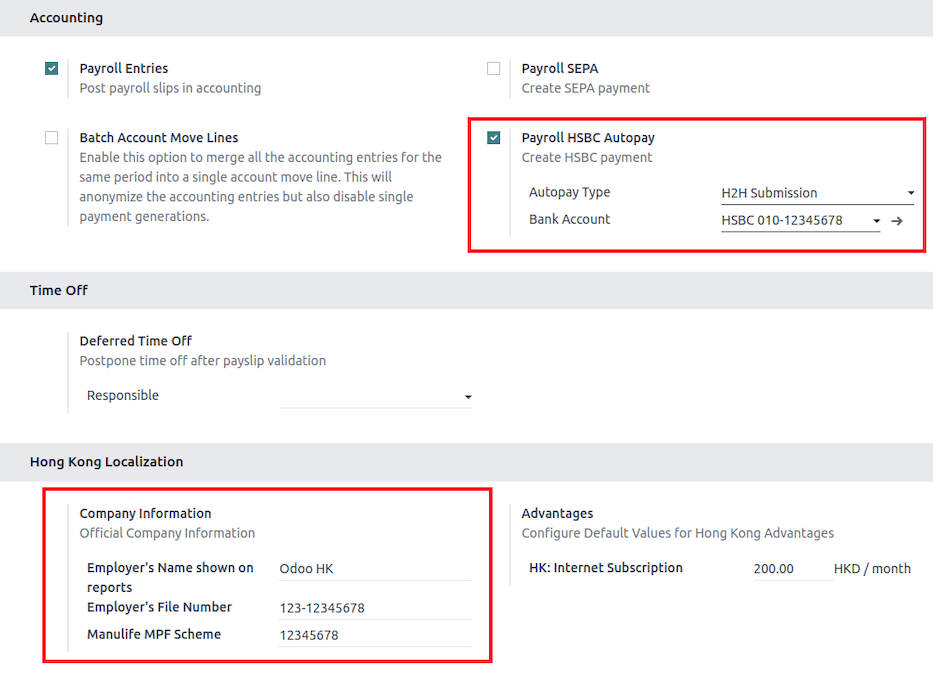

Before generating the below reports, setup the following in .

Configure the following in the Accounting section:

Tick the Payroll HSBC Autopay checkbox.

Autopay Type: Set as H2H Submission.

Select the Bank Account to use.

Configure the following in the HK Localization section:

Employer’s Name shows on reports

Employer’s File Number

Manulife MPF Scheme

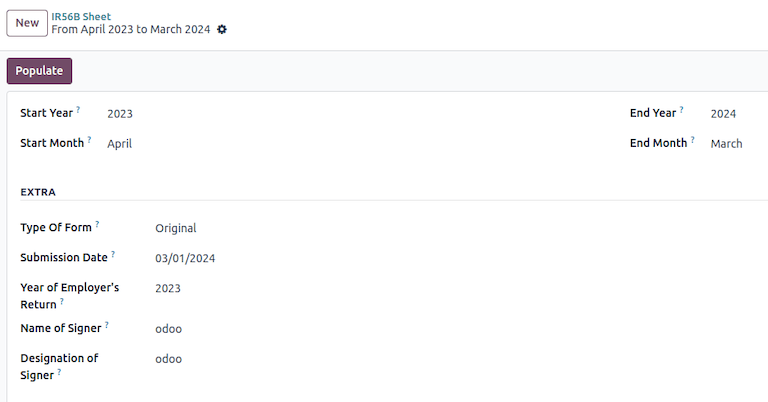

IRD report¶

There are a total of four IRD reports available:

IR56B: employer’s Return of Remuneration and Pensions.

IR56E: notification of Commencement of Employment.

IR56F: notification of Ceasation of Employment (remaining in HK).

IR56G: notification of Ceasation of Employment (departing from HK permanently).

Go to , and select one of the IR56B/E/F/G Sheet options:

点击 新建。

Fill in the relevant information for the IRD report.

Click on Populate, and the Eligible Employees smart button appears.

The Employee Declarations status is Draft and changed to Generated PDF status once the schedule runs.

Once the PDF is generated, the IRD form may be downloaded.

注解

The scheduled action called Payroll: Generate pdfs can be manually triggered. It is set by default to run the PDF generation monthly.

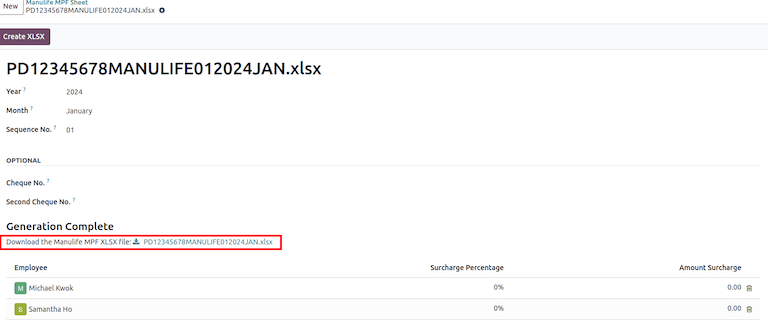

Manulife MPF sheet¶

Go to .

点击 新建。

Select the relevant Year, Month, and Sequence No..

Click on Create XLSX.

The Manulife MPF XLSX file is then generated, and available for download.

注解

Odoo will not be developing further reports for other MPF trustee as there will soon be an eMPF platform setup by the local government.

更多内容

HSBC autopay report¶

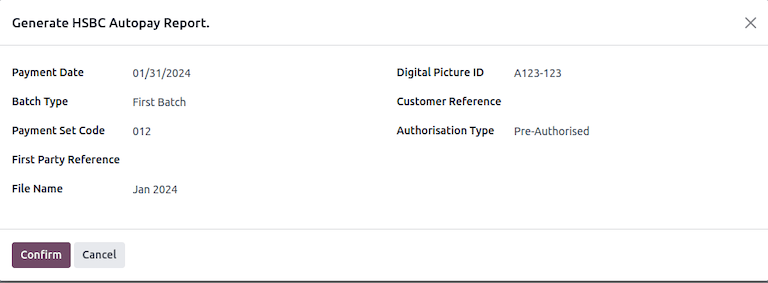

If HSBC Autopay is selected as the batch payment method, click on Create HSBC Autopay Report, and fill in the mandatory fields:

This creates an .apc file format which can be uploaded to the HSCB portal for processing.