比利时¶

Understanding the Belgian payslip¶

概述¶

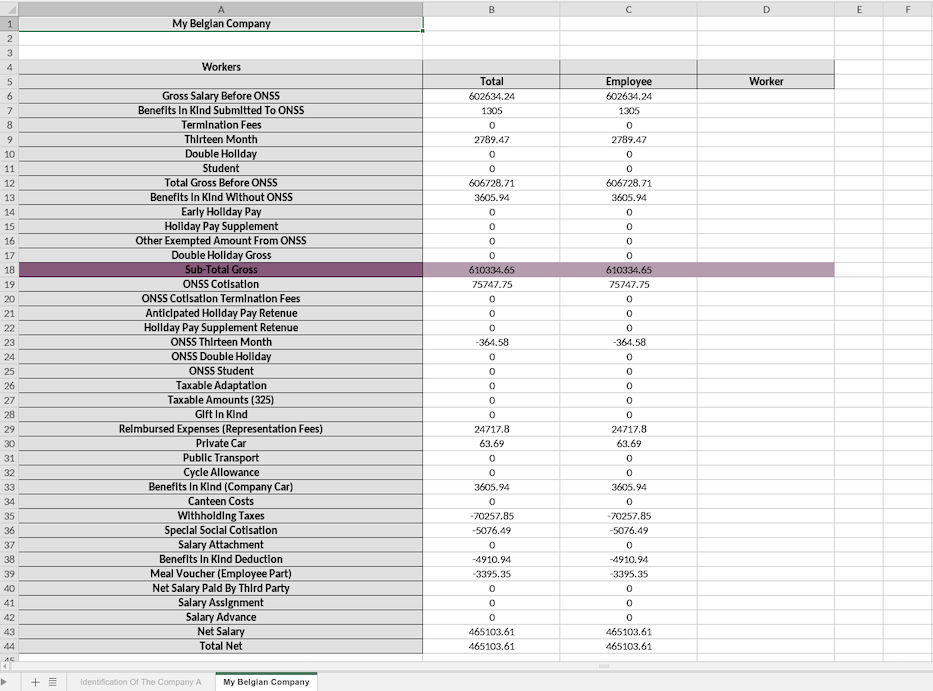

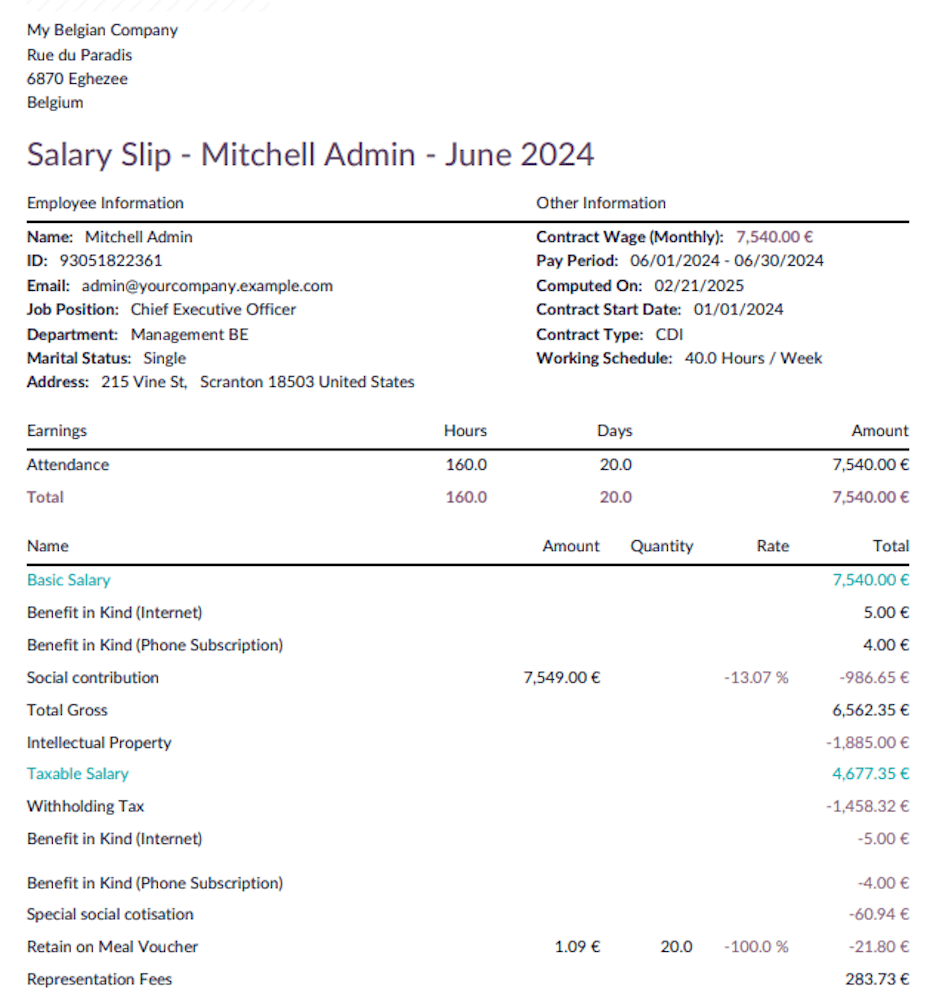

Providing employees with a clear, transparent payslip is essential for compliance and employee satisfaction. This guide explains how to interpret a Belgian payslip, detailing key components that impact salary calculations and deductions.

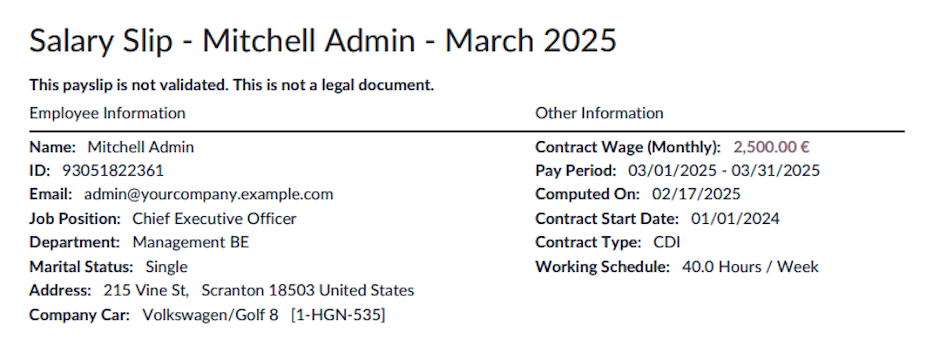

一般信息¶

The first section of the payslip contains the employee’s general details. It is crucial to verify the accuracy of the civil status and the number of dependents, as these factors influence tax calculations. Employers can ensure updates are made through their internal salary configurator or employee profile management systems.

工作条目¶

This section outlines time-off applications and their impact on salary. The base salary typically remains constant unless unpaid leave is taken. If an employee has taken unpaid leave, parental leave, or any unexpected absence, their salary will reflect the corresponding deductions.

Payroll calculation¶

The core of the payslip details various salary components, deductions, and benefits. Below are the primary elements:

Benefits in Kind: If applicable, benefits in kind (such as a mobile or internet subscription or a laptop) are subject to taxation and impact net remuneration.

When a company car is provided for personal use, a taxable benefit (ATN) is added to the employee’s salary. This is determined by:

The catalog value and age of the vehicle

The vehicle’s CO2 emissions

This benefit is subject to withholding tax and will be adjusted later in the payroll process.

Social Security contributions: A mandatory 13.07% deduction from gross salary is allocated to the National Social Security Office (ONSS). This includes:

Pensions: 7.5%

Health Insurance for Care: 3.55%

Health Insurance for Benefits: 1.15%

Unemployment: 0.87%

Additionally, the employer contributes on average 25% of the employer’s contributions to the National Social Security Office.

Employment bonus: A reduction in employee contributions based on gross salary, which is phased out if the salary exceeds a specific threshold.

Withholding taxes: Withholding tax rates are revised annually by the SPF Finances.

The tax amount is influenced by:

Gross salary

Marital status (married, legally cohabiting, or single)

Household composition (children or other dependents)

This serves as an advance payment on professional income tax.

Reduction in withholding tax: A reduction based on gross salary, which is ignored if salary surpasses a specific amount.

Special Social Security contribution: A household income-based tax applicable to all employees covered by social security.

Meal voucher deduction: Employees receive meal vouchers valued for instance at €8 per workday, where:

The employer contributes €6.91

The employee contributes €1.09

Example

5 worked days -> deduction of €5.45 (\(5\times\text{€}1.09\))

22 worked days -> deduction of €23.98 (\(22\times\text{€}1.09\))

Variations in this deduction impact monthly net salary.

Representation fees: An optional net salary component, allocated in two parts:

A fixed portion, independent of working hours

A prorated portion, adjusted for part-time schedules

Net salary: The final amount deposited into the employee’s bank account after deductions.

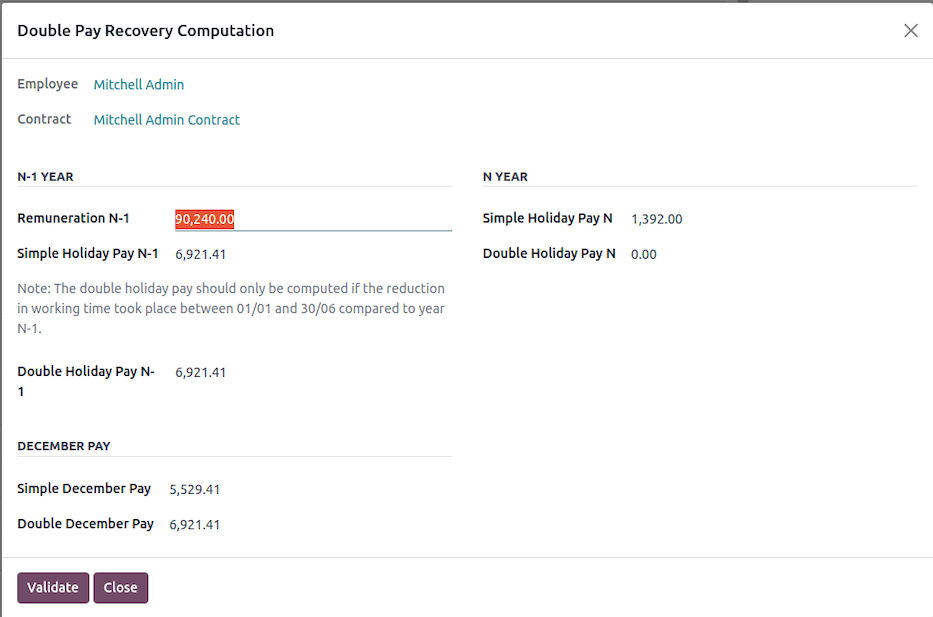

December pay¶

Why a December settlement?¶

An employer must pay a vacation allowance to an employee in December under two conditions:

If the employee has reduced their working hours during the vacation year.

If the employee is unable to take all their vacation days before the end of the year.

In principle, employers must ensure that employees take their annual vacation before December 31. However, certain circumstances may prevent employees from using all their vacation days. In these cases, the employer must pay the simple vacation allowance for unused days before the end of the year. Additionally, if the employee has not received the double vacation allowance earlier in the year (typically in May or June), they are entitled to receive it.

Reduction of working hours¶

When an employee reduces their average working hours with the same employer, the employer must pay the vacation allowance in December of the year in which the reduction occurs, as if the employee had left the company.

Possible scenarios:

Transition to part-time work.

Partial career break.

Thematic leave on a part-time basis.

Partial return to work after a full incapacity period.

The settlement is calculated based on the previous vacation year’s earnings and includes:

Simple vacation allowance: 7.67% of the yearly gross salary from the previous year, including any fictitious salary for assimilated interruption days, minus the simple vacation allowance already paid during the vacation year.

Double vacation allowance: 7.67% of the yearly gross salary from the previous year, including any fictitious salary for assimilated interruption days, minus the double vacation allowance already paid during the vacation year.

If all vacation days have been taken before the reduction in working hours, no additional calculation is required.

Inability to use vacation days¶

As a general rule, all vacation days must be used within the vacation year. However, if an employee is unable to take all their vacation due to force majeure or specific suspension reasons, the employer must pay the following by December 31:

Simple vacation allowance for unused days, based on the December salary.

Double vacation allowance if it has not yet been paid, based on the December salary.

Eligible reasons include:

Common illness or accident.

Work accident or occupational disease.

Maternity leave, paternity leave (converted maternity leave), prophylactic leave.

Birth, adoption, or reception leave.

Parental leave or protective maternity leave measures.

New rule (effective end of 2024)¶

Employees unable to take vacation due to the above reasons (except force majeure or protective maternity leave measures) can carry over unused days for up to 24 months. Since the vacation allowance is already paid in December of the vacation year, no additional payment will be made when the carried-over days are used.

Employer payment responsibilities¶

The employer must pay any outstanding simple vacation allowance based on 7.67% of the gross salary from the previous year. However, an exit vacation allowance based on the current year’s gross salary is not due.

If an employee reduces their working hours and continues in the same role the following year, an additional vacation allowance calculation may be required in December.

Example calculation¶

In 2013, an employee works full-time (5 days per week).

In 2014, the employee works full-time until June 30, then switches to part-time (5 half-days per week).

The employee takes vacation in August 2014 under the new part-time regime (20 half-days over 4 weeks).

They receive a simple vacation allowance for 20 half-days and a double vacation allowance equivalent to 92% of their monthly salary.

In December 2014, the employee receives additional simple (7.67%) and double (7.67%) vacation allowances based on 2013’s gross salary, minus previously paid amounts.

In 2015, if the employee continues part-time, they receive vacation based on part-time hours plus 5 full-time vacation days from the 2014 vacation year.

A second settlement in December 2015 includes additional simple (7.67%) and double (7.67%) vacation allowances based on the 2014 gross salary, minus previously paid amounts.

How to do it in Odoo¶

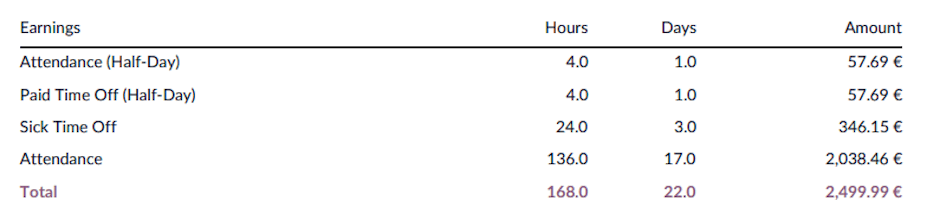

On a classic payslip issued in December, press the Compute December Holiday Pay button to open a configuration wizard.

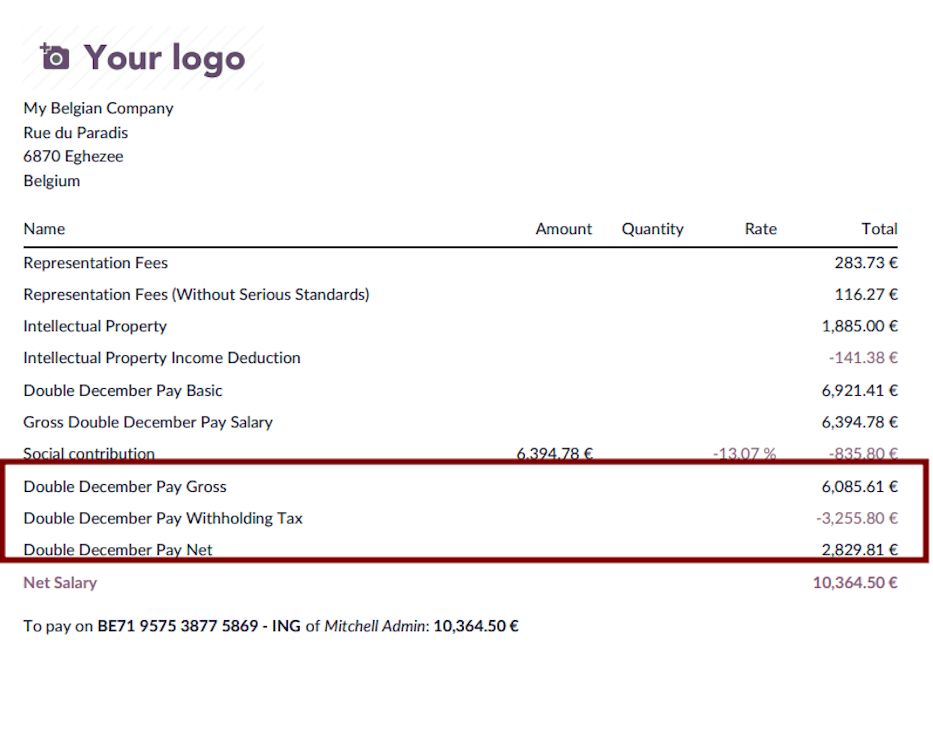

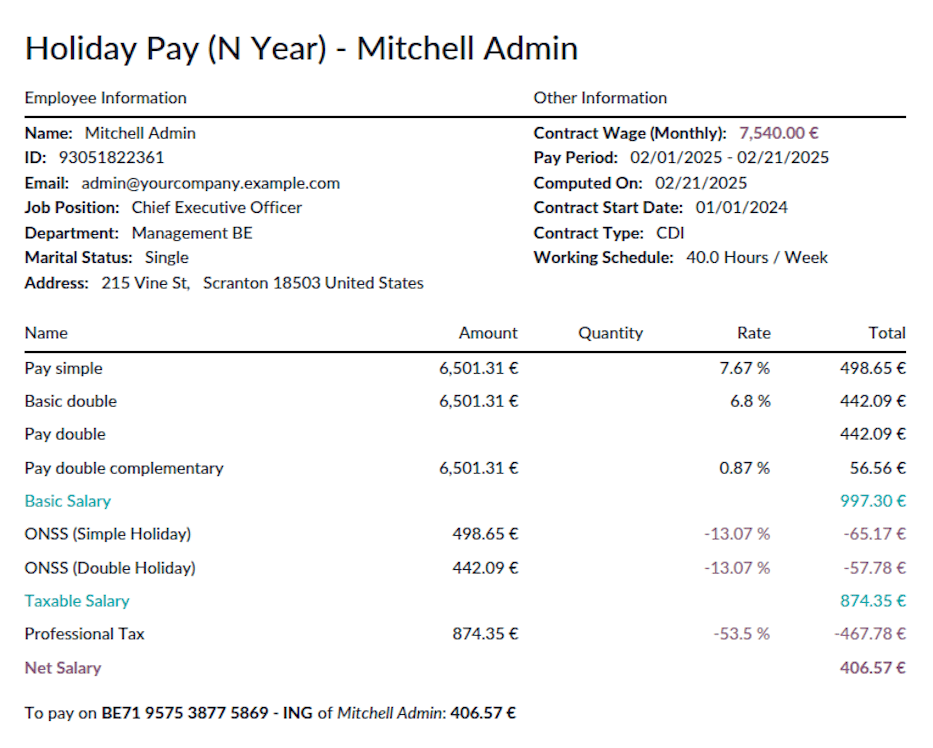

Based on the allocated and requested time off, the Simple Holiday Pay N-1 and Double Holiday Pay N-1 for the December payslip are computed (and editable for manual encoding). Click Validate to confirm.

After validation, two additional inputs are stored on the payslip, and the payslip is re-computed to take those new remunerations into account.

The simple holiday pay is included into the gross remuneration.

The double holiday pay is computed separately and included into the net amount.

Departure: holiday attests¶

概述¶

In Belgium, when an employee leaves a company, the employer is required to provide vacation attestations. These documents help the new employer determine the employee’s vacation entitlements and any vacation pay due. Odoo facilitates the automatic generation of these attestations based on payroll and time-off data.

Types of attestations¶

Odoo generates two types of vacation attestations:

For the previous year (N-1): If the employee has not yet taken all the vacation days from the previous year.

For the current year (N): Covering the vacation rights accrued in the year of departure.

Each attestation includes details such as:

The period the employee was employed.

Agreed working time and any modifications.

Gross amounts of single and double vacation pay paid.

Social security contributions paid by the employer.

Number of vacation days already taken.

Additional (European) vacation pay and days.

Calculation logic in Odoo¶

Odoo computes the attestations based on payroll and leave data. The main calculations include:

Retrieving payroll and leave records

The system identifies the employee’s payroll records for the current and previous years.

It retrieves validated leave requests and allocations.

Computing gross remuneration

The gross annual salary for both the current and previous years is computed from payroll records.

The average monthly salary is calculated for unpaid leave adjustments.

Time-off calculations

The number of vacation days taken and allocated in the current year is determined.

Unpaid leave days are accounted for separately.

Fictitious remuneration calculation

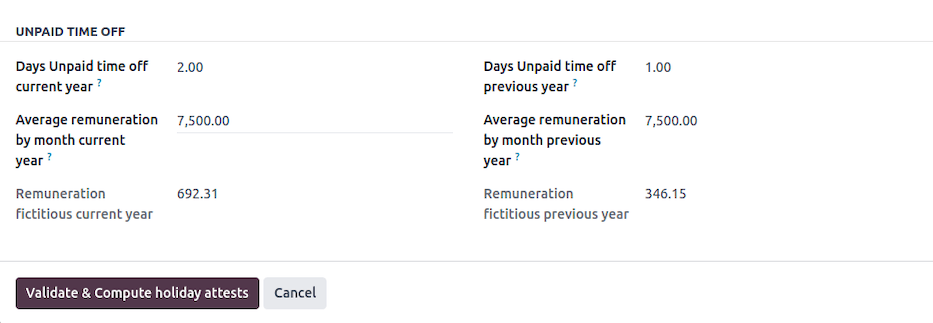

If unpaid leave was taken, Odoo computes a fictitious remuneration adjustment using the formula:

\[\text{Fictitious Remuneration} = (\text{Unpaid Leave Days} \times \text{Average Monthly Salary} \times 3) \div (13 \times 5)\]

Generating the final attestation

Odoo creates a payroll entry reflecting the vacation pay due.

The attestation document is generated and can be printed or exported.

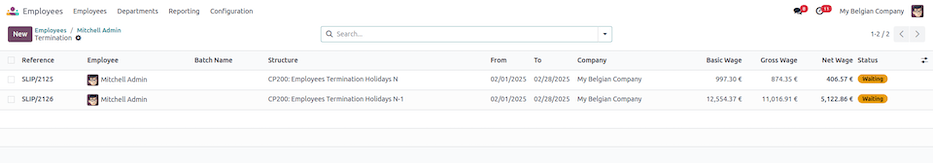

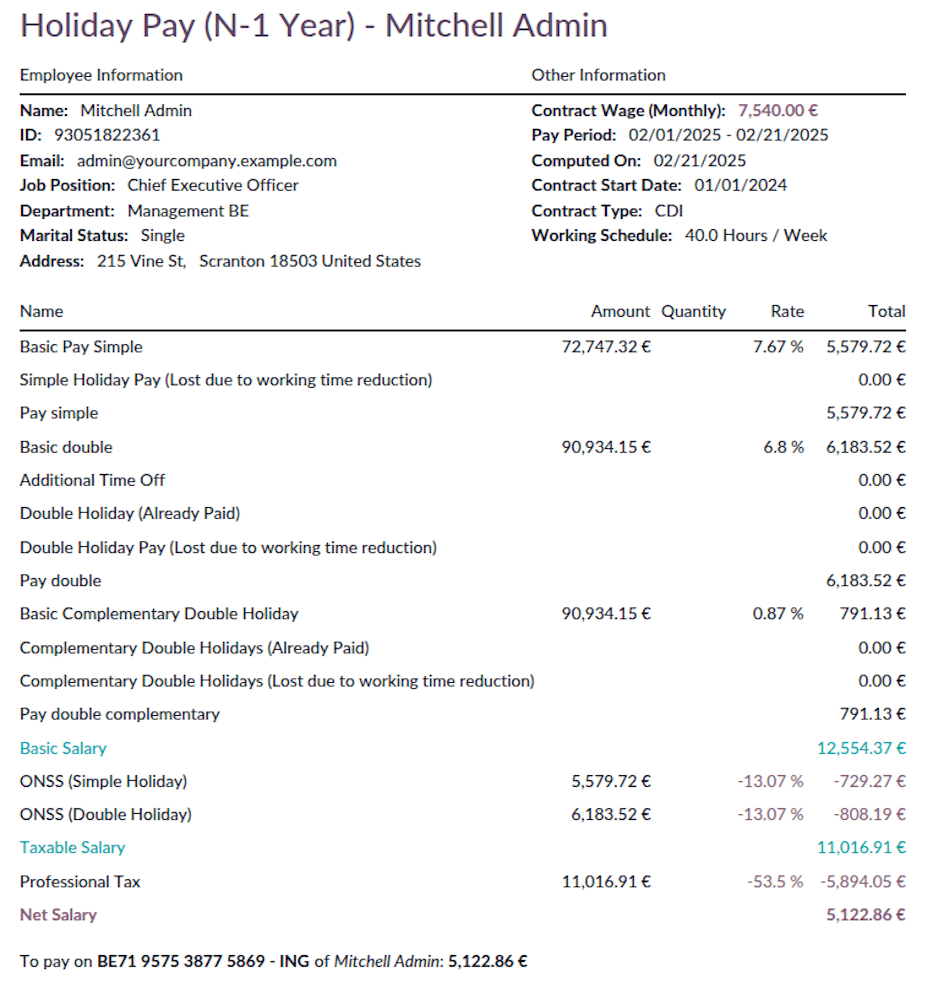

Two payslips are created:

Payslip for the current year (

termination_payslip_n)This payslip covers the employee’s last salary period in the year of termination.

Payslip for the previous year (

termination_payslip_n1)The one accounts the amount of money converted from the untaken time off of previous year.

Each payslip is generated using the appropriate payroll structure, ensuring correct calculations for all entitlements and deductions.

Before computing the final payment, the system gathers necessary payroll data:

年度工资总额计算

要估算员工的 年度总工资,系统会查找最近验证的月度工资单。如果找到工资单,则该工资单中的 总工资 乘以 12 以获得年度估计。如果不存在工资单,则年薪总额将设置为 零。

欧洲休假收回

系统会检索员工当年享受的所有欧洲休假日(LEAVE216)。然后计算这些休假的总报酬金额并确定应扣除的金额。

系统按以下原则进行扣除:

如果员工已休**欧洲假期(额外的假期)**,必须收回预先支付的金额。

收回方式为:

从下一年的**双重假期工资(85%)**中扣除。

或者,如果员工离职,从最终离职工资单中扣除。

如果员工已休假,**离职证明**必须注明:

已授予的**欧洲休假天数**。

对应这些天数的**总津贴**。

为确保公平,系统首先检查是否已在**双重假期工资**中扣除。如果已扣除,则只从最终工资单中扣除剩余金额。

确定所需值后,系统将其记录在工资单中作为**额外薪资输入**:

总薪资参考值:包括最终薪资金额加上任何名义报酬。

欧洲休假扣除额:扣除先前支付的欧洲休假金额。

其他输入项:分配已休假期、应税金额和任何未完成的分配。

设置这些值后,系统**计算工资单**以确保所有扣除和支付正确应用。

此过程确保最终**离职工资单**考虑到所有薪资组成部分,包括**年度总薪资、欧洲休假款项收回和任何未支付的权益**。Odoo 检索过去的工资单和休假记录,以确保符合**比利时薪资法规**。

通过自动化该流程,Odoo 最大限度地减少了人工干预,降低了错误风险,并确保员工获得正确的离职付款。

Odoo 系统中的运作方法?¶

在 Odoo 中,要访问假期证明处理流程,请转到员工表单视图,点击 :icon:fa-cog (操作),然后选择 离职:假期证明,或前往 。

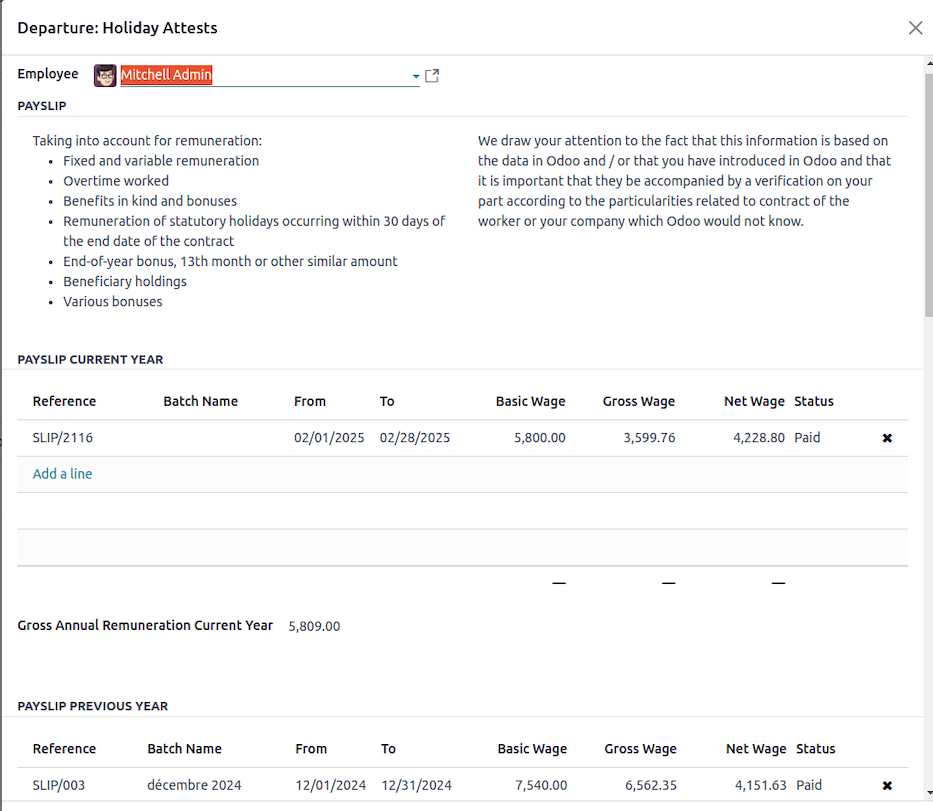

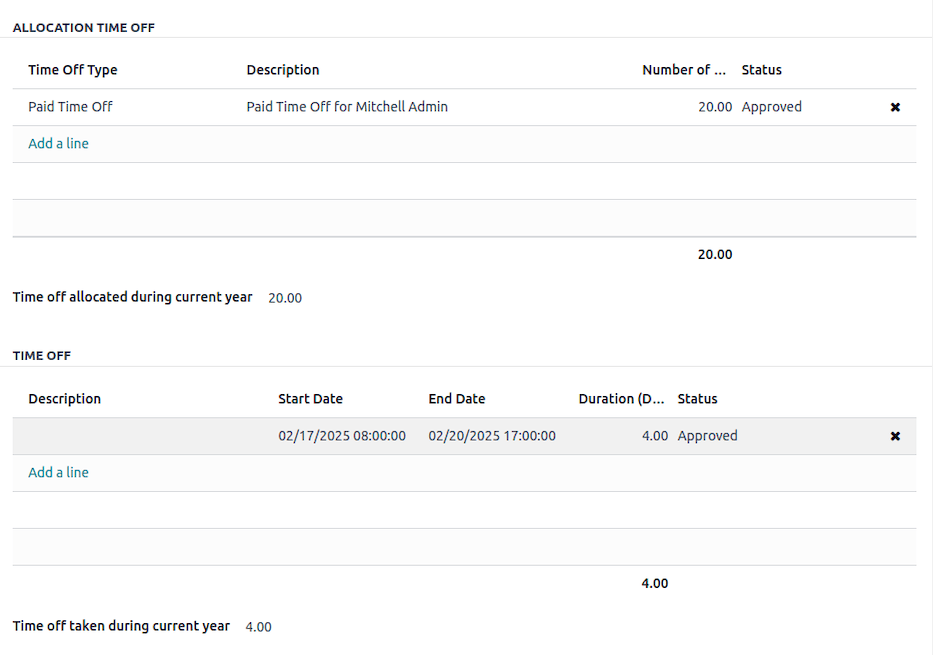

在弹出的向导中,您可以查看当前和上一年的所有工资单、休假申请和分配情况。您还可以录入希望在该假期证明上声明的无薪休假。

准备就绪后,点击 验证并计算假期证明 按钮。系统将为每个考虑的期间(当年和上一年)生成两份工资单。

验证后,将生成两份 .pdf 文档。一份是**标准工资单**,另一份是供未来雇主使用的**假期证明**。

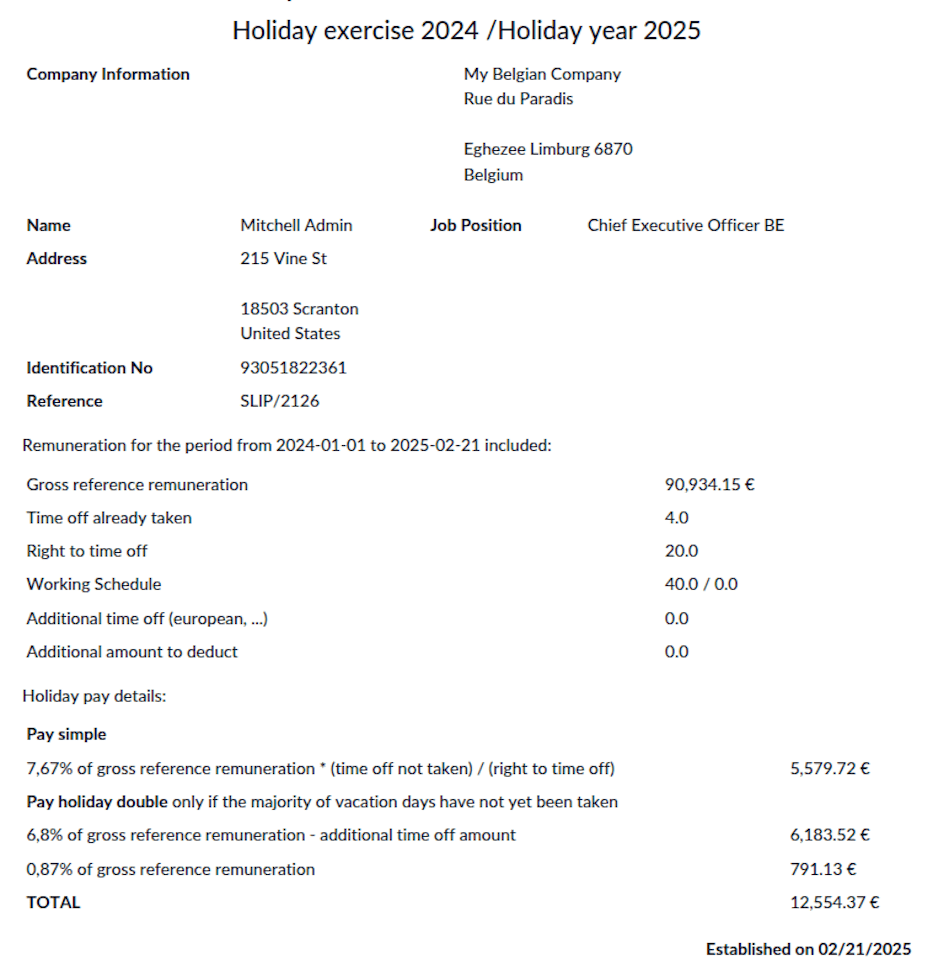

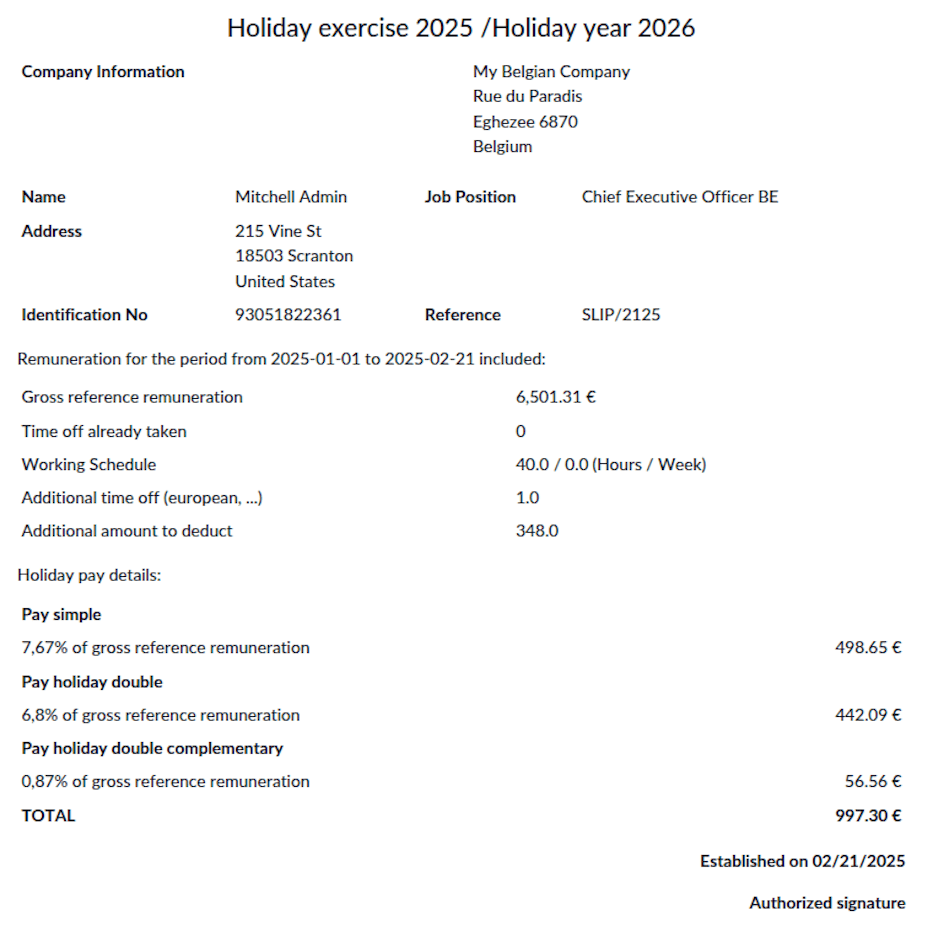

Example

在我们的示例中,该员工在当年(N年)也休了一天欧洲假期。

对于前一年(N-1年),您可以看到所有法定休假都已休完。

对于当年(N年),系统也会考虑额外休假(欧洲假期)和已休的法定休假。

注意事项¶

通过使用 Odoo 的自动化证明生成功能,公司可以确保符合比利时劳动法,同时减少手动行政工作。

重要

该功能仅适用于在比利时注册的公司。

如果未为员工设置通知期,Odoo 将提示输入此信息。

雇主必须确保在员工需要向新雇主或 ONEM(比利时就业局)提交假期证明前提供这些证明。

离职:通知期和终止费用¶

本文档说明了应用程序中员工离职流程的工作方式,重点关注通知期计算和当员工不执行通知期时的遣散费。

概述¶

该模块通过基于工作年限、离职原因和特定国家法规(比利时)来确定正确的通知期,帮助管理员工离职。它还计算员工在通知期内不工作时的遣散费。

主要功能¶

自动计算通知期的开始和结束日期。

考虑公共假期和公司特定的时间表。

根据公司政策和政府规定计算遣散费。

Generation of a final payslip including termination fees.

Notice period calculation¶

The notice period depends on several factors:

The employee’s seniority in the company.

The reason for departure (resignation, dismissal, retirement, etc.).

Whether the employee works during the notice period or not.

The salary level before January 1, 2014 (for some cases).

The notice period starts on the first Monday after the departure date unless a specific rule applies (e.g., a mandatory waiting period of three days for certain dismissals).

Notice duration rules¶

The following table shows the duration of the notice period based on the length of service:

For resigned employees¶

Seniority (months) |

Notice Period (weeks) |

|---|---|

0 - 3 |

1 |

3 - 6 |

2 |

6 - 12 |

3 |

12 - 18 |

4 |

18 - 24 |

5 |

24 - 48 |

6 |

48 - 60 |

7 |

60 - 72 |

9 |

72 - 84 |

10 |

84 - 96 |

12 |

96+ |

13 |

For dismissed employees¶

Seniority (months) |

Notice Period (weeks) |

|---|---|

0 - 3 |

1 |

3 - 4 |

3 |

4 - 5 |

4 |

5 - 6 |

5 |

6 - 9 |

6 |

9 - 12 |

7 |

12 - 15 |

8 |

15 - 18 |

9 |

18 - 21 |

10 |

21 - 24 |

11 |

24 - 36 |

12 |

36 - 48 |

13 |

48 - 60 |

15 |

60 - 72 |

18 |

72 - 84 |

21 |

84 - 96 |

24 |

96 - 108 |

27 |

108 - 120 |

30 |

120 - 132 |

33 |

132 - 144 |

36 |

144 - 156 |

39 |

156 - 168 |

42 |

168 - 180 |

45 |

180 - 192 |

48 |

192 - 204 |

51 |

204 - 216 |

54 |

216 - 228 |

57 |

228 - 240 |

60 |

240 - 252 |

62 |

252 - 264 |

63 |

264 - 276 |

64 |

276 - 288 |

65 |

288+ |

66+ |

Special case: employees hired before 2014¶

For employees who started before January 1, 2014, the notice period calculation is divided into two parts:

Part 1: Seniority acquired before December 31, 2013¶

Lower-level employees (annual gross salary ≤ €32,254): The notice period is 3 months for the first 5 years of seniority, increasing by 1.5 months per additional year.

Higher-level employees (annual gross salary > €32,254): The notice period is 1 month per started year of seniority, with a minimum of 3 months.

Part 2: Seniority acquired from January 1, 2014 onwards¶

The standard notice period rules from 2014 apply to seniority acquired after this date.

The total notice period is the sum of both periods calculated separately.

Severance pay calculation¶

If an employee does not serve their notice period, severance pay is calculated based on:

The remaining notice duration.

The employee’s last salary.

Additional compensation such as bonuses, stock options, and insurance contributions.

The severance pay consists of:

The current salary, which corresponds either to the full notice period that should normally be observed or the remaining part of it.

Benefits acquired during the contract (e.g., meal vouchers, company car, mobile phone usage).

The current salary is determined as follows:

The employee’s gross monthly salary at the time of dismissal.

All recurring bonuses, except for one-time bonuses (e.g., team work bonus, seniority bonus).

Additional compensation for overtime hours worked over a longer period.

Variable salary (average over the last twelve months).

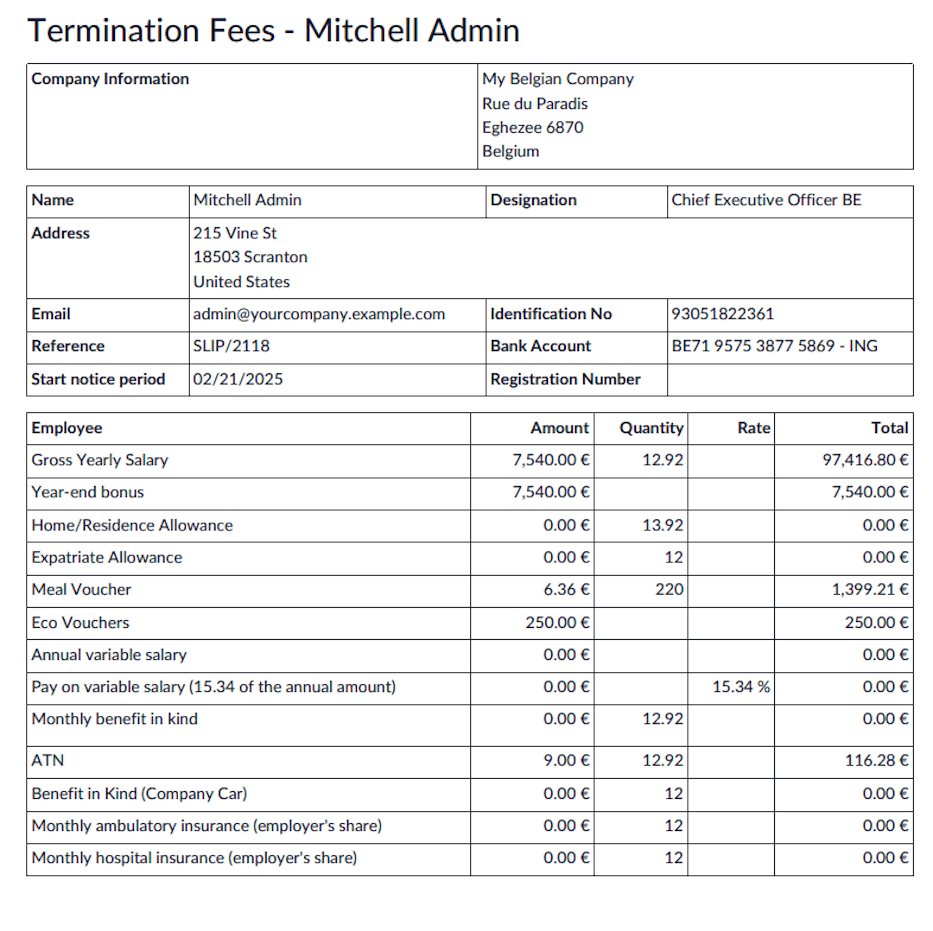

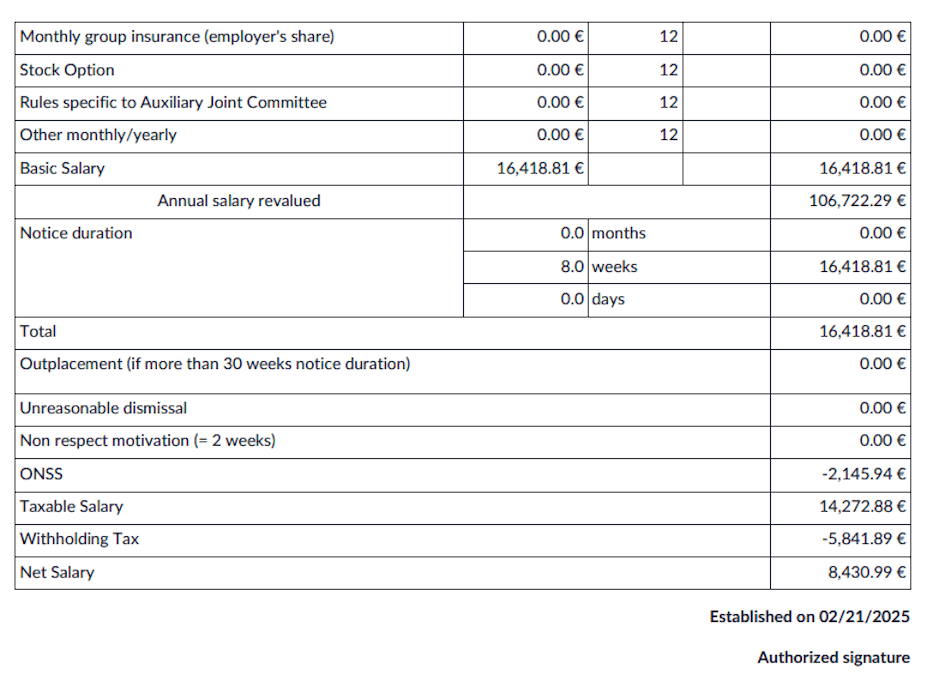

The system automatically generates a termination payslip including these calculations, ensuring compliance with Belgian labor laws.

Odoo 系统中的运作方法?¶

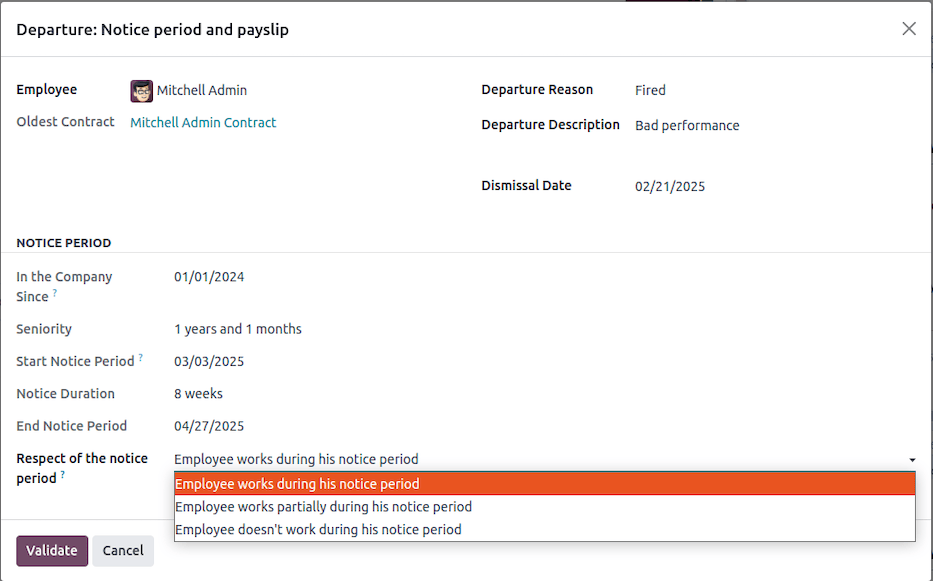

In Odoo, to access the departure process, go to the employee form view and click on (Action) then Departure: Notice Period and payslip or navigate to .

In the wizard that appears, select the reason for departure, provide a description of the departure, and specify the dismissal date. The employee’s seniority is calculated based on their contract history, and the notice period is determined accordingly. You can also indicate whether the employee will be working during the notice period.

If the employee is working during the notice period, there are no termination fees to calculate, and the notice period will be recorded on the employee’s form. Click the Validate button.

注解

If the employee is working partially or not at all, the wizard will generate and calculate a termination fees payslip. Click the Validate & Compute termination fees button.

The payslip takes into account all the salaries and benefits the employee would have received over the course of a year to calculate a virtual annual remuneration. This amount is then prorated based on the notice period to convert it into a gross salary.

A detailed summary is provided on the payslip.

Example

结论¶

This module simplifies the departure process by providing clear and automatic calculations for the notice period and severance pay. It helps HR teams ensure compliance and streamline the exit process for employees.

DIMONA¶

What is the Dimona?¶

Obligation¶

All employers, both in the public and private sectors, are required to electronically communicate the entry and exit of their personnel to the National Social Security Office (Royal Decree of November 5, 2002).

This involves the immediate declaration of employment, also known as DIMONA (Déclaration Immédiate - Onmiddellijke Aangifte). Its purpose is to immediately notify social security institutions of the beginning and end of an employment relationship between the worker and the employer.

The declarations submitted by the employer and immediately checked by the NSSO feed into a database called the personnel file. The employer can access it in a secure environment. There are numerous search criteria: they can be based on characteristics and combinations of characteristics.

Failure to comply with this reporting obligation may result in criminal penalties as provided for in Article 181 of the Social Penal Code.

Furthermore, in case of omission of declaration, the employer will owe the NSSO a solidarity contribution.

Concept and terminology¶

Employer-worker relationship¶

The relationship between the “employer” and the “worker” couple. This relationship includes stable data (employer identification number, worker’s national identification social security number (NISS), start date of the relationship, and optionally end date), which will be maintained even in case of creation, closure, modification, or cancellation of a period. This relationship begins with the worker’s first engagement and ends at the end of their last occupation. In the personnel file, “employer-worker” relationships constitute the first level of consultation. The second level encompasses all Dimona periods;

Dimona period¶

A period is created with each IN declaration, thus at the beginning of each new occupation. It is closed by an exit date at the end of each occupation. The employer-worker relationship, on the other hand, is maintained until the end of the last occupation. Several Dimona periods may or may not succeed each other within the same employer-worker relationship.

Any changes generated by an OUT declaration, a modification (UPDATE), or a cancellation (CANCEL) occur at this second level.

This Dimona period is identified by a “period identification number”. It is assigned to each IN declaration and constitutes the unique identification key of a period for submitting OUT, modification, or cancellation declarations.

Dimona number¶

A unique number assigned by the NSSO to each Dimona declaration (IN, OUT, UPDATE, CANCEL,…). For an IN declaration, it is the period identification number. When declarations are submitted via file transfer, multiple Dimona numbers are created: one number per employment relationship included in the structured message;

Dimona characteristics¶

Mandatory data of a Dimona declaration. There are four: the industry sector number, worker type, sub-entity (reserved for certain public sector employers), and user (for temporary workers). Characteristics are always linked to a period. In case of different characteristics, multiple periods can coexist;

Receipt confirmation¶

Confirms for web users that the declaration has been received (appears immediately on the screen);

Receipt acknowledgment¶

Electronic message for batch senders indicating whether the file is usable for the NSSO. This “receipt acknowledgment” contains the ticket number (file identification number) and the file status: accepted or rejected depending on whether the file is readable or not;

通知¶

Electronic message with feedback on the processing of the declaration. The notification is the immediate result of form and content checks. It can be of three types: positive (Dimona accepted), negative (Dimona rejected), or provisional (only in case of problems with worker identification). The provisional notification will always be followed by a positive or negative notification.

For the declaration of students under a student contract (STU), the notification will also contain a warning if the student is declared for more than 475 hours. If the declaration was made via a secure channel, the exact number of days of excess will be communicated.

For the daily declaration of occasional workers in the hospitality industry, the notification will also contain a warning if the worker is declared for more than 50 days and/or for the employer quota, if more than 100 days of occasional work have been declared.

Once you have received this notification, you have five working days to contest the accuracy of the data mentioned therein. At the end of this period, these data will be considered final. For any disputes, you must contact the Eranova Contact Center (tel: 02 511 51 51, email: contactcenter@eranova.fgov.be).

Note that if the employer is affiliated with an approved social secretariat or a full-service secretariat, they may not receive any notification. In this case, notifications are electronically transmitted to the social secretariat or full-service secretariat, even for declarations that the employer has submitted personally. However, the employer has access to the personnel file, where they can view all data.

频道¶

The Dimona declaration must be submitted in the form of an electronic message via one of the following channels:

网络

personnel file

file transfer

web service (REST)

Dimona Mobile

The choice of one channel over another has no impact on the declaration. Therefore, you can freely choose the channel you will use.

Any declaration modifications can also be made through any of these four channels. The channel through which the original declaration was submitted plays no role.

A Dimona declaration cannot be submitted via SMS.

Dimona in Odoo¶

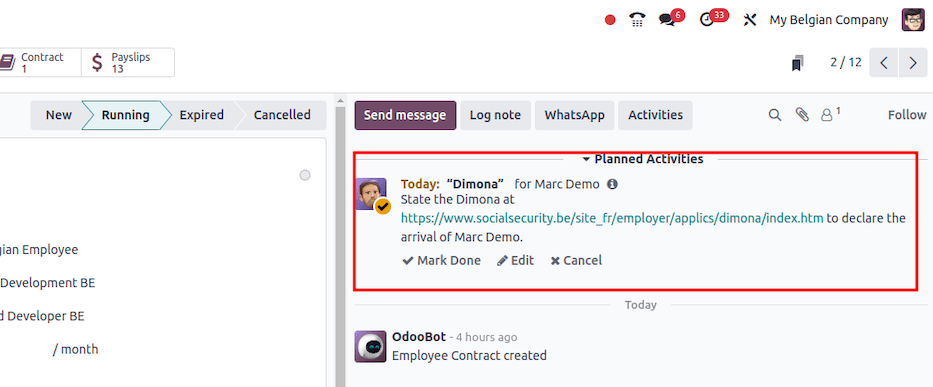

手动¶

In Odoo, when you have the Belgian Payroll Localization installed, as soon as you have a contract set to the running stage, it creates an activity for the HR responsible that they need to introduce the Dimona for today with the correct link to the Dimona Platform (the web channel mentioned in the Channels section of this article).

自动¶

In Odoo, when you have the Belgian Payroll Localization installed, it is also possible to install the module Belgium - Payroll - Dimona. This module will allow you to perform the 4 main actions needed in the Dimona (as seen in Section 1 of this article):

Open the dimona

Update the dimona

Close the dimona

Cancel the Dimona

These actions answer the different use case explained in Section 1.

Contract and employee data¶

Basically, it checks the contract and employee data needed to create, update, close or cancel.

Error handling¶

If some information is missing or wrongly configured, the system will return errors and you can take corrective action in order to make sure your Dimona is correctly sent, updated, closed or canceled.

Synchronization status¶

The status of sync and errors are shown in the chatter of the contract.

Scheduled action¶

Finally, the cron checks every day, for all contracts that have the status dimona waiting and triggers the necessary actions to update the dimona status accordingly.

Technical configuration (outside Odoo)¶

Regarding the technical configuration, everything is described in the module information with all the technical prerequisites. If your customer or partner need further assistance with that, they need to contact their IT department or representatives as this is not part of Odoo configuration.

Functional configuration (within Odoo)¶

From the Odoo configuration point of view, navigate to and in the Belgian Localization section for ONSS, configure the following:

ONSS Company ID: VAT Number of the Company

Registration Number: 9 digits code received from the NSSO (ONSS - RSZ)

DMFA Employer Class: 3 digits code received from the NSSO (ONSS - RSZ)

Expeditor Number ONSS: Not Mandatory (see technical documentation of the module for more information)

PEM Certificate, PEM Passphare, KEY file: check the module information for explanation

DmfA - Multifunctional Declaration¶

概述¶

DmfA stands for “Déclaration Multifonctionnelle” or “Multifunctionele Aangifte.” It has replaced the quarterly ONSS declaration since the first quarter of 2003. Through this declaration, employers submit salary and working time data for their employees.

These data are processed in a way that allows all social security institutions to work with the same information. The declaration is called “multifunctional” because it is used not only for social security contribution calculations and reductions but also as a data source for institutions managing social security rights and benefits.

Sectors utilizing DmfA data include:

Health insurance

Unemployment benefits

Pensions

Occupational risks (Fedris)

Family allowances

Annual leave

All employers registered with ONSS must submit a DmfA declaration.

Relationship with Dimona and DRS¶

DmfA is closely linked to two other mandatory declarations:

Dimona (immediate declaration)¶

Dimona records the start and end of an employment relationship with an employee.

Who submits the DmfA declaration?¶

Self-declaration options¶

Employers can submit their DmfA declaration themselves via:

Web Submission: Suitable for employers with a small workforce. Declarations are entered directly through the social security portal.

Batch Submission: Designed for large employers or organizations handling multiple declarations (e.g., social secretariats, payroll software providers). Declarations are submitted via file transfer (FTP, SFTP, etc.).

Advantages of web submission¶

Automatic access to the company’s employee list: Based on Dimona data. If an employee is missing, they must first be declared via Dimona. After 24 hours, the employee list is updated, allowing for an accurate DmfA submission.

Automatic calculation of net payable amount: Once all required data is entered, the system calculates the total payable amount.

Reduction calculations: The system calculates applicable reductions, except for reductions under code “0001” (personal contribution reductions for low-income workers). Employers need to check the relevant boxes and, if necessary, provide additional details.

Advantages of batch submission¶

Submission of large volumes of declarations: Ideal for organizations managing multiple payrolls.

Quick response on acceptance status: Employers receive immediate feedback on whether their declaration has been accepted.

Error reporting: The system generates a report on detected anomalies, regardless of acceptance status.

Automatic correction of calculation errors: When possible, errors are corrected automatically, and employers are notified of adjustments.

Third-Party submission options¶

Employers who do not wish to submit the DmfA themselves can delegate the task to:

Accredited Social Secretariats: These organizations handle payroll and declaration tasks on behalf of employers.

Service Providers: These may be companies or individuals with whom the employer has a contractual agreement to manage payroll declarations securely.

For more information on accredited social secretariats or service providers, please refer to the relevant official DmfA documentation.

配置¶

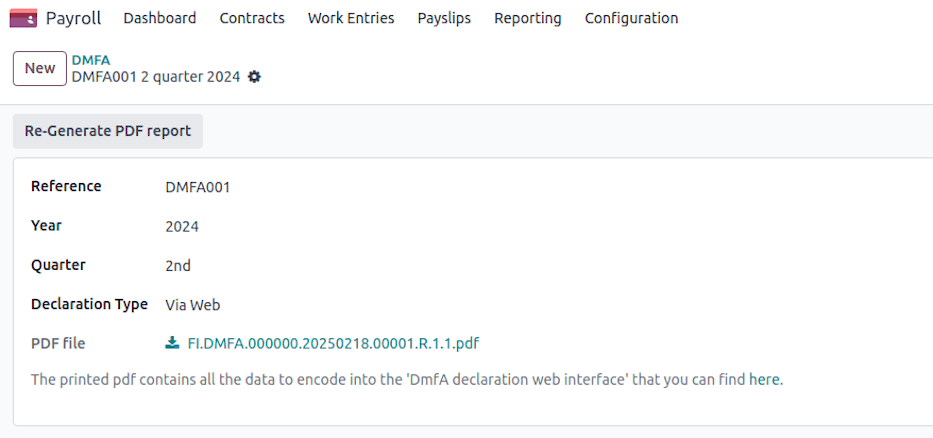

The declaration is generated under as is supposed to work properly after several required configuration steps.

公司(备用金)¶

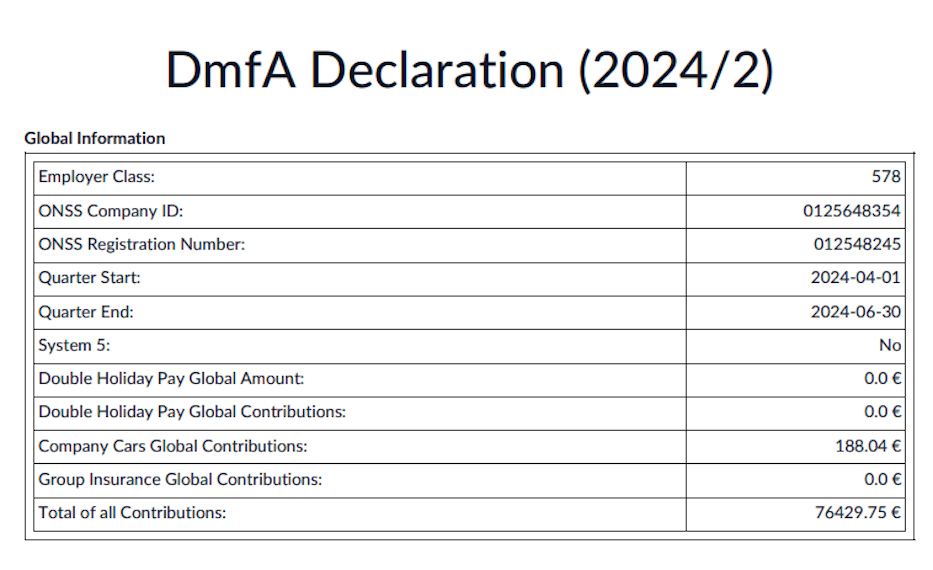

To generate a valid DmfA declaration, specific company and employer-related information is required, (under ). These include:

ONSS Company ID

ONSS Registration Number

DMFA Employer Class

ONSS Certificate: certificate for signature file generation (required for batch declarations)

VAT Company Number

Revenue Code

FFE Employer Type (Fonds de Fermeture d’Entreprise)

员工¶

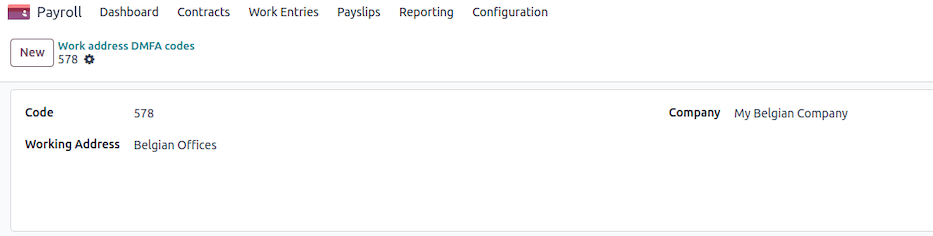

Additionally, each employee must be assigned to a valid working address, identified with a DmfA code, in their employee record. This operating unit must be linked to a valid ONSS identification number to ensure compliance with declaration requirements. Failing to configure this properly may result in errors during the declaration submission process.

On the employee form, the Work Address must be defined.

Under , you can link the work address to a ONSS identification number.

Work entry type¶

A DmfA code should be defined for each work entry type that is declared. Under , specify the DMFA code.

Potential configuration errors¶

During the declaration generation process, configuration issues may arise, triggering errors such as:

Terminated employees without or with invalid start/end notice period

Invalid NISS number for some employees

Work addresses not linked to an ONSS identification code

Work entry type missing a corresponding DmfA code

Other inconsistencies in employer or employee records

Employers should ensure accurate configuration to avoid delays and rejection of their declarations.

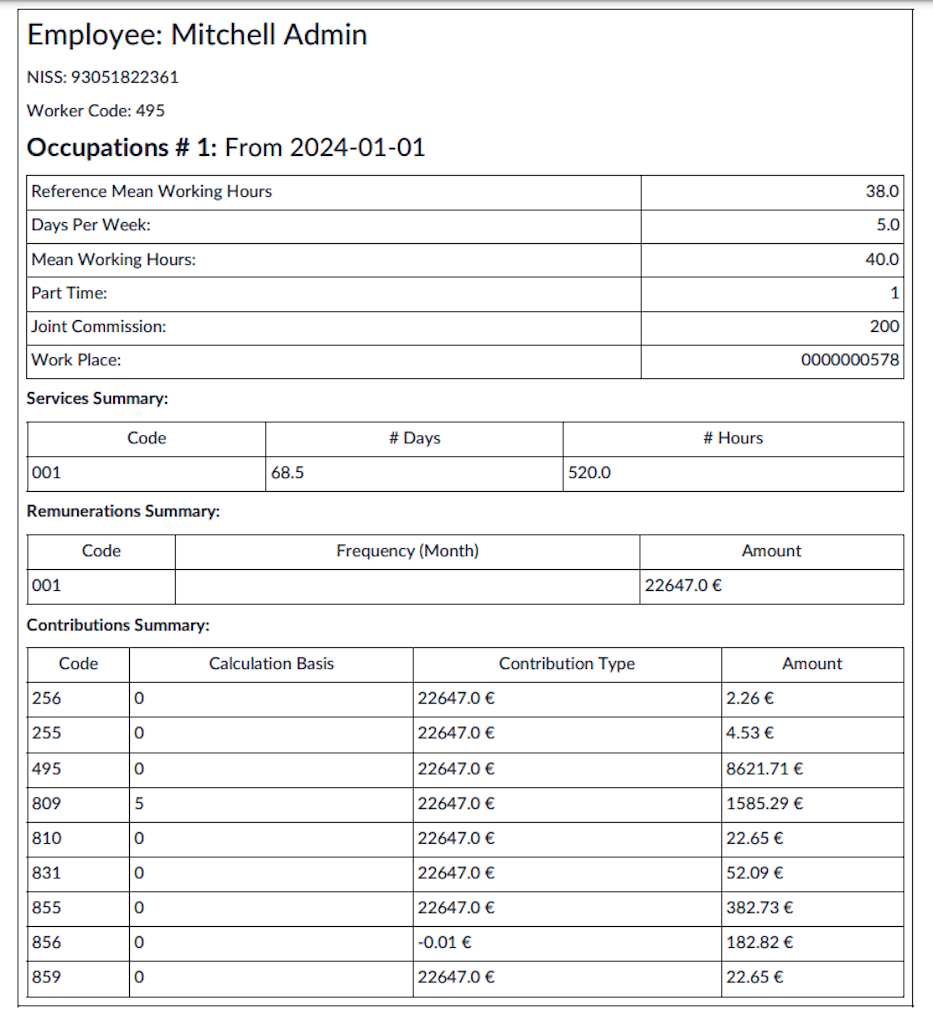

Web declaration¶

A web declaration generates a PDF summarizing the company’s general information, as well as all employee data that must be manually entered into the system. This includes:

For the company:

For a specific employee:

Occupations: Work schedules, part-time codes, parental leave, exploitation unit, reference working hours.

Services: Aggregated work performance (in days and hours) for the quarter, categorized by occupation and type. The codification of working time in the DmfA declaration ensures accurate reporting of employee activities. Each code corresponds to a specific type of working time or absence. For a complete and detailed list of codes, please refer to the official social security website: socialsecurity.be

1: All performances covered by a salary subject to ONSS contributions, excluding legal and additional vacation for workers.

2: Legal vacation days for workers.

3: Additional vacation days for workers.

4: Compensatory rest days.

5: Days of illness or non-occupational accident.

6: Family leave days.

7: Maternity or paternity leave days.

8: Strike days.

9: Temporary unemployment for economic reasons.

10: Temporary unemployment for bad weather.

11: Temporary unemployment for force majeure.

12: Professional training days.

13: Suspension for disciplinary reasons.

14: Additional vacation days for employment start or resumption.

15: Flexible vacation days.

Remunerations: Aggregated by code per occupation:

1: Regular salary amounts excluding certain indemnities.

2: Bonuses and similar benefits granted independently of actual working days.

3: Severance payments expressed in working hours.

7: Simple vacation pay for exiting employees (subject to contributions).

10: Personal use of a company vehicle and other mobility benefits.

11: Simple vacation pay for exiting employees (not subject to contributions).

12: Advance vacation pay paid by a previous employer (not subject to contributions).

Contributions: Employer and employee contributions, such as:

256: Asbestos fund contribution.

255: Special work accident contribution.

495: Total employer + 13.07% employee contribution.

809: Enterprise closure fund contribution.

810: Special enterprise closure fund contribution.

831: Auxiliary Joint Committee for Employees (CP200) contribution.

855: Wage restraint contribution.

856: Special social security contribution.

859: Temporary unemployment contribution.

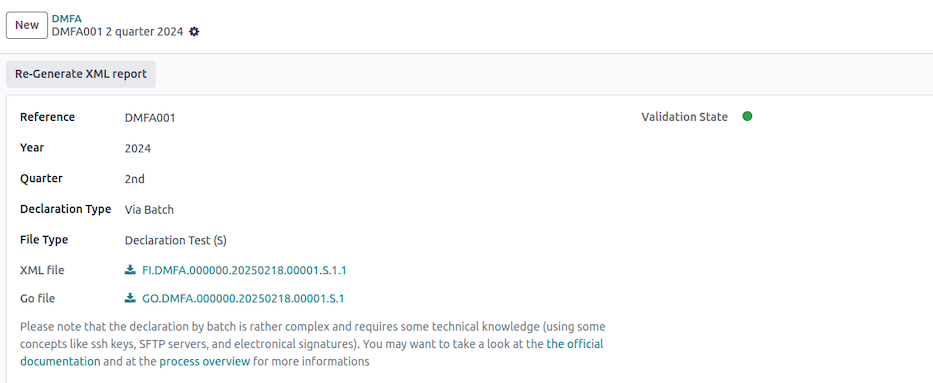

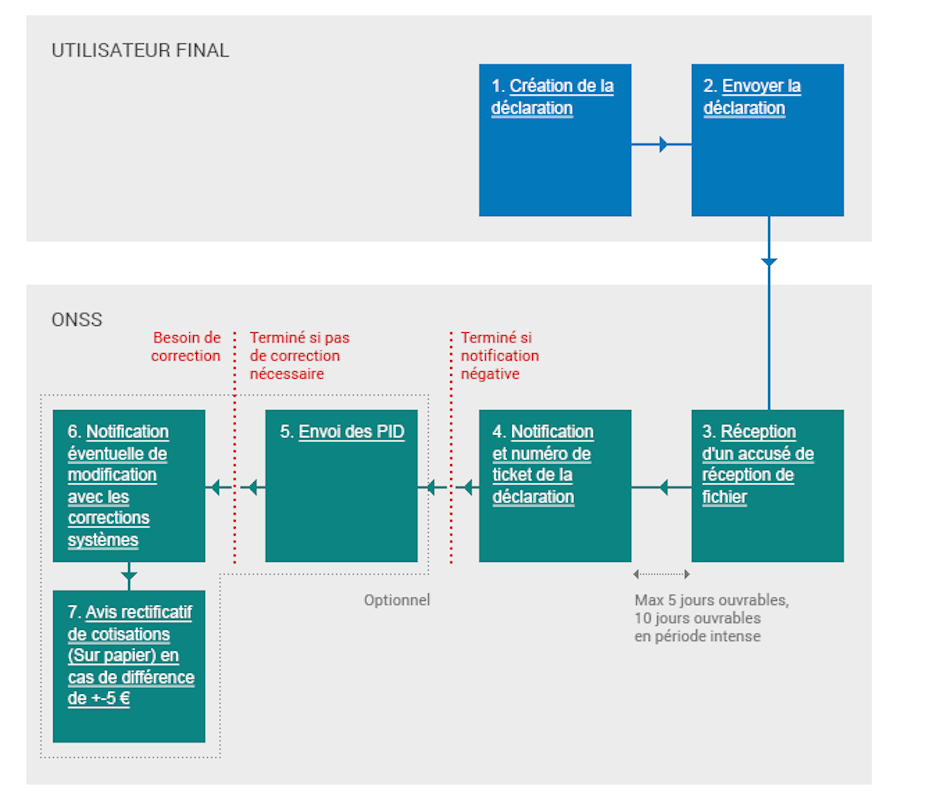

Batch declaration¶

Batch declarations require technical knowledge, including SSH keys, SFTP servers, and electronic signatures. Employers should refer to the official batch documentation and process overview.

A batch submission generates three files:

Declaration file (e.g., FI.DMFA.112768.20250109.00014.R.1.1)

Launch file (e.g., GO.DMFA.112768.20250109.00014.R.1)

Electronic signature file (e.g., FS.DMFA.112768.20250109.00014.R.1.1) (only for real declarations, not tests)

The full process includes creating, sending, validating, and potentially correcting declarations. Rejections and anomalies must be addressed before final acceptance.

Creation of the Declaration

Create an XML document containing employee benefit data, remuneration, and contributions for the company.

More information on XML files can be found in the Specifications page.

Sending the Declaration

Use FTP or SFTP for sending the file. Access requires prior authorization for secure zone access by a local manager.

Detailed instructions are available on the Introduce and Modify (via batch).

File Acknowledgment Receipt

Positive Receipt: Indicates the file can be processed. However, this does not guarantee acceptance.

Negative Receipt: Indicates issues with the file structure or access rights.

Notification and Ticket Number for the Declaration

A positive notification is sent for each accepted declaration.

Negative notification: Provides information on encountered anomalies.

Sending PID

Employers and SSA will receive PID and version numbers via batch for declarations.

Modification Notification with System Corrections

If corrections are made, a modification notification is sent with corrected values.

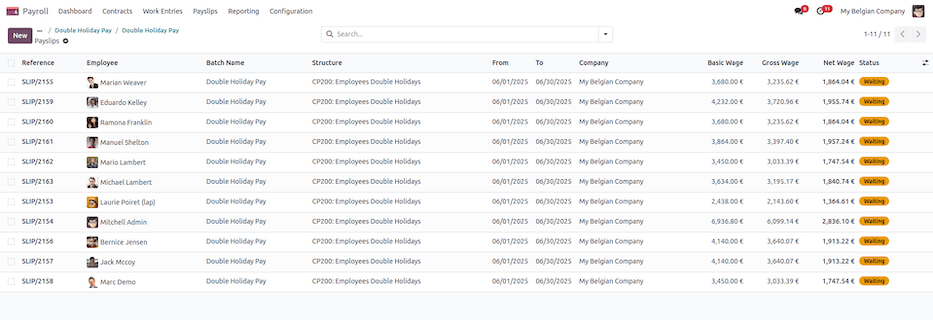

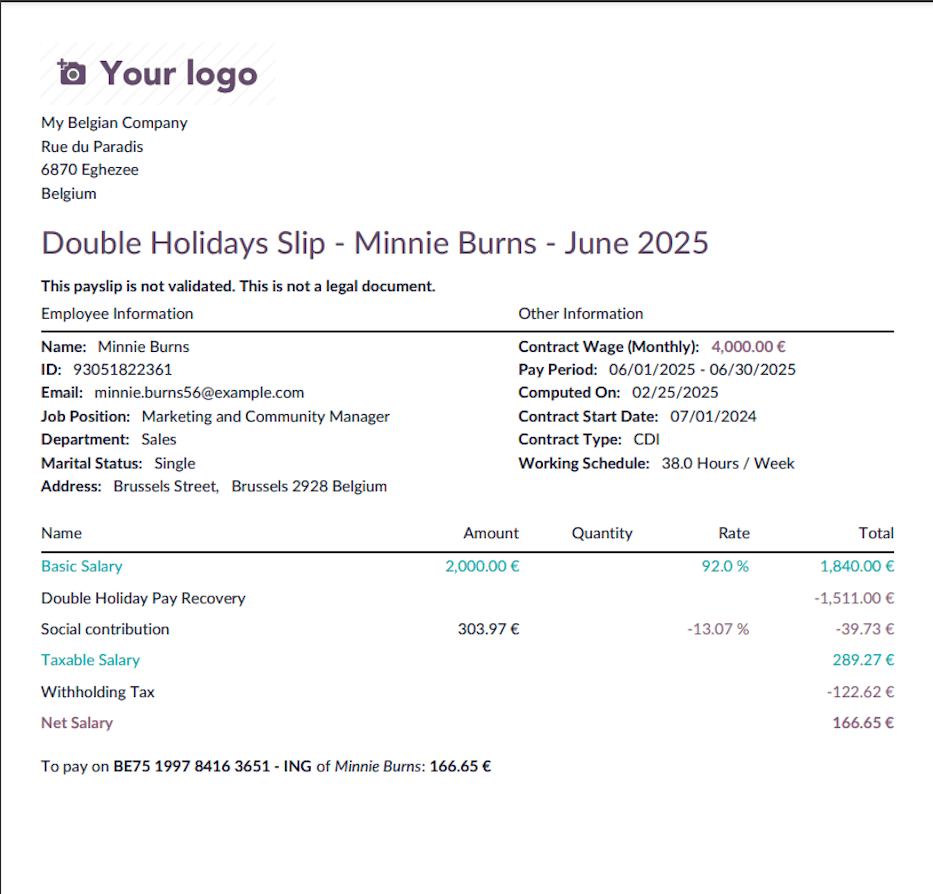

Double holiday pay¶

Double holiday pay is an additional bonus paid to employees and workers during their annual leave. The amount depends on the employee’s or worker’s salary.

How is double holiday pay calculated?¶

For employees, double holiday pay amounts to 92% of their gross salary for the month when they take their main annual leave. This amount is calculated based on the number of months worked or considered equivalent in the previous year.

Impact of additional or European leave¶

If you take additional or European leave, your employer will pay you regular holiday pay for that leave. However, the following year, this amount will be deducted from your double holiday pay. This is because additional leave is considered an advance on the next year’s legal leave.

Factors affecting the calculation¶

Months Worked: The calculation is based on the number of months you worked in the previous year.

Absences: If you had unpaid absences, they may reduce your double holiday pay.

Variable Revenues: Bonuses and commissions earned in the previous year can impact the total amount of double holiday pay.

Withholding Taxes: The double holiday pay is subject to income tax deductions, which depend on your annual earnings and family situation.

Withholding tax calculation¶

The withholding tax is calculated using a progressive rate system. The process involves:

Identify the Employee’s Annual Taxable Revenue:

Compute the annualized salary, including benefits in kind (e.g., company car, internet, mobile phone, laptop).

Apply reductions for dependent children.

Apply Tax Rates:

Use predefined tax brackets to determine the base withholding tax rate.

If applicable, apply a reduction based on the number of dependent children.

Tax brackets¶

The withholding tax is applied progressively based on the following brackets (as of 2025):

Lower Bound |

Upper Bound |

Tax Rate |

|---|---|---|

0.00 |

10,415.00 |

0.00% |

10,415.01 |

13,330.00 |

19.17% |

13,330.01 |

16,960.00 |

21.20% |

16,960.01 |

20,340.00 |

26.25% |

20,340.01 |

23,020.00 |

31.30% |

23,020.01 |

25,710.00 |

34.33% |

25,710.01 |

31,070.00 |

36.34% |

31,070.01 |

33,810.00 |

39.37% |

33,810.01 |

44,770.00 |

42.39% |

44,770.01 |

58,460.00 |

47.44% |

58,460.00 |

∞ |

53.50% |

免税¶

A withholding tax exemption is granted when the normal annual gross income does not exceed a specific threshold, which is determined based on the number of dependent children [2].

A disabled dependent child counts as two.

The method involves referring to a two-column table:

Column 1: Indicates the number of dependent children.

Column 2: Specifies the maximum allowable normal annual gross income, based on the number of dependent children listed in Column 1, which must not be exceeded to qualify for full or partial exemption from withholding tax.

After determining the annual gross income, two scenarios may arise:

If the annual income exceeds the threshold, no exemption is granted.

If the annual income does not exceed the threshold, an exemption will be applied.

The amount of this exemption corresponds to the difference between the annual gross income and the threshold amount.

Of course, if this difference exceeds the base withholding tax amount, no withholding tax will be due.

No. of Children |

Max Revenue (EUR) |

|---|---|

1 |

18,400.00 |

2 |

21,930.00 |

3 |

28,270.00 |

4 |

35,330.00 |

5 |

42,390.00 |

6 |

49,450.00 |

7 |

56,510.00 |

8 |

63,570.00 |

9 |

70,630.00 |

10 |

77,690.00 |

11 |

84,750.00 |

12 |

91,810.00 |

减税¶

When there is no justification for fully or partially exempting the exceptional allowance from withholding tax, it is still possible to grant a reduction in withholding tax.

To determine eligibility for this reduction, one must check whether the normal annual gross salary exceeds a certain higher threshold, which varies according to the number of dependent children [3]. This threshold is higher than the one used for exemption purposes.

A disabled child counts as two.

The method involves referring to a three-column table:

Column 1: Indicates the number of dependent children (up to a maximum of 5).

Column 2: Specifies the percentage reduction in withholding tax, based on the number of dependent children listed in Column 1, which must not be exceeded to qualify for the reduction.

Column 3: Shows the threshold amount that must not be exceeded, corresponding to the number of dependent children listed in Column 1.

Two scenarios may arise:

If the threshold amount is exceeded, no reduction will be granted.

If the threshold amount is not exceeded, a reduction will be applied to the withholding tax amount, up to a percentage rate determined in Column 2.

For employees with dependent children, tax reductions apply as follows:

No. of Children |

Reduction (%) |

Max Revenue |

|---|---|---|

1 |

7.5% |

28,245.00 |

2 |

20.0% |

28,245.00 |

3 |

35.0% |

31,070.00 |

4 |

55.0% |

36,720.00 |

5+ |

75.0% |

39,550.00 |

Final tax calculation¶

The final withholding tax amount is:

The resulting tax is deducted from the gross double holiday salary to determine the net amount payable to the employee.

The calculation considers work duration, absences, variable revenue, and applicable withholding taxes. Odoo automates these calculations to ensure compliance with Belgian labor laws and tax regulations.

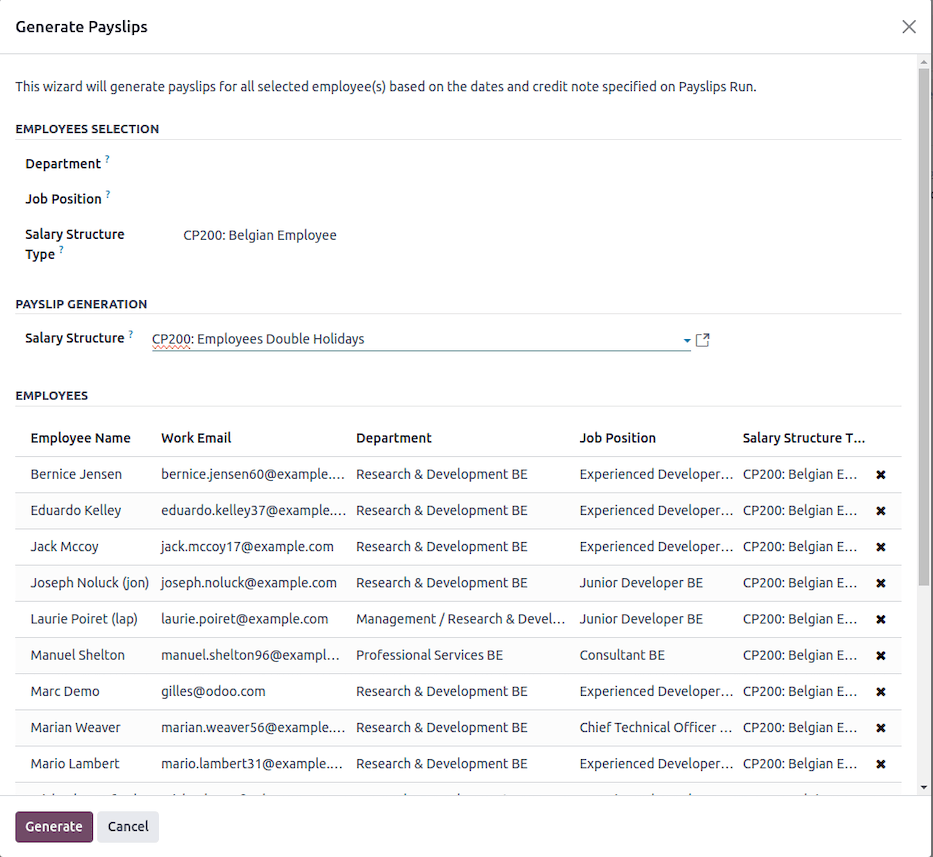

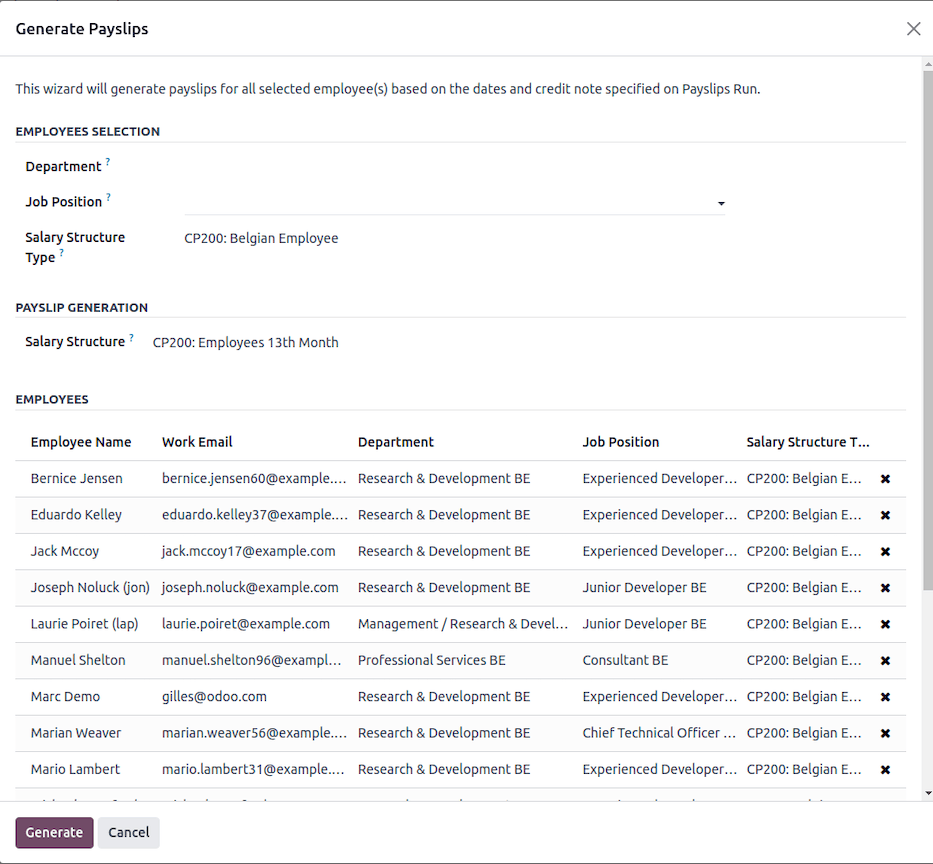

Generate a batch in Odoo¶

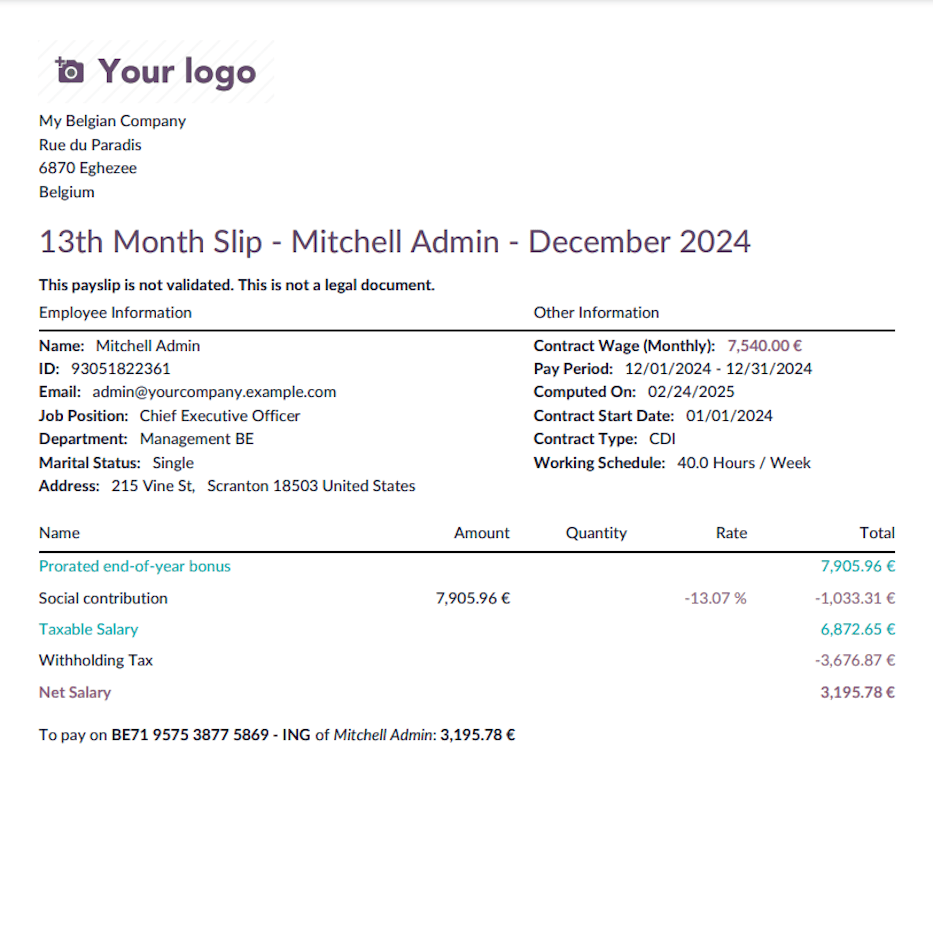

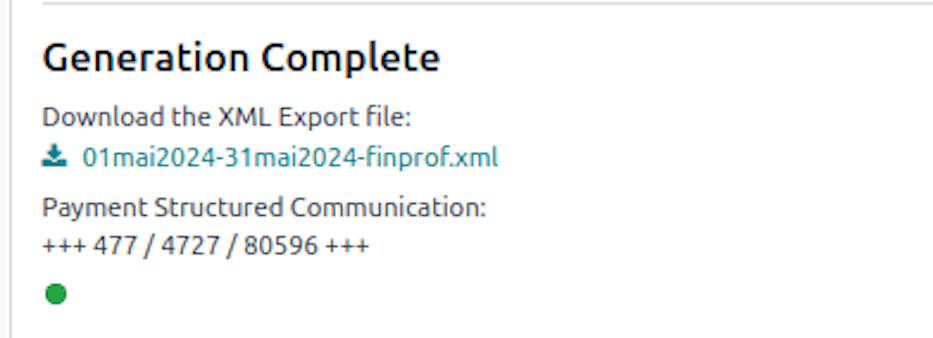

Navigate to and create a new record with valid dates (here december 2024)

Then click the Generate Payslips button, select the CP200 salary structure type and the Thirteen Month salary structure. You can also filter eligible employees by department and / or job position.

Once validated, a payslip is generated for each employee.

You can now check the different payslips before validation. Once validated, the PDF files are generated and posted on employee portals as for classic payslips.

结论¶

Double holiday pay is a significant benefit that rewards employees for their work in the previous year. Understanding how it is calculated helps in better financial planning for the holiday period.

Eco vouchers¶

概述¶

Eco vouchers are a tax-free employee benefit designed to support the purchase of environmentally-friendly products and services. These vouchers are ordered via external providers and are exempt from social security contributions.

Eligibility & allocation¶

Employees who have worked during the reference period (01/06/N-1 - 31/05/N) are eligible for up to 250€ in eco vouchers, which are granted at the beginning of July.

Example

For 2025, employees must have worked between 01/06/2024 and 31/05/2025 to qualify.

For employees who join during the reference period, the voucher amount is prorated based on their worked days.

Example

An employee hired on 06/01, having worked 6 out of 12 months, would receive:

For part-time employees, the amount is adjusted as follows:

Work Regime |

Voucher Amount (€) |

|---|---|

4/5 |

250€ |

3/5 |

200€ |

1/2 |

125€ |

< 1/2 |

100€ |

Example

If an employee starts on 1st September in full-time and then switches to half-time on 1st April 2024, the calculation will be:

Exceptions & adjustments¶

If an employee worked full-time for the entire reference period but did not receive 250€, certain non-assimilated leave days may have affected the calculation.

The following leave types are not considered for eco-voucher entitlement:

Unpaid leaves

Sick leave compensated by mutual insurance (after 30 days of work incapacity)

Usage & validity¶

Eco vouchers are valid for 24 months from the date of issuance.

更多内容

The list of eligible products and services that can be purchased with eco vouchers is available here:

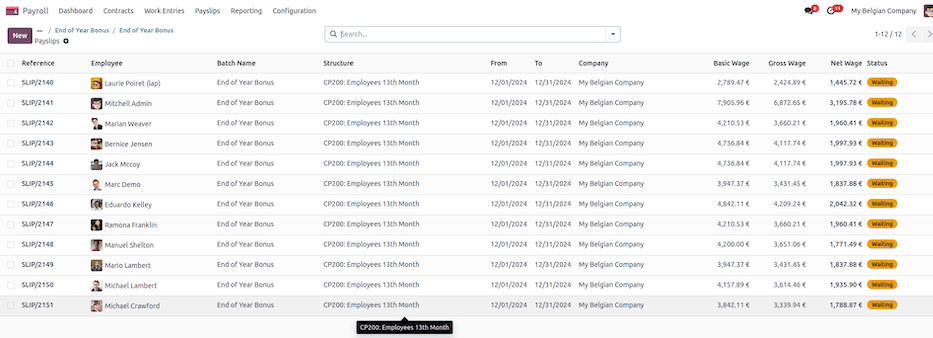

End of year bonus¶

This document explains the calculation of the thirteenth-month salary (year-end bonus) in Belgium within Odoo. The calculation considers the employee’s contracts, working time rates, and applicable taxes.

Calculation of the thirteenth-month salary¶

资格标准¶

员工必须在一年中至少工作了**6 个完整月。

全职和兼职雇员都有资格参加,根据工作时间按比例计算。

工资计算¶

第 13 个月工资的计算方法如下:

确定基本工资:

Retrieve the employee’s contractual wage.

确定适用的工时费率。

计算符合条件的月份:

如果明确提供(

MONTHS输入),则使用给定的月数。否则,计算完整的工作月数。

非全年工作按比例计算工资。

缺勤调整:

扣除未付缺勤以获得出勤比例。

将最多 60 天的病假视为带薪休假。

包括可变收入:

如果明确提供(

VARIABLE输入),则使用给定值。否则,请计算去年的平均可变收入。

最终金额:

第 13 个月的最终数额是按比例计算的固定工资和平均可变收入之和。

Withholding tax calculation¶

The withholding tax is calculated using a progressive rate system. The process involves:

确定雇员的年应税收入:

Compute the annualized salary, including benefits in kind (e.g., company car, internet, mobile phone, laptop).

Apply reductions for dependent children.

Apply Tax Rates:

Use predefined tax brackets to determine the base withholding tax rate.

If applicable, apply a reduction based on the number of dependent children.

Tax brackets¶

The withholding tax is applied progressively based on the following brackets (as of 2025):

Lower Bound |

Upper Bound |

Tax Rate |

|---|---|---|

0.00 |

10,415.00 |

0.00% |

10,415.01 |

13,330.00 |

23.22% |

13,330.01 |

16,960.00 |

25.23% |

16,960.01 |

20,340.00 |

30.28% |

20,340.01 |

23,020.00 |

35.33% |

23,020.01 |

25,710.00 |

38.36% |

25,710.01 |

31,070.00 |

40.38% |

31,070.01 |

33,810.00 |

43.41% |

33,810.01 |

44,770.00 |

46.44% |

44,770.01 |

58,460.00 |

51.48% |

58,460.00 |

∞ |

53.50% |

免税¶

A withholding tax exemption is granted when the normal annual gross income does not exceed a specific threshold, which is determined based on the number of dependent children [2].

A disabled dependent child counts as two.

The method involves referring to a two-column table:

Column 1: Indicates the number of dependent children.

Column 2: Specifies the maximum allowable normal annual gross income, based on the number of dependent children listed in Column 1, which must not be exceeded to qualify for full or partial exemption from withholding tax.

After determining the annual gross income, two scenarios may arise:

If the annual income exceeds the threshold, no exemption is granted.

If the annual income does not exceed the threshold, an exemption will be applied.

The amount of this exemption corresponds to the difference between the annual gross income and the threshold amount.

Of course, if this difference exceeds the base withholding tax amount, no withholding tax will be due.

No. of Children |

Max Revenue (EUR) |

|---|---|

1 |

18,400.00 |

2 |

21,930.00 |

3 |

28,270.00 |

4 |

35,330.00 |

5 |

42,390.00 |

6 |

49,450.00 |

7 |

56,510.00 |

8 |

63,570.00 |

9 |

70,630.00 |

10 |

77,690.00 |

11 |

84,750.00 |

12 |

91,810.00 |

减税¶

When there is no justification for fully or partially exempting the exceptional allowance from withholding tax, it is still possible to grant a reduction in withholding tax.

To determine eligibility for this reduction, one must check whether the normal annual gross salary exceeds a certain higher threshold, which varies according to the number of dependent children [3]. This threshold is higher than the one used for exemption purposes.

A disabled child counts as two.

The method involves referring to a three-column table:

Column 1: Indicates the number of dependent children (up to a maximum of 5).

Column 2: Specifies the percentage reduction in withholding tax, based on the number of dependent children listed in Column 1, which must not be exceeded to qualify for the reduction.

Column 3: Shows the threshold amount that must not be exceeded, corresponding to the number of dependent children listed in Column 1.

Two scenarios may arise:

If the threshold amount is exceeded, no reduction will be granted.

If the threshold amount is not exceeded, a reduction will be applied to the withholding tax amount, up to a percentage rate determined in Column 2.

For employees with dependent children, tax reductions apply as follows:

No. of Children |

Reduction (%) |

Max Revenue |

|---|---|---|

1 |

7.5% |

28,245.00 |

2 |

20.0% |

28,245.00 |

3 |

35.0% |

31,070.00 |

4 |

55.0% |

36,720.00 |

5+ |

75.0% |

39,550.00 |

Final tax calculation¶

The final withholding tax amount is:

从第十三个月工资总额中扣除计算得出的税金,以确定应支付给员工的净额。

The calculation considers work duration, absences, variable revenue, and applicable withholding taxes. Odoo automates these calculations to ensure compliance with Belgian labor laws and tax regulations.

How to do it in Odoo¶

导航至 并创建一个新的有效日期记录(此处为 2024 年 12 月)。

然后点击 生成工资单`按钮,选择 :guilabel:`CP200:比利时员工 工资结构类型 和 CP200:雇员第 13 个月 工资结构。您还可以通过 部门 和/或 工作职位 筛选符合条件的员工。

Once validated, a payslip is generated for each employee.

You can now check the different payslips before validation. Once validated, the PDF files are generated and posted on employee portals as for classic payslips.

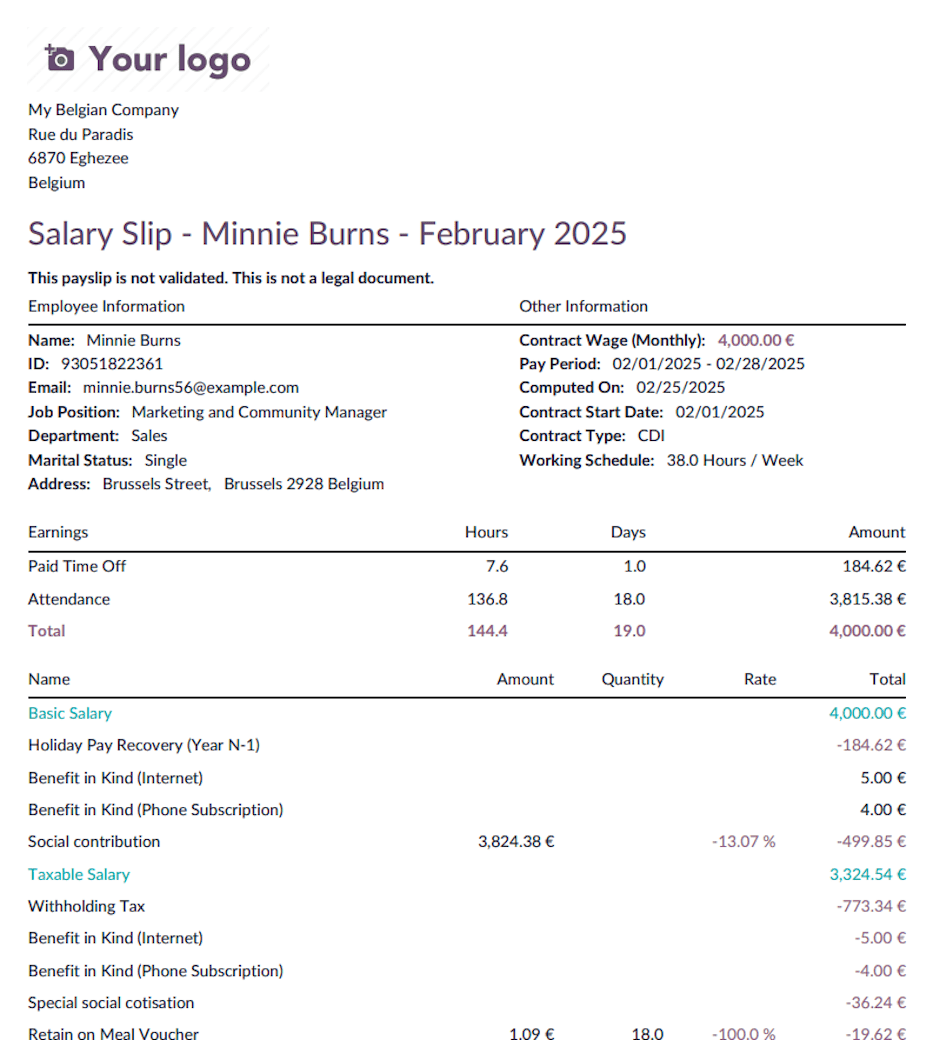

假期工资追回¶

本文档说明了 Odoo 如何计算比利时员工在更换雇主时的假期工资(包括单倍和双倍)追回。当员工从一家公司转到另一家公司时,他们的前雇主可能已经支付了上一年的假期工资。这笔金额需要由新雇主追回,本指南概述了 Odoo 如何管理这个过程。

了解比利时的假期工资¶

在比利时,员工有权获得年假和相应的假期工资,包括:

单倍假期工资:休假期间的正常工资支付。

双倍假期工资:在员工休年假时额外支付的款项,通常约等于每月工资总额的 92%。

当员工更换工作时,其前雇主可能已经支付了这些款项。为避免重复支付,新雇主需要收回已支付的金额。

追回简单假期工资¶

在Odoo中单倍假期工资的追回基于以下标准:

如果员工在当年休假且其前雇主已支付假期工资,则适用追回。

计算时考虑已休假天数和每周工作时数。

追回流程分为:

年度N:当年的假期工资追回。

年度N-1:上一年的假期工资追回。

系统检查:

员工在公司的首份合同日期是否在上一年。

员工是否有待追回的假期工资金额。

是否尚未处理过追回。

员工是否已休年假。

如果所有条件都满足,Odoo 会计算从工资单中扣除的金额,以计入已从前雇主处收到的假日工资。

追回双倍假期工资¶

追回双倍假期工资的步骤如下:

系统会核实员工的合同并确定其雇佣期限。

工资总额根据员工的合同计算。

确定前一年的工作月数。

阈值的计算方法如下:

\[阈值 = 当前月薪 × 上一年工作月数 × 工作率 × 7.67%\]如果前雇主提供的假期证明上的金额低于这个阈值,则不适用限制。

系统追回以下两者中的较低值:

计算的阈值。

前雇主实际支付的金额。

如果员工在当前公司工作超过 12 个月,则无需追回双倍假期工资。

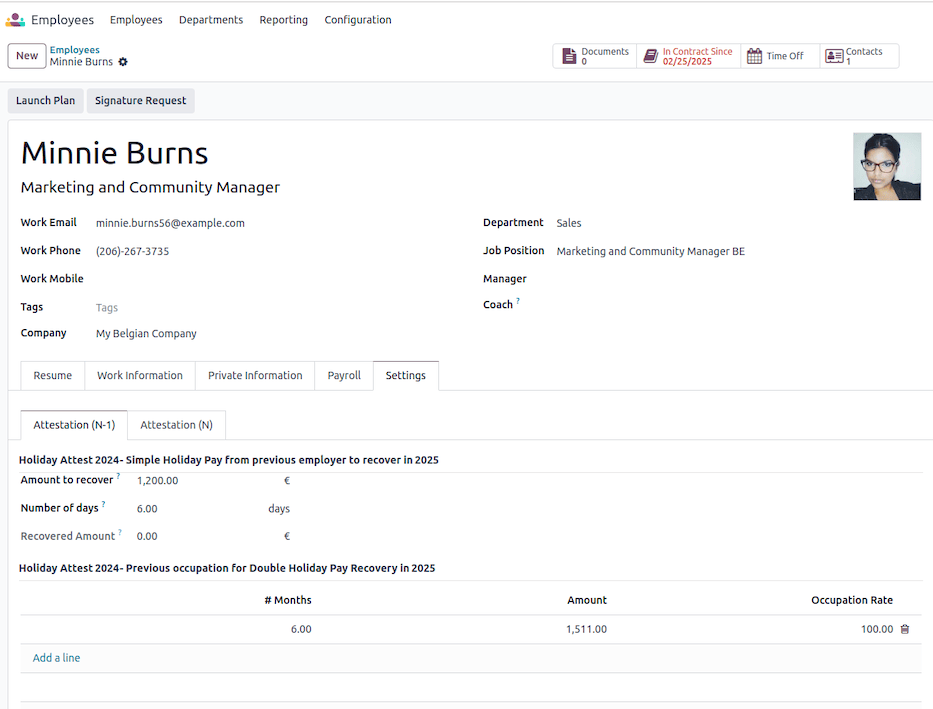

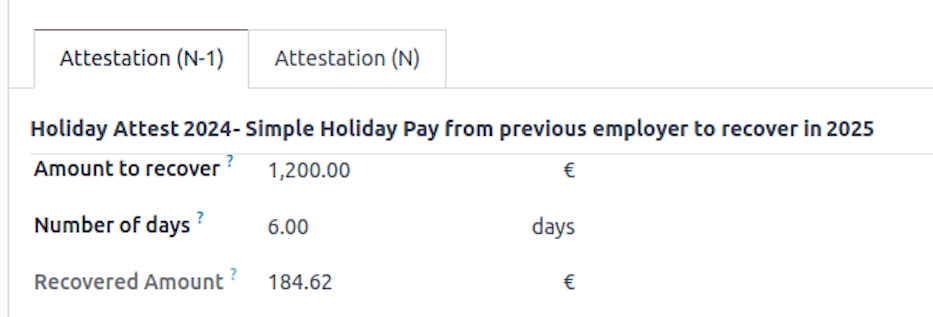

如何在 Odoo 中配置¶

在员工表单视图的 :guilabel:`设置`选项卡下,您可以输入新员工提供的各种假期证明金额。

对于单倍假期工资追回,您需要输入:

带薪休假的 天数

员工的 待追回金额

注解

The Recovered Amount field displays the amount already recovered.

对于双倍假期工资追回,您必须为**每个雇主的假期证明输入一行**。每行应包括:

该 # 月数 (员工为该雇主工作的月数)。

提供给员工的 金额

职业费率

Odoo 使用这些数据计算**追回限额**。如果员工现在的工资较低,则无法追回全部金额。

小技巧

注意不要将当年(N)和前一年(N-1)的节假日证明混在一起。

对于简单的节假日工资补偿,系统会从每个法定休假时间段中扣除相应金额,直到:

一旦 工资单 生效并支付,追回的简单假期工资就会反映在员工表单视图中。

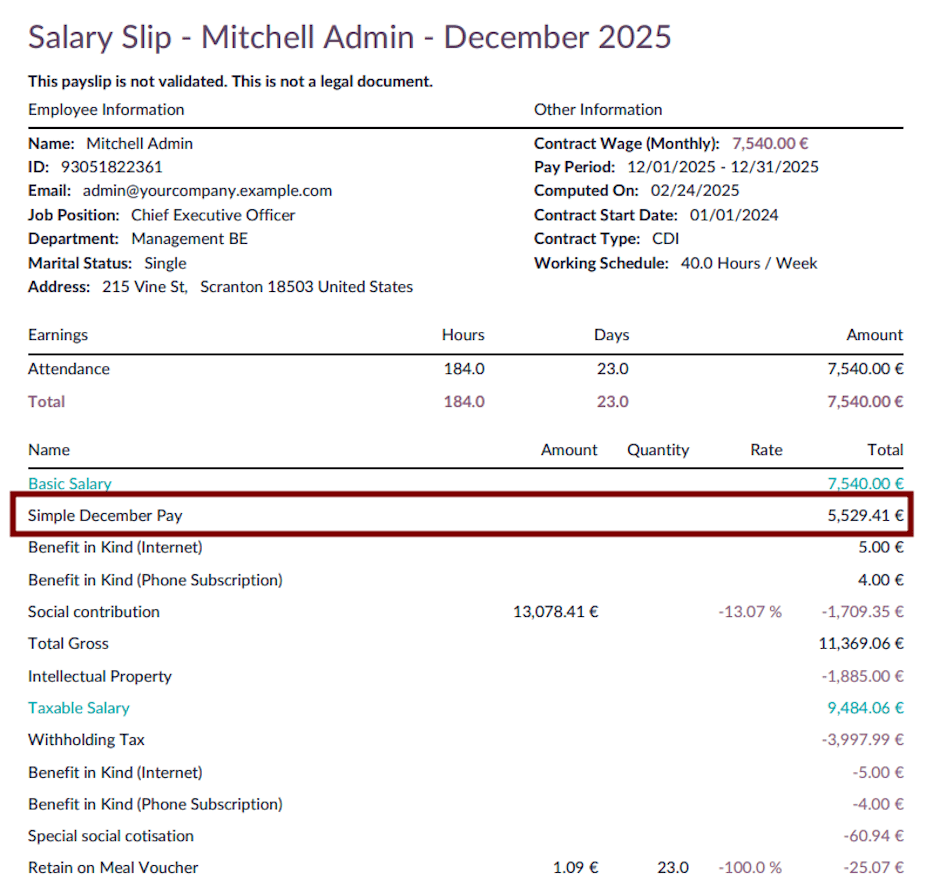

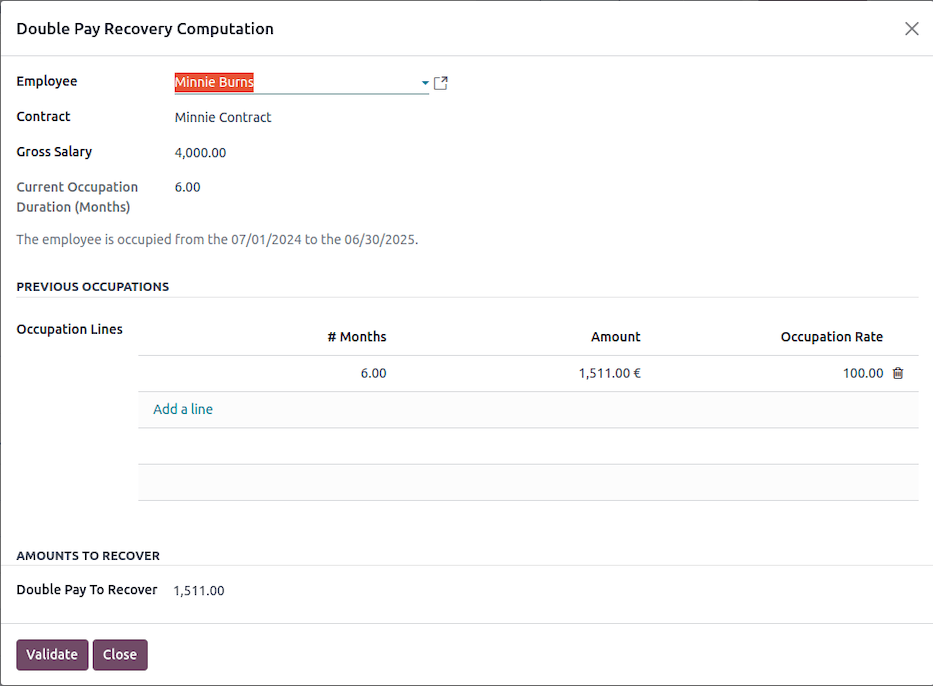

在双休日工资单上,点击 计算双倍工资恢复额度 打开一个向导,帮助计算可追回金额。

在 双倍工资追回计算 向导中,您会发现:

在 职业行 中列出的相关节假日证明

基于阈值的 待追回双倍支付 金额

如果需要手动调整,该金额可**编辑**。

Once validated, the double pay recovery is applied to the payslip.

Odoo automates the recovery of both simple and double holiday pay, ensuring compliance with Belgian labor laws. By analyzing contract details, employment duration, and past payments, Odoo calculates the necessary deductions and prevents duplicate holiday pay payments.

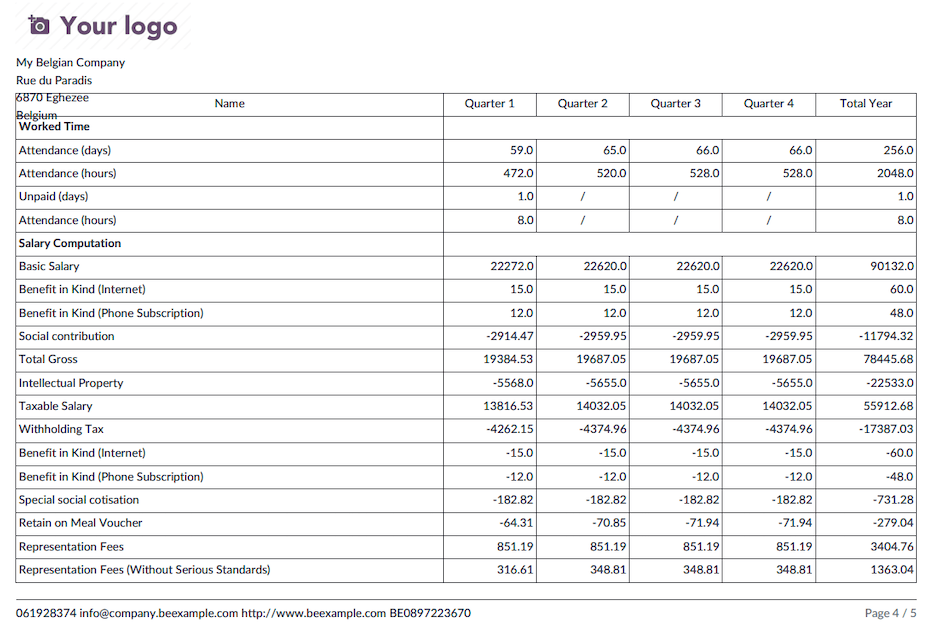

Individual accounts¶

介绍¶

The individual account provides workers with a detailed overview of their earnings, deductions (such as social security contributions, withholding tax, etc.), and the working days performed, on a pay period basis. Additionally, it contains all relevant administrative data related to remuneration.

Required information in the individual account¶

The individual account must include several mandatory details as determined by Royal Decree.

Employer identification:

Name, address, ONSS number, ONVA number

Relevant joint committee (or sub-committee)

Name of the holiday fund for workers

Insurer for work-related accidents

Approved social secretariat

Relevant affiliation numbers

Worker identification:

Name, address, date of birth, gender, tax status

Type of employment contract, job title, professional qualification

Workplace location (or note if working at multiple locations)

Start and end date of employment

Employee ID number, starting salary

Remuneration components and payment periodicity

Remuneration components:

Per pay period (daily, weekly, bi-weekly, or monthly):

Number of working days and hours (regular, additional, and overtime)

Days of work interruption and reasons (illness, vacations, public holidays, replacement days, compensatory rest days, etc.)

Fixed or hourly salary, variable remuneration, bonuses, meal vouchers, eco vouchers, holiday pay (including early holiday pay if applicable), severance pay, year-end bonuses (as per sectoral or other collective labor agreements), benefits in kind and their estimated value

Gross amount of all remuneration components

Amounts subject to social and tax deductions

Various social and tax deductions: personal ONSS contributions, withholding tax, special social security contributions

Net amount payable to the worker

Other payments made by the employer, including reimbursement of travel expenses, allowances, and other payments

Per quarter:

Number of actual working days

Days of work interruption by reason

Total remuneration subject to social security contributions

Employee social security contribution amounts

Per year:

Total amounts subject to social security contributions

Employee social security contribution amounts

Taxable remuneration and other amounts

Withholding tax amount

Responsibility for establishing and updating the individual account¶

Belgian employers using Odoo Payroll can generate the individual accounts of their workers.

However, to ensure accurate record-keeping, employers must:

Ensure payment of sector-mandated year-end bonuses

Ensure that all public holidays, legal vacation days, and compensatory rest days are taken before the end of the year

Plan collective vacation and replacement public holidays in advance

Pay workers their holiday pay (including early holiday pay if applicable)

Distribute due eco vouchers

Pay any required travel expenses between home and work

If these obligations are met, the corresponding data will be included in the individual account.

Storage and retention period of the individual account¶

The individual account is a social document that must be kept by the employer for a specified period after its creation.

Employers may store individual accounts:

At the ONSS-registered address

At a workplace

At their home or registered office if located in Belgium; otherwise, at the residence of a designated agent in Belgium

At the office of the approved social secretariat, if affiliated

Records must be kept legible and in a format allowing efficient oversight. The retention period is five years from the end of the annual closing of the account.

When must workers receive a copy of their individual account?¶

Each worker must receive a copy of their individual account:

During employment: Before March 1 of the following year

At the end of employment: Within two months following the end of the quarter in which the contract ended

If additional payments occur after contract termination: A copy reflecting the additional payment must be provided within two months of the payment

Additionally, employers must issue a simplified individual account with certain worker and employer details within two months of the worker’s employment start date.

Any modifications to mandatory details, such as job function or workplace location, must be communicated in writing (e.g., an updated simplified individual account) within one month of the effective change date.

Generate individual accounts in Odoo¶

Navigate to .

Then select the reference year and click the Populate button. The .pdf are

displayed as soon as they are available and are generated 30 by 30, this could take some time

according to the number of employees.

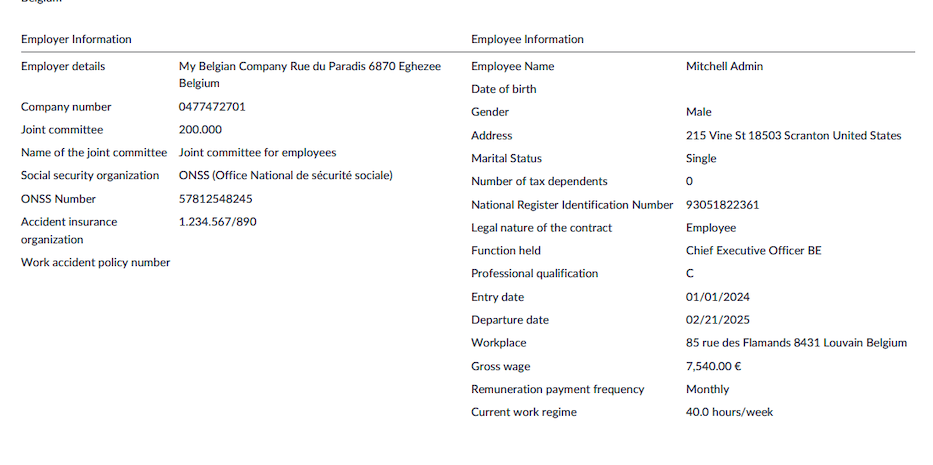

On the first page, the Employer Information and the Employee Information is listed.

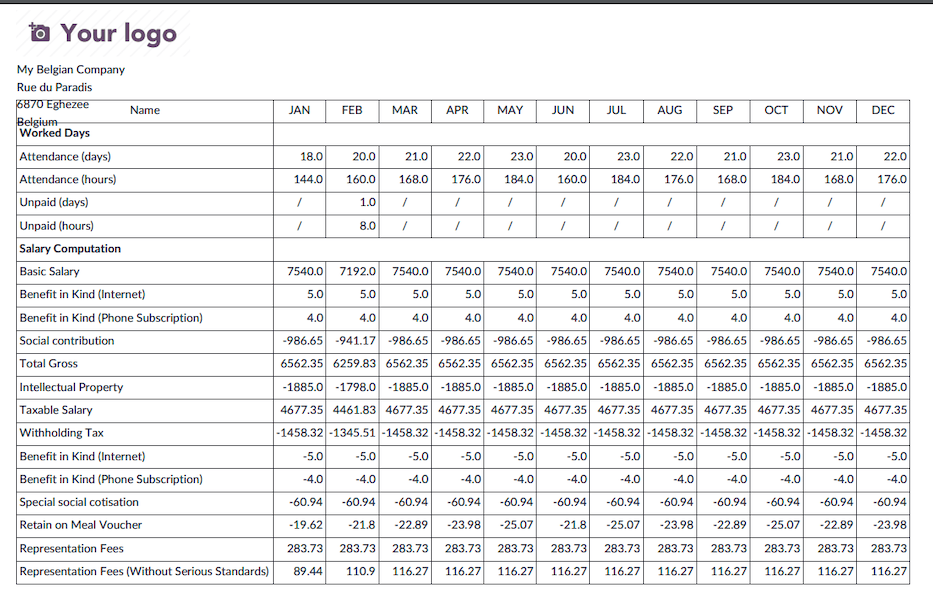

The next page displays all the employee worked days and payslip lines, month by month, split by structure (e.g., End of year bonus and monthly pay).

The next page displays the same information quarter by quarter and summarized for the whole year.

Once all PDF files are generated, they can be posted to the employee documents portal if the Documents application is installed and properly configured.

Select the checkbox of each employee whose documents you want to post, and click the Post PDF button.

Intellectual property and 273 sheets¶

介绍¶

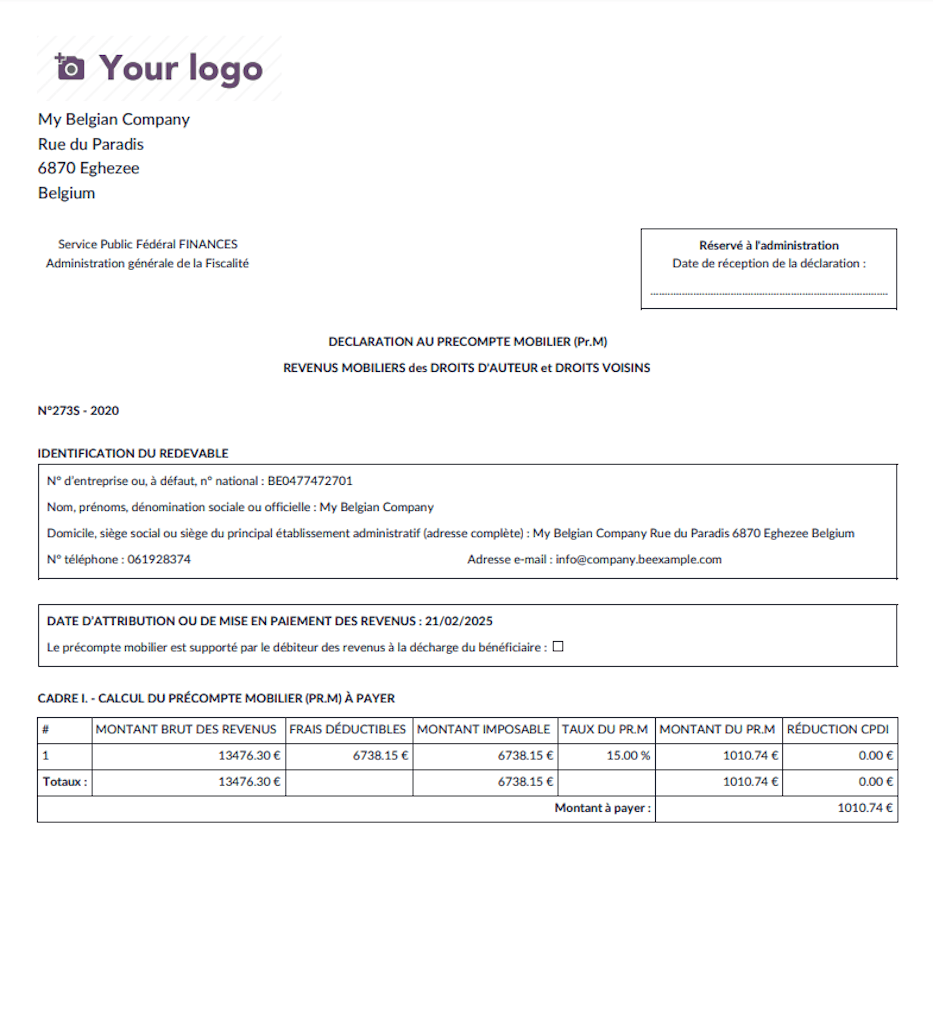

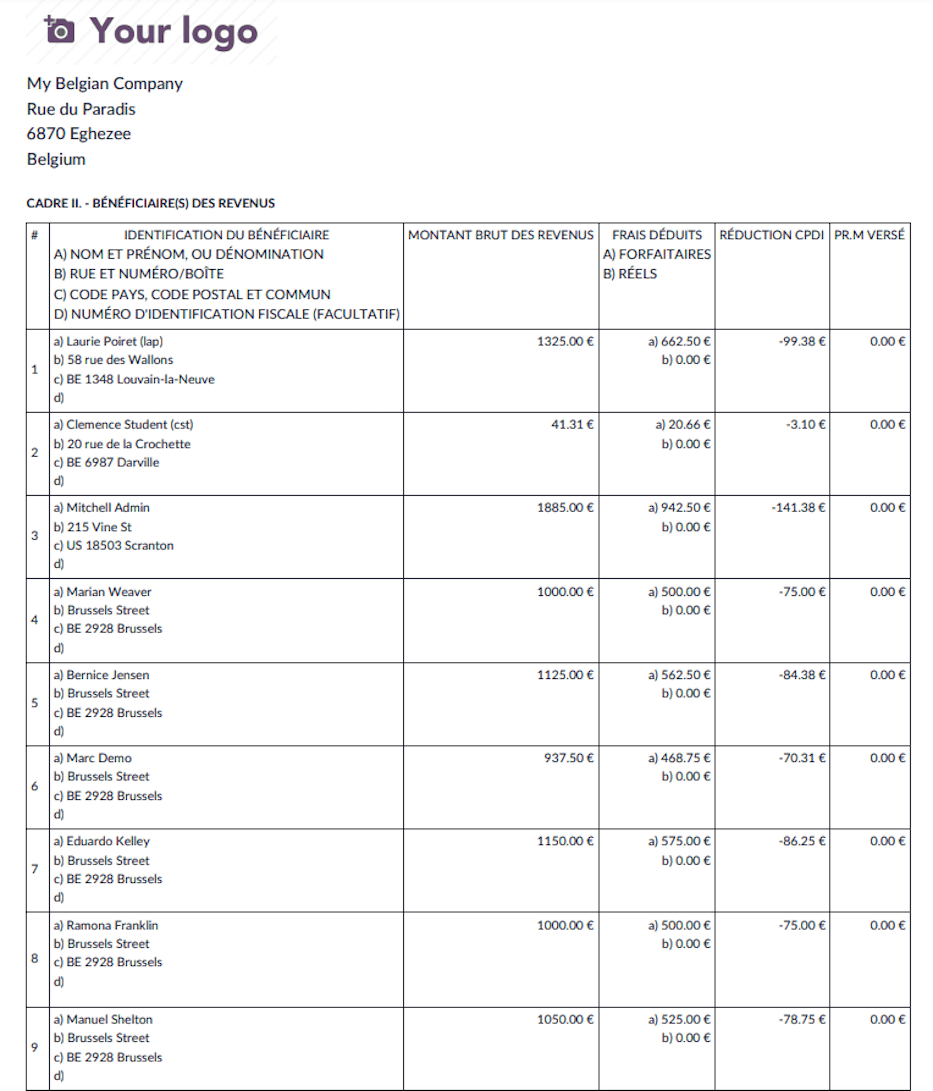

The 273S declaration is used for the Prepayment on Mobile Income (Pr.M), which concerns the taxation of Author’s Rights and Neighboring Rights (also known as Revenus Mobilier). These are specific types of income that are subject to particular tax treatment in certain jurisdictions.

This document provides users with essential information about how the 273S declaration functions within Odoo for reporting income derived from these rights, including applicable tax rates and conditions.

Tax rates and calculation¶

The net income from Author’s Rights and Neighboring Rights is taxable at a specific rate of 15%. However, the effective tax rate can vary based on the application of flat-rate deductions. These flat rates reduce the taxable amount, leading to a lower effective tax rate for lower incomes.

Key points of taxation:

Effective tax rate:

For incomes below the first flat-rate threshold, the effective tax rate can be as low as 7.5%.

For incomes reaching the flat-rate ceiling of 37,500 EUR (indexed annually), the rate can increase to 12%.

Additional taxes: Income from Author’s Rights and Neighboring Rights must be declared in the personal income tax declaration. As a result, municipal surcharges may also apply to the tax due.

The prepayment of the tax is handled via a withholding tax on the income. The debtor of the income (e.g., the employer or company paying the royalties) must submit the 273S declaration to the tax authorities. This withholding tax rate is generally 15%, but for incomes exceeding the indexed ceiling of 37,500 EUR, the rate increases to 30%.

Odoo integration for Declaration 273S¶

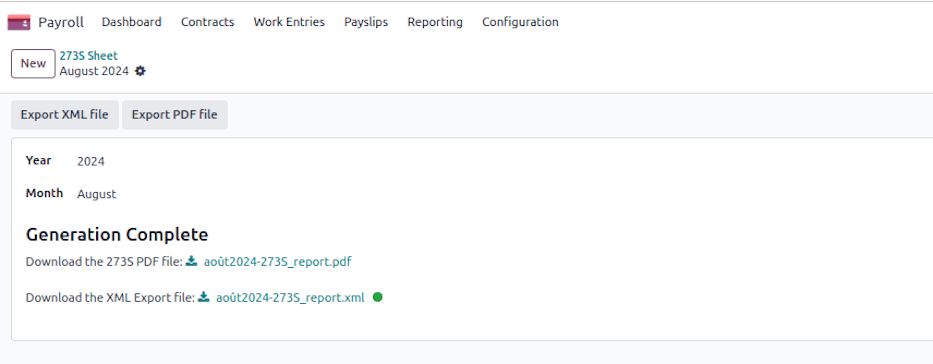

Odoo users can efficiently manage the submission of the 273S Declaration for Author’s Rights and Neighboring Rights income via the Odoo Payroll module. Here’s a quick overview of how this can be done:

Generate the 273S form¶

Odoo can generate the 273S form automatically based on the income data entered into the system. Ensure that all required details, including the amount of income subject to the tax, are accurately entered.

Navigate to to create a New record.

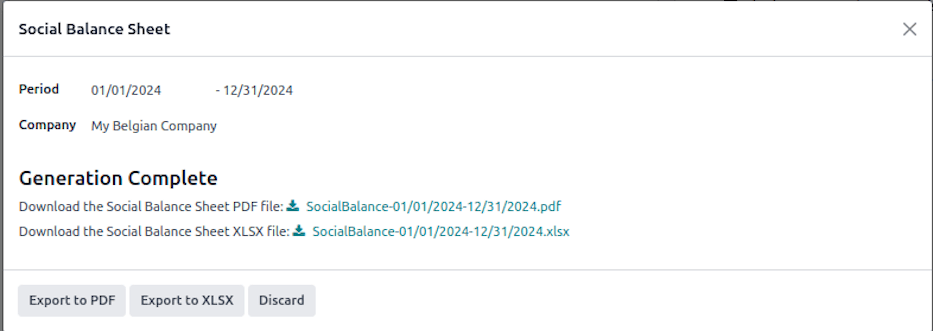

Select the reference Year and Month, then click Export XML file to generate the declaration. Click Export PDF File to generate the printed details.

On the first PDF section, the company information and the global declaration is listed.

On the second section, the employees specific information is listed.

File the 273S Declaration¶

After generating the XML file, the company or the debtor of the income can submit it to the tax authorities directly from MyMinfin. Keep track of the filing and payment deadlines to ensure timely submission and compliance.

结论¶

The 273S Declaration is an essential tool for companies and individuals benefiting from the favorable tax regime on Author’s Rights and Neighboring Rights. By leveraging Odoo’s tax management features, users can ensure compliance while optimizing their tax liabilities.

For further assistance, please consult a tax professional.

Representation fees¶

介绍¶

Representation fees must be allocated on the payslip between serious and non-serious representation costs. By default, the threshold is set at €283.73, but it can be adjusted based on what the company can legally justify.

The representation fees is configured on the employee’s contract form in the Expense Fees field.

On the payslip, two or one line are displayed in the case the representation fees amount exceeds the threshold or not.

Breakdown of the threshold¶

Only part of the representation costs are pro-rated because certain costs are fully covered by the company. These fixed costs include:

The serious portion of the representation costs is not prorated, while the non-serious portion is prorated based on working time.

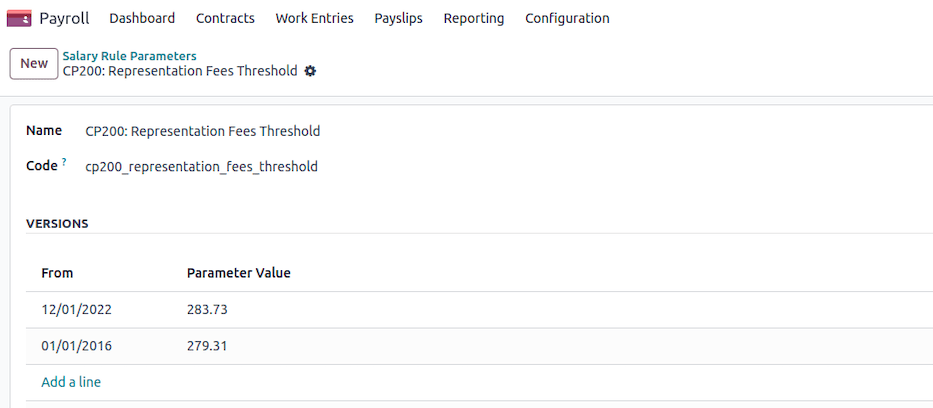

Navigate to , and

search for the CP200: Representation Fees Threshold record. Then, adapt the current value or

introduce a new one from a given date.

注解

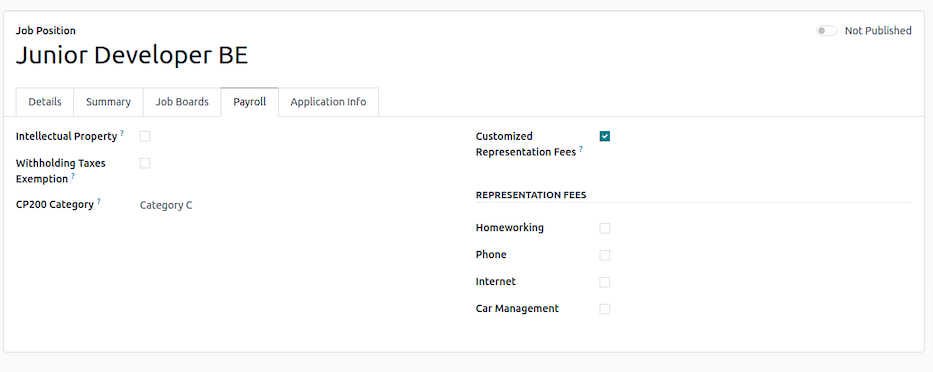

It is possible to define, based on job position, which jobs are eligible to certain criteria in the Payroll tab.

Calculation of representation fees¶

Conditions for payment¶

Representation fees are only granted if:

The employee receives a basic salary, and

The employee has worked at least part of the time, unless a salary simulation is in progress.

If the employee is on full leave (without any working days), they are not eligible for representation fees.

Determining the work time rate¶

The number of working days per week is extracted from the employee’s contract.

If the employee has periods of incapacity for work (e.g., illness), the calculation adjusts the work time rate accordingly:

The total incapacity hours are determined.

If the company follows a biweekly schedule, the incapacity hours are divided by two.

The incapacity rate is calculated as:

\[\text{incapacity rate} = 1 - \frac{\text{incapacity hours}}{\text{total weekly hours}}\]The final work time rate is then adjusted by multiplying it with the incapacity rate.

Applying the threshold and pro-rating rules¶

The default threshold (€283.73) is applied unless adjusted by the company.

If the employee has worked a full-time schedule, they receive the full representation fees without reduction.

If the employee works part-time (contractual or due to time credit), only the non-serious portion of the fees is prorated.

The prorated formula for non-serious expenses is:

\[\text{adjusted amount} = \text{threshold} + (\text{total fees} - \text{threshold}) \times \frac{\text{work time rate}}{100}\]

If the employee has missing workdays, the final amount is further adjusted:

First calculate the daily reduction:

\[\text{daily reduction} = \frac{(\text{total amount} - \text{threshold}) \times 3}{13 \times \text{days per week}}\]Then calculate the final amount:

\[\text{final amount} = max(0, \text{total amount} - \text{daily reduction} \times \text{missing days})\]

Final calculation¶

If the employee meets all conditions, the final representation fees amount is rounded to two decimal places for payroll purposes.

Employees working a full schedule receive full reimbursement, while those working reduced hours have the non-serious portion prorated accordingly.

结论¶

This calculation ensures fair allocation of representation fees by distinguishing between fixed serious costs and prorated non-serious costs. The company can adjust the threshold (€283.73 by default) based on justifiable business expenses.

Employees working full-time receive their full representation fees, while those working part-time or with absences only receive a pro-rated portion of the non-serious fees.

Sick time off and relapse¶

In Belgium, sick leave is managed according to two main regimes:

With guaranteed salary: The employer continues to pay the worker’s salary for a specified period.

Without guaranteed salary: The worker receives benefits from the mutual insurance company after the guaranteed salary period.

Sick leave with guaranteed salary¶

The guaranteed salary is a period during which the employer continues to pay the salary of the worker who is unable to work.

Employees: The employer pays 100% of the salary during the first full month of incapacity. After this period, if the incapacity continues, the worker falls under the mutual insurance regime.

Sick leave without guaranteed salary¶

After the guaranteed salary period, the ONEM (National Employment Office) or the mutual insurance company takes over.

Long-term illness: An incapacity lasting more than 30 days leads to benefits from the mutual insurance company.

Relapse: If a worker returns to work and then becomes ill again for the same reason within 14 days, this may be considered a relapse, and the rules for guaranteed salary may be adjusted.

Management in Odoo¶

In Odoo, sick leave is automatically managed if the absences are related to the Sick Time Off work entry type.

Recording time off: The employee records their absence through the Time Off module.

Automation of work entries: If the request is approved, Odoo automatically generates the corresponding Work Entries.

Impact on payroll: The guaranteed salary is automatically calculated according to the rules configured based on the worker’s status (employee).

Compensation after the guaranteed salary: Once the guaranteed salary period has expired, Odoo adjusts the Work Entries to reflect the transition to the mutual insurance company.

Thus, Odoo ensures a smooth and compliant management of sick leave according to Belgian regulations.

介绍¶

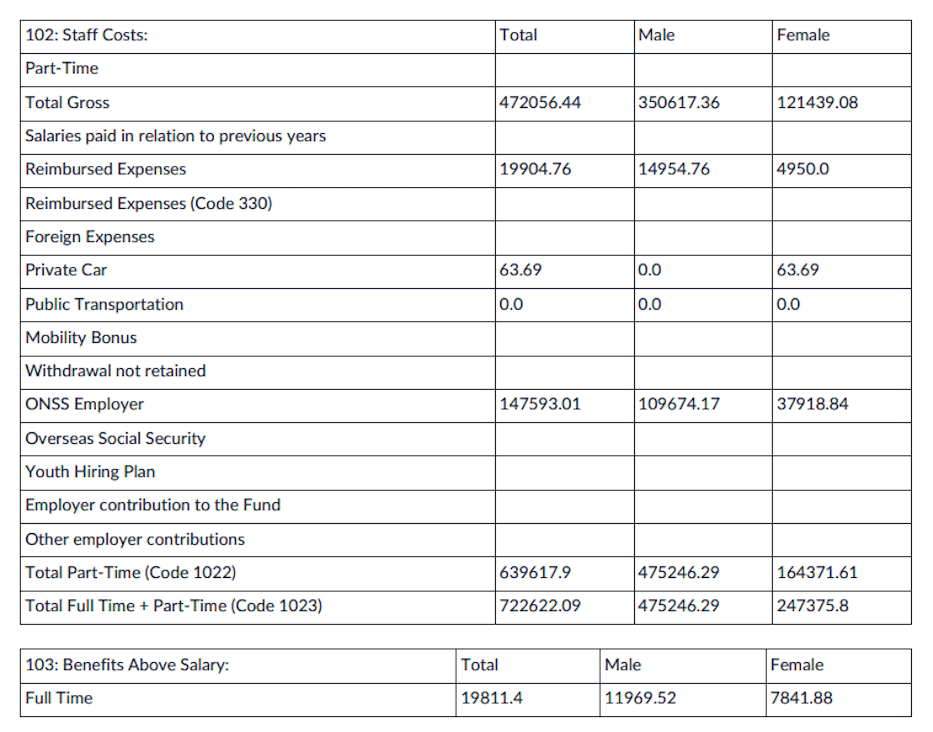

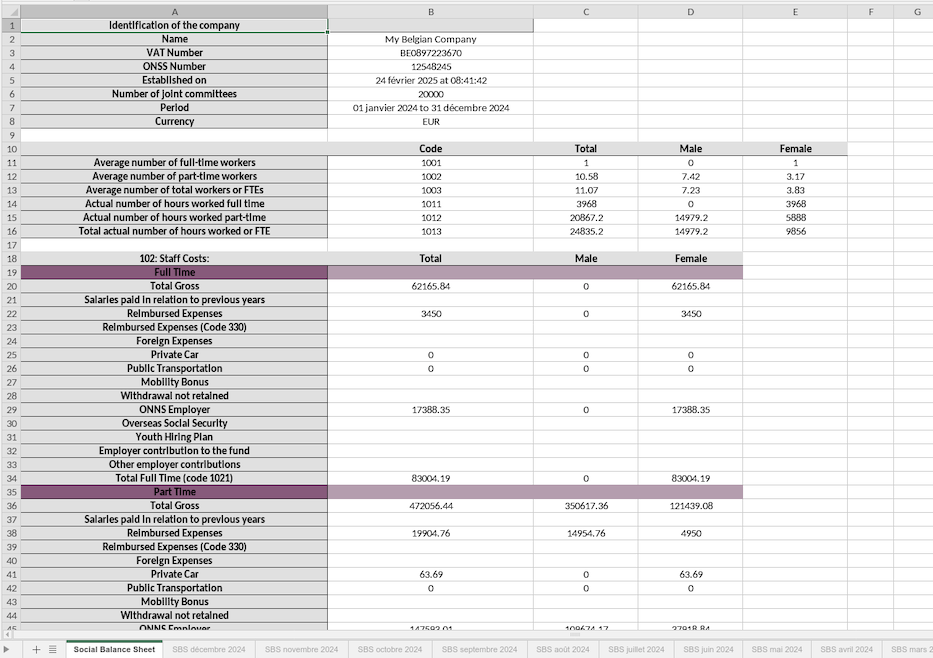

The Social Balance Sheet was introduced by the law of December 22, 1995, as part of measures for the implementation of the multi-year employment plan. Companies required to file annual accounts (including some that are not obligated to publish such accounts - see the National Bank of Belgium website for details) must also prepare and submit a Social Balance Sheet to the National Bank of Belgium.

The Royal Decree of August 4, 1996, incorporates the Social Balance Sheet into the annual accounts, specifically as an annex. This makes it an integral part of a company’s financial statements.

Obligations by entity type¶

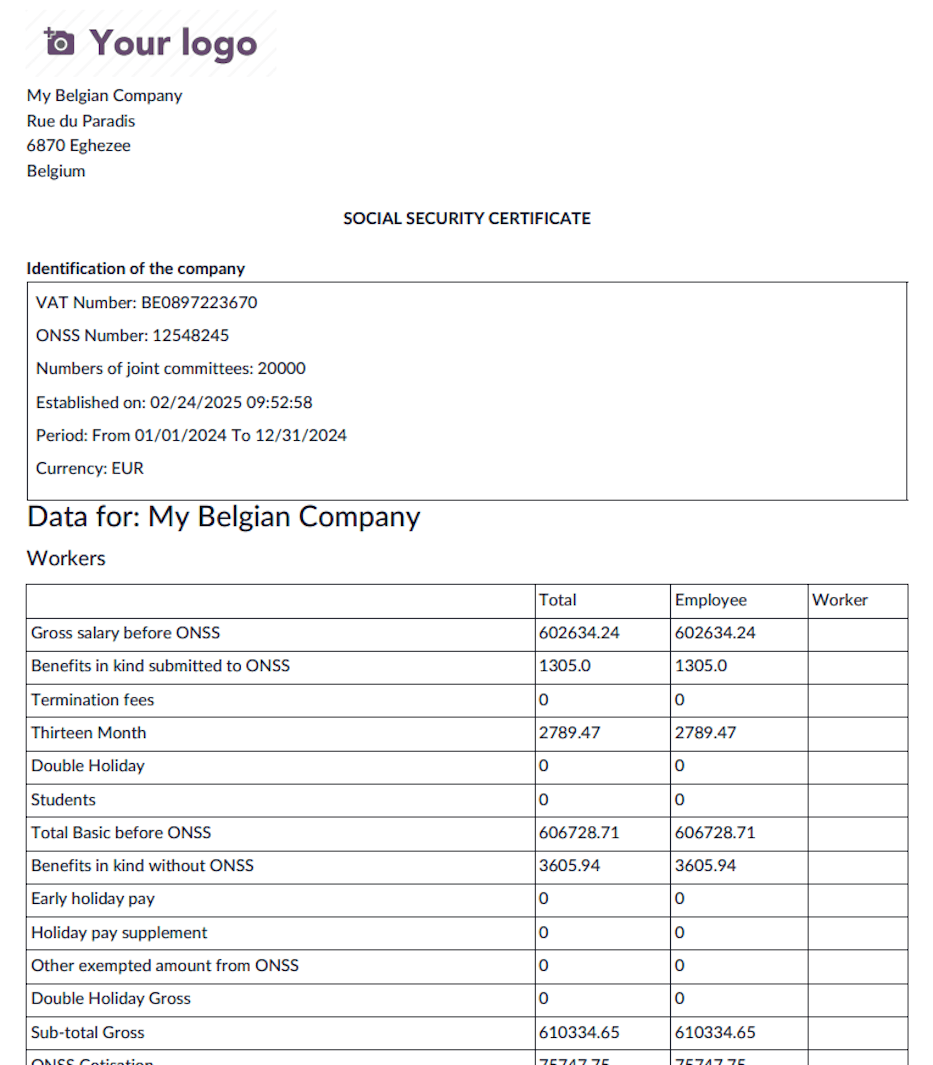

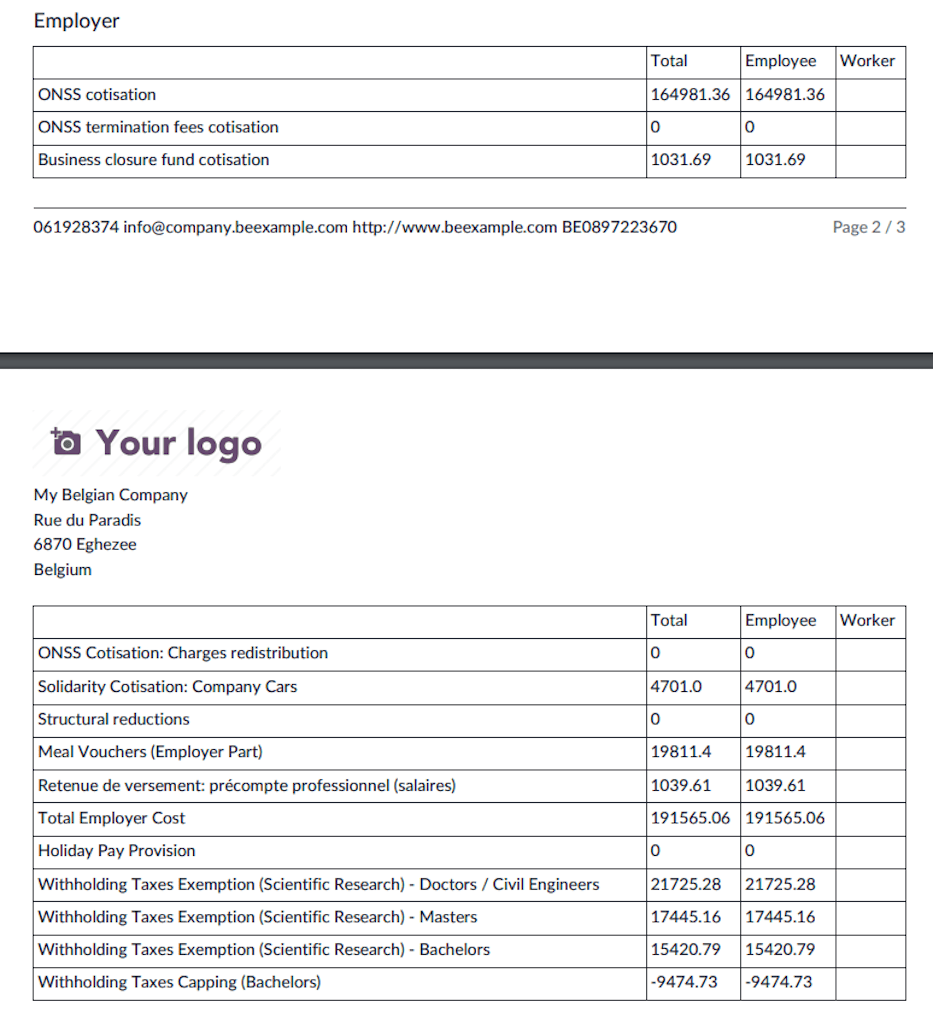

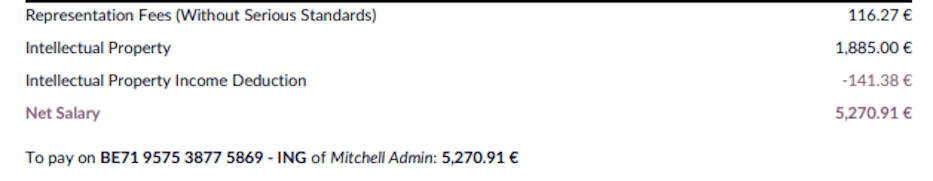

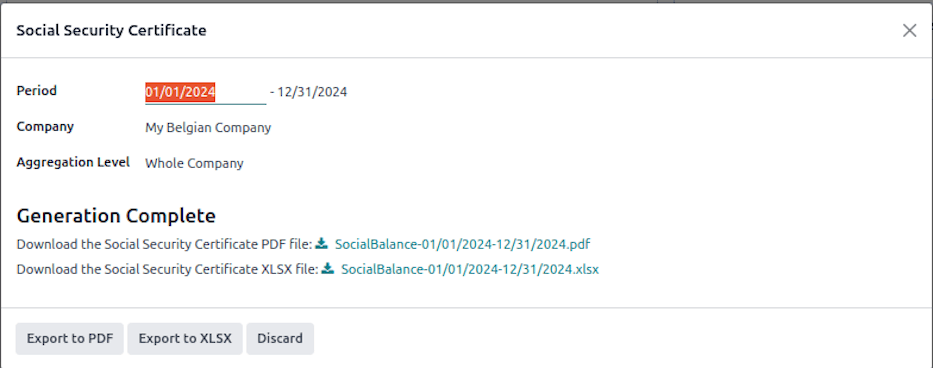

Exporting the report¶

Once the selections are made, you can export the report in different formats:

Click Export to PDF to generate a printable version of the Social Security certificate.

Click Export to XLSX to generate an Excel file containing all relevant data.

This feature ensures full transparency and compliance with social security regulations in Belgium.

休息时间¶

Legal time off¶

This guide provides an overview of the basic rules governing legal holiday entitlements in Belgium for employers using Odoo.

Holiday entitlement calculation¶

Your holiday entitlement for the current year (N) is determined by the number of months worked in Belgium during the previous year (N-1).

Calculation details:

Employees earn 2 days of leave per month based on a 6-day work week.

The entitlement is adjusted for a 5-day work week: \((\text{Total Days} \div 6) \times 5\).

Example

If an employee worked 7 months in the previous year (N-1):

6-day work week: \(7 \times 2 = 14 \text{ days}\)

5-day work week: \(14 \div 6 \times 5 = 11.67 \text{ days}\)

Partial Month Calculation:

Worked 1st to 10th: Full month counted.

Worked 11th to 19th: Half month counted.

Worked 20th onwards: Month not counted.

Rounding Rules:

Less than 0.35: Round to 0.

Between 0.35 - 0.74: Round to 0.5.

0.75 and above: Round to 1.

For a full-time employee, this typically results in 11.5 days of legal holiday entitlement.

Maximum holiday entitlement¶

Employees are entitled to a maximum of 4 weeks of holiday based on their working schedule. If an employee switches between full-time and part-time work, their entitlement is adjusted accordingly.

Calculation details:

5-day work week: \(4 \times 5 = 20 \text{ days}\)

4-day work week: \(4 \times 4 = 16 \text{ days}\)

3-day work week: \(4 \times 3 = 12 \text{ days}\)

Example

If an employee joined Odoo on January 1, 2024, and plans to switch to a 3-day work week from April 1, 2024:

Step 1: Calculate holiday entitlement for 2024

The employee worked 9 months in 2023.

6-day work week basis: \(9 \times 2 = 18 \text{ days}\)

Adjusted for 5-day work week: \(18 \div 6 \times 5 = 15 \text{ days}\)

Step 2: Verify maximum holiday entitlement

For a 5-day work week, the maximum entitlement is 20 days.

Since the employee is entitled to 15 days, they remain within the limit.

Step 3: Adjust entitlement for the new work schedule

From April 1, 2024, the employee moves to a 3-day work week.

Maximum entitlement for a 3-day work week: \(3 \times 4 = 12 \text{ days}\).

If no leave is taken before April 1, the employee may take up to 12 days from their 15-day entitlement.

The remaining 3 days will be settled at the end of the year.

This ensures compliance with Belgian legal leave regulations and allows employers to manage holiday entitlements effectively within Odoo.

Legal time off allocation¶

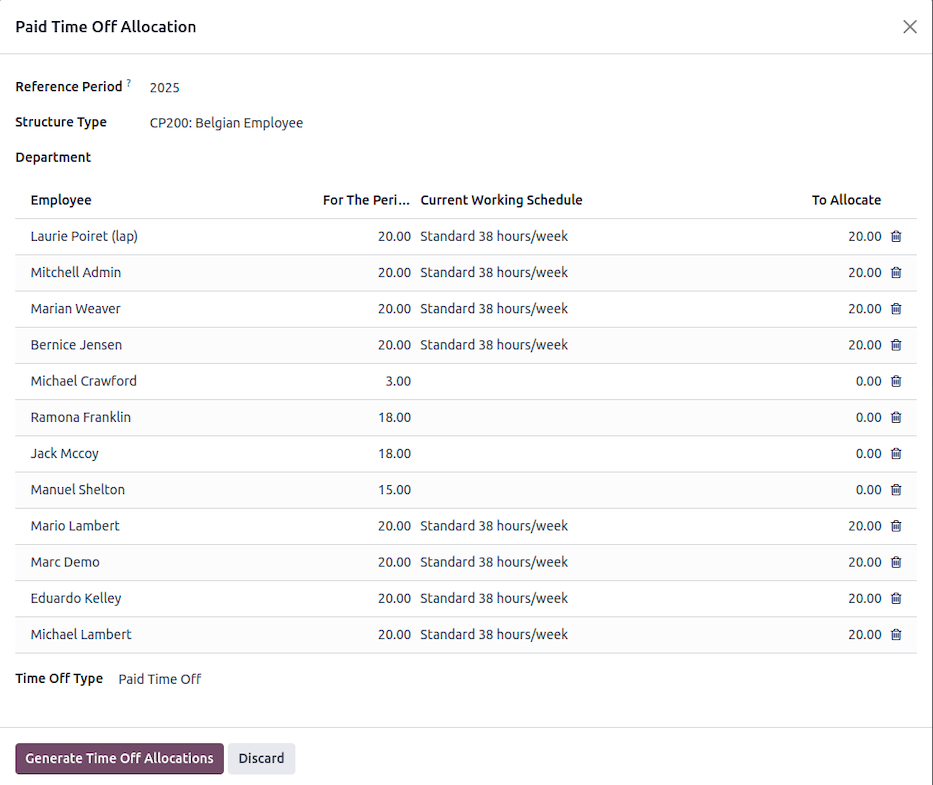

This is possible to generate the legal time off for all your employees at the beginning of a new year using the wizard in .

Based on your employees occupation over last year, the number of available time off is pre-computed for each employee.

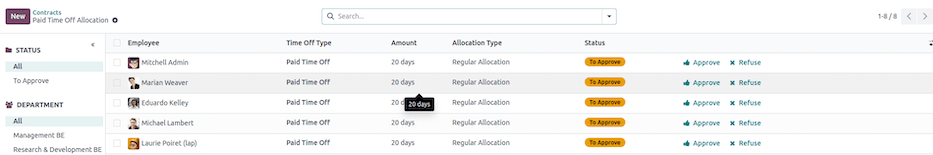

Once validated, a draft allocation is generated for each single employee, waiting a manual confirmation that can be done in batch.

European time off¶

工作原理是什么?¶

If you were not subject to Belgian ONSS contributions before joining our company and do not have entitlement to legal holidays, or if your entitlement is incomplete, you can apply for European leave.

To qualify for European leave in a given year, you must work for at least 3 months during that year, whether with us or another employer. Once you have met this requirement, you will earn 5 days of European leave. Subsequently, you will accumulate additional days of vacation each month as follows:

After 3 months: 5 days

After 4 months: 7 days

After 5 months: 9 days

After 6 months: 10 days

After 7 months: 12 days

After 8 months: 14 days

After 9 months: 15 days

After 10 months: 17 days

After 11 months: 19 days

重要

The total of legal leave and European leave cannot exceed 20 days per year. You must use all your legal holidays before taking European leave.

European leave entitlement expires on December 31st of the year it is earned and cannot be carried over to the following year. To qualify for European leave in a new year, you must complete another 3 months of work.

How are these days paid?¶

European leaves are paid holidays taken in advance of your “Double Holiday Pay” (the June extra pay) for the following year. Essentially, the more European leave days you take in a given year, the less you will receive as June extra pay in the following year.

Working schedule change¶

This guide explains how to modify an employee’s working time schedule in the Belgian payroll module of Odoo. Changing an employee’s working hours affects their wage calculation, time-off allocation, and contract terms.

Steps to change an employee’s working schedule¶

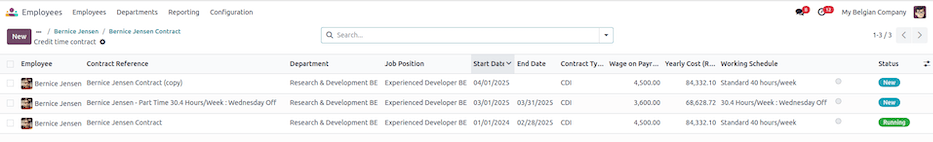

Navigate to the employee’s contract (), and select the contract of the employee whose working schedule you want to modify.

Click on (Action) and select Working Schedule Change. The wizard displays the current contract details and allows you to set new working time parameters.

Set the new working schedule:

Choose the new Working Schedule from the available resource calendars.

Define the Start Date for the change (mandatory).

If applicable, specify an End Date.

If the Part Time checkbox is selected, any difference between the reference calendar and the employee’s new calendar will be covered using the Absence Work Entry Type. This ensures that the employee’s monthly salary remains the same, regardless of the number of absence days in a given month. This setup is required for configuring Time Credit, Parental Leave, or Medical Half-Time correctly.

Adjust the employee’s wage:

The wizard automatically computes the full-time equivalent wage based on the new working schedule.

You can review and modify the new wage if necessary.

Manage time off allocation:

Select the relevant Time Off Type.

Odoo automatically adjusts the employee’s time-off entitlement based on the new working schedule using the following formula:

\[\text{New Time Off Allocation} = \max(\min(\text{ Computed Allocation}, \text{ Max Allocation}) + \text{ Leaves Taken}, \text{ Leaves Taken})\]Computed Allocation is the expected leave allocation based on the new schedule.

Max Allocation is the maximum number of days allowed under the new working time.

Leaves Taken ensures the employee does not receive fewer days than already used.

Decide on a follow-up contract

If the working time change is temporary, you can enable Post Change Contract Creation to automatically create a contract that resumes the previous working schedule after the specified end date.

Validate the changes

Click Validate to apply the new working schedule.

If the new schedule is the same as the current one, an error will be displayed.

The system will create a new contract with the updated working time and wage.

If a previous contract existed, it will be closed with an end date before the new contract begins.

结果¶

The employee’s new working schedule is recorded.

Wage and time-off entitlements are adjusted accordingly.

A follow-up contract is created if applicable.

Work entries exports¶

What are work entries?¶

In the context of payroll, work entries typically refer to records or documentation related to an employee’s work hours and earnings for a specific pay period. These entries are crucial for accurately calculating and processing employee compensation.

Work entries in the context of payroll are essential for both employees and employers. They provide a transparent and accurate record of an employee’s compensation and deductions, ensuring that employees are paid correctly and that tax and legal requirements are met. Payroll software and systems are commonly used to manage and automate these work entries, making the payroll process more efficient and accurate.

Main concepts¶

通用¶

In Odoo, work entries mainly refer to time entries (attendance tracking), these are work entries that consist of time records, which include the number of hours worked by an employee during a given pay period. These entries may specify regular working hours, overtime hours, and any other relevant time-related information, such as breaks, paid time off, unpaid time off, parental leave, credit-time, etc.

Work entries serve a dual role in payroll management. First, they enable organizations to independently compute employee payslips. Second, they facilitate the transmission of pertinent data to external payroll service providers, who then use this information to calculate and generate the payslips.

工作条目¶

They have a Name: used to identify the type of entry (e.g., Attendance, Paid Time Off, etc.).

They have a Payroll Code: used in Odoo’s salary rules computations

They have an External Code: used to provide the correct Work Entry code to an external payroll service provider.

They are generated based on the configuration of the contract and the time off types

They have a duration, a start and end date, a state and are always linked to an employee.

工作条目类型¶

They are the main source of configuration for your work entries. Thanks to your different types of work entries, you’ll be able to differentiate the time records of your employees.

They have a name.

They contain a code, external code, payroll code and a color for visual tracking.

They allow other types of configurations such as how they are displayed in payslips, decide whether this type of work entry should be considered as paid or unpaid (eg. unpaid leave), decide whether this type of work entry has a link with time off, is valid for some advantages or how it should be reflected in your reporting.

休假类型¶

As mentioned above, since work entry types can be linked to a time off type, you are also able to define the work entry type for each time-off type. On the time off type you have a many2one relation with the work entry type.

Steps to generate the work entries of your staff¶

Create all the employees

Create a contract and set its status to Running for each employee.

In the contract, choose the Work Entry Source. It tells the system how work entries for an employee should be generated. It can be based on:

Working Schedule: Odoo uses the predefined working hours and days set in the employee’s working schedule to generate work entries. This is useful for regular, predictable shifts.

Attendances: Work entries are generated from the employee’s attendance records (i.e., when they check-in and check-out).

Planning: Work entries are created based on the validated shifts or slots allocated to the employee in the Planning app (often used for scheduling roles like retail shifts, restaurants, etc.).

Generate the work entries each month

Odoo automatically creates the work entries in the Payroll app based on the work entry source of the contract and the different time-offs taken. You can edit the work entries manually. You can always decide to regenerate work entries manually but be careful if you already made some manual changes, Odoo will regenerate the work entries based on what it knows (e.g., your working schedule and time off).

Managing conflicts