澳大利亚¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2 and SuperStream. An announcement will be made as soon as companies can use Odoo for payroll as a one-stop platform.

Setting up employees¶

Employee settings¶

Create an employee by going to . Go to the Settings tab, and configure the Australian Payroll section, for example checking if they are Non-resident, if they benefit from the Tax-free Threshold, their TFN Status, Employee Type, etc.

Employee private information¶

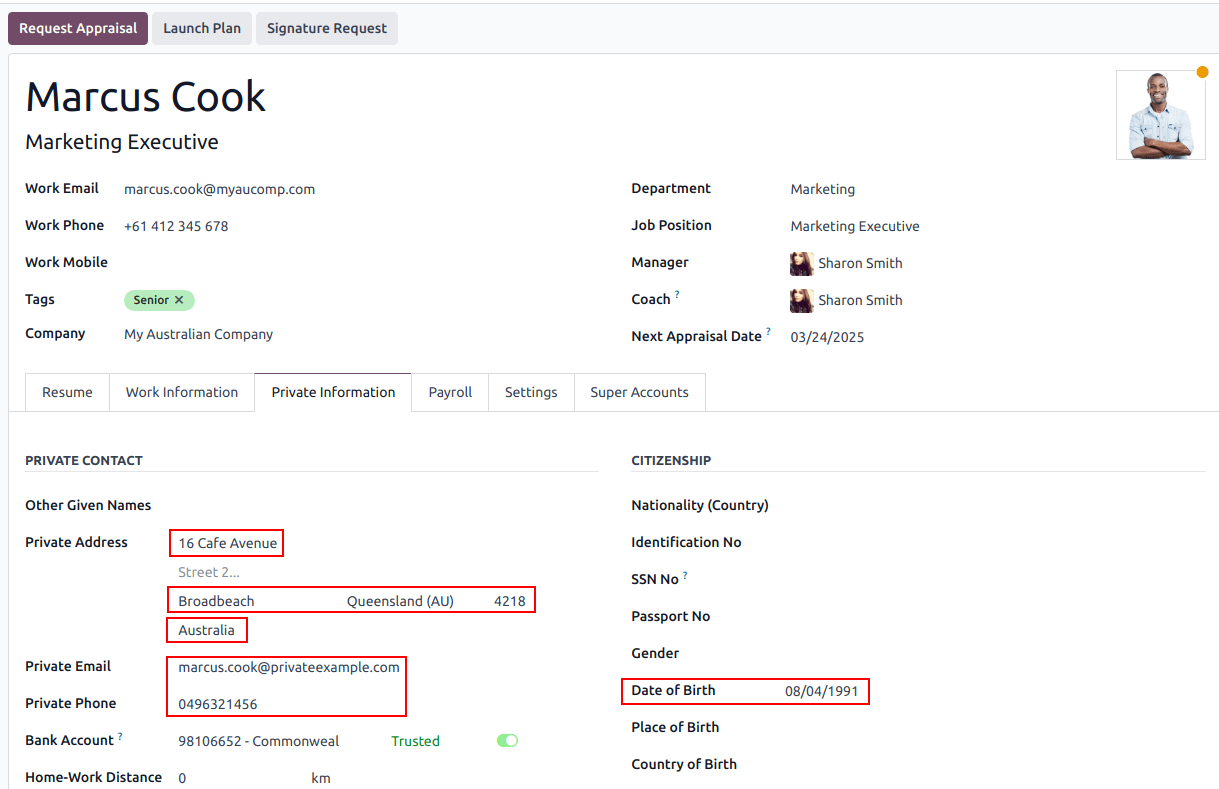

In addition, some personal employee information is required for payroll compliance with Single Touch Payroll, and to process superannuation payments. Open the employee’s Private Information tab and fill in the following fields:

Private Address

Private Email

Private Phone

Date of Birth

注解

Odoo will remind you to complete the required data at different stages of the process.

Super accounts and funds¶

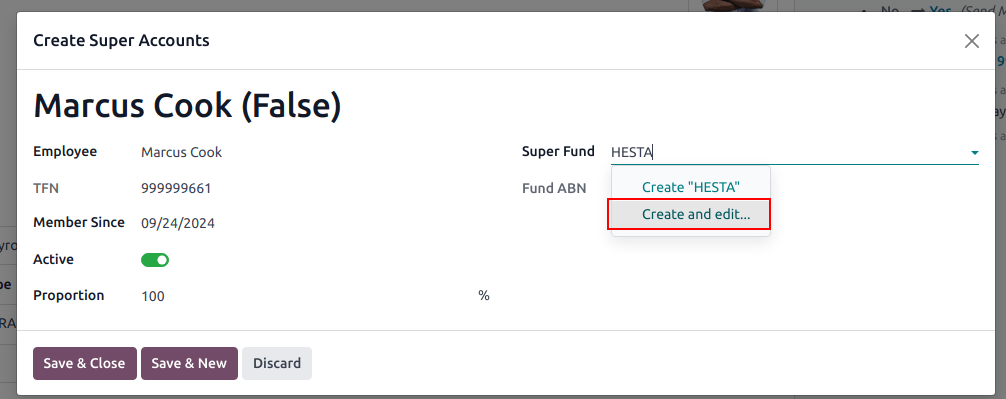

You can add the superannuation details of new employees under the employee’s Super Accounts tab. Click Add a line and make sure to include the Member Since date, Member Number, and Super Fund.

小技巧

Use the Proportion field if an employee’s contributions should sent to multiple funds at a time.

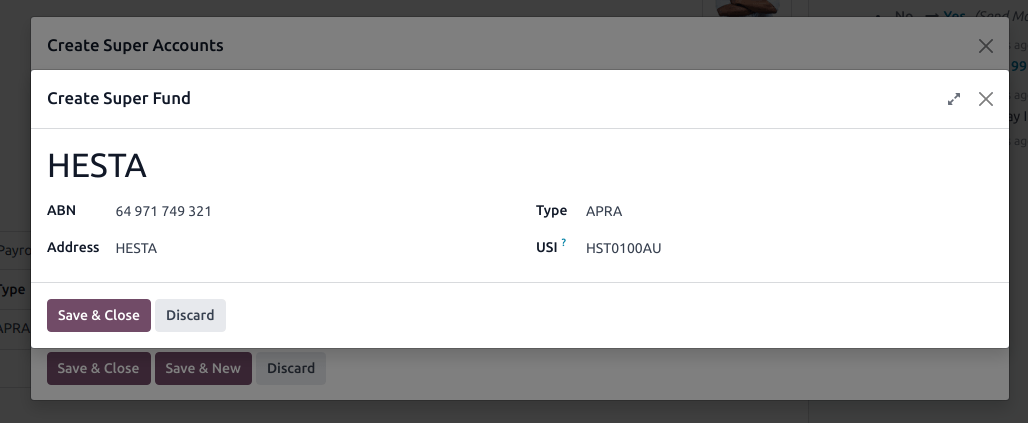

To create a new Super Fund, start typing its name and click Create and edit…. Fill in its:

地址

ABN

Type (APRA / SMSF)

unique identifier (USI for APRA, ESA for SMSF)

(for SMFS only) Bank Account

小技巧

Manage all super accounts and funds by going to or .

重要

Odoo is currently in the process of becoming SuperStream-compliant.

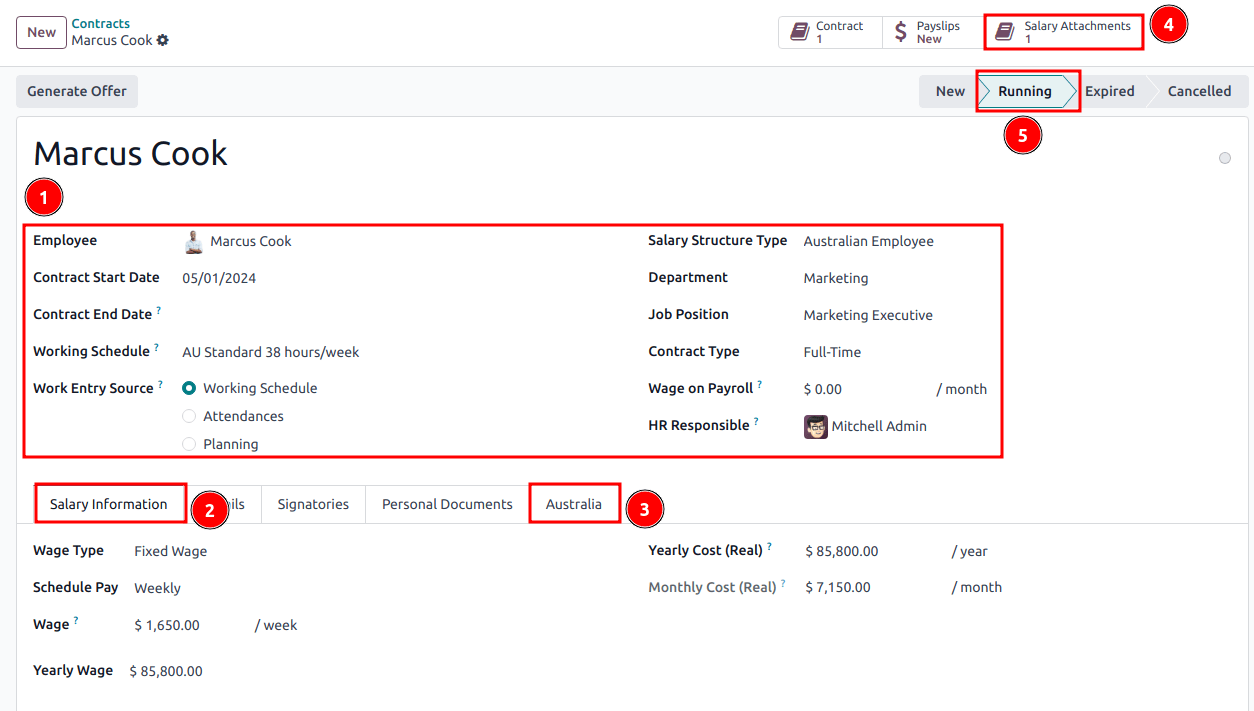

合同¶

Once the employee has been created, create their employment contract by clicking the Contracts smart button, or by going to .

注解

Only one contract can be active per employee at a time. However, an employee can be assigned consecutive contracts during their employment.

Employment contract creation: recommended steps¶

1. Basic contractual information¶

Select the Contract Start Date and Working Schedule (set, or flexible for casual workers).

Keep the Salary Structure Type set to Australian Employee. This structure covers all of the ATO’s tax schedules.

(if using the Attendances or Planning app) Select the Work Entry Source to define how working hours and days are accounted for on the employee’s payslip.

Working Schedule: work entries are automatically generated based on the employee’s working schedule, starting from the contract’s start date.

Example

An employee works 38 hours a week, their contract begins on 01/01, today’s date is 16/01, and the user generates a pay run from 14/01 to 20/01. The working hours on the payslip will be automatically calculated to be 38 hours (5 * 7.36 hours) if no unpaid leave is taken.

Attendances: the working schedule is ignored, and work entries are only generated after clocking in and out of the Attendances app. Note that attendances can be imported.

Planning: the working schedule is ignored, and work entries are generated from planning shifts in the Planning app.

重要

Timesheets do not impact work entries in Odoo. If you need to import your timesheets in Odoo, import them by going to instead.

2. Salary Information tab¶

Wage Type: select Fixed Wage for full-time and part-time employees, and Hourly Wage for casual workers. The latter allows you to add a Casual Loading percentage.

注解

For hourly workers, the Hourly Wage field should exclude casual loading.

Schedule Pay: in Australia, only the following pay run frequencies are accepted: Daily, Weekly, Bi-weekly (or fortnightly), Monthly, and Quarterly.

Wage /period: assign a wage to the contract according to their pay frequency. On payslips, the corresponding annual and hourly rates will be computed automatically.

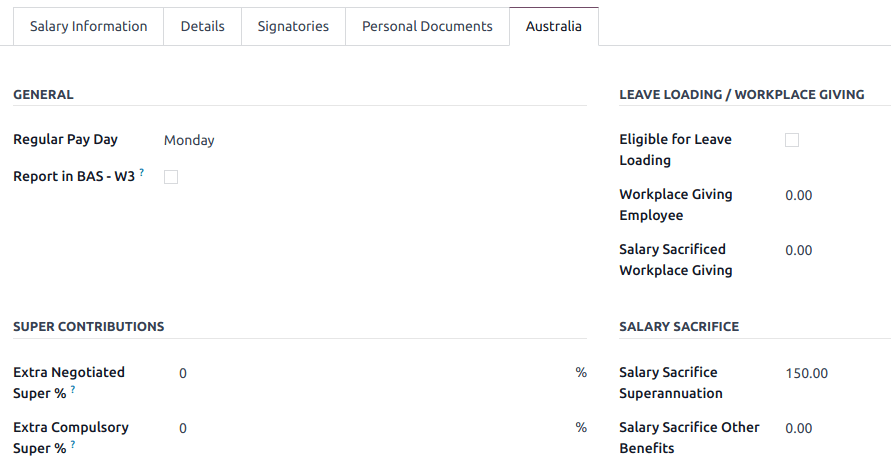

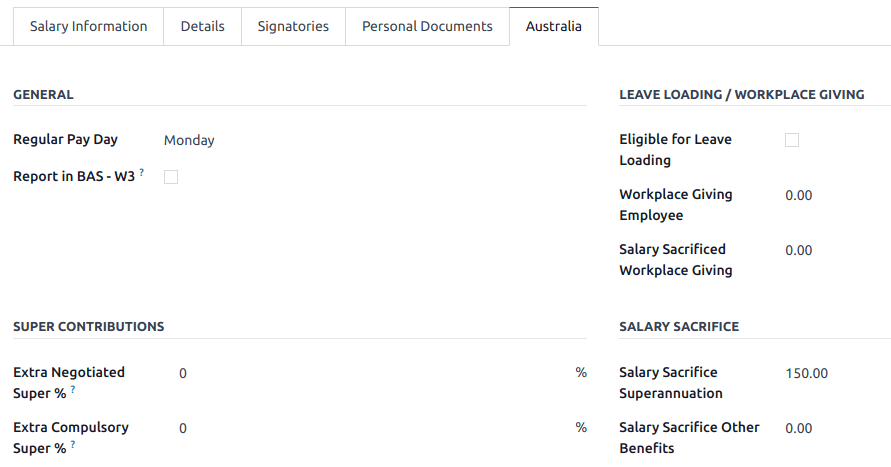

3. Australia tab¶

通用

Add the Regular Pay Day if relevant.

Enable Report in BAS - W3 if you choose to add PAYG withholding amounts in BAS section W3 instead of W2 (refer to the ATO’s web page on PAYG withholding for more information).

Leave loading / workplace giving

Define whether your employees are Eligible for Leave Loading.

Set the Workplace Giving Employee amount in exchange for deductions.

Set the Salary Sacrificed Workplace Giving amount (e.g., receiving a benefit instead of a deduction).

Super contributions

Add the Extra Negotiated Super % on top of the super guarantee.

Add the Extra Compulsory Super % as per industrial agreements or awards obligations.

Salary sacrifice

Salary Sacrifice Superannuation allows employees to sacrifice part of their salary in favor of reportable employer superannuation contributions (RESC).

Salary Sacrifice Other Benefits allows them to sacrifice part of their salary towards some other form of benefit (refer to the ATO’s web page on Salary sacrificing for employees for more information).

注解

As of Odoo 18, salary sacrificing for other benefits currently does not impact fringe benefits tax (FBT) reporting.

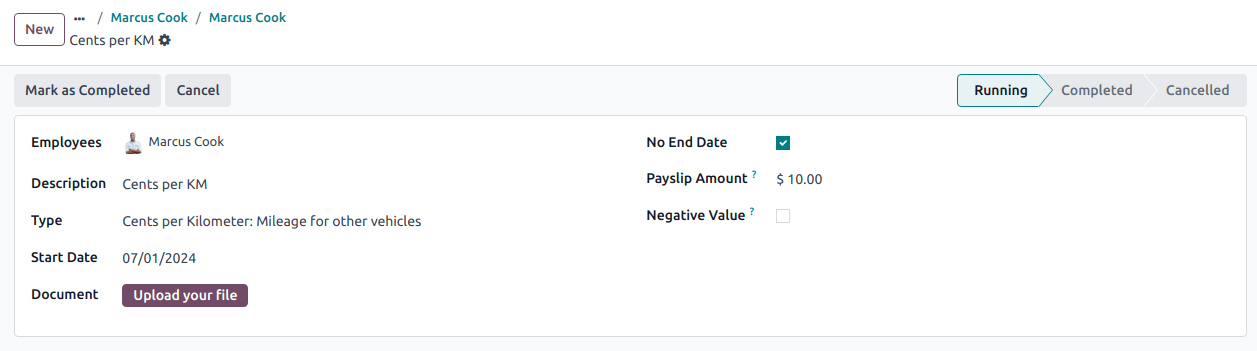

4. Salary attachments¶

If the employee is to receive additional recurring payments every pay run, whether indefinitely or for a set number of periods, click the Salary Attachments smart button on the contract. Choose a Type and a Description.

注解

Around 32 recurring salary attachment types exist for Australia. These are mostly related to allowances and child support. Contact us for more information as to whether allowances from your industry can be covered.

5. Run the contract¶

Once all the information has been completed, change the contract stage from New to Running.

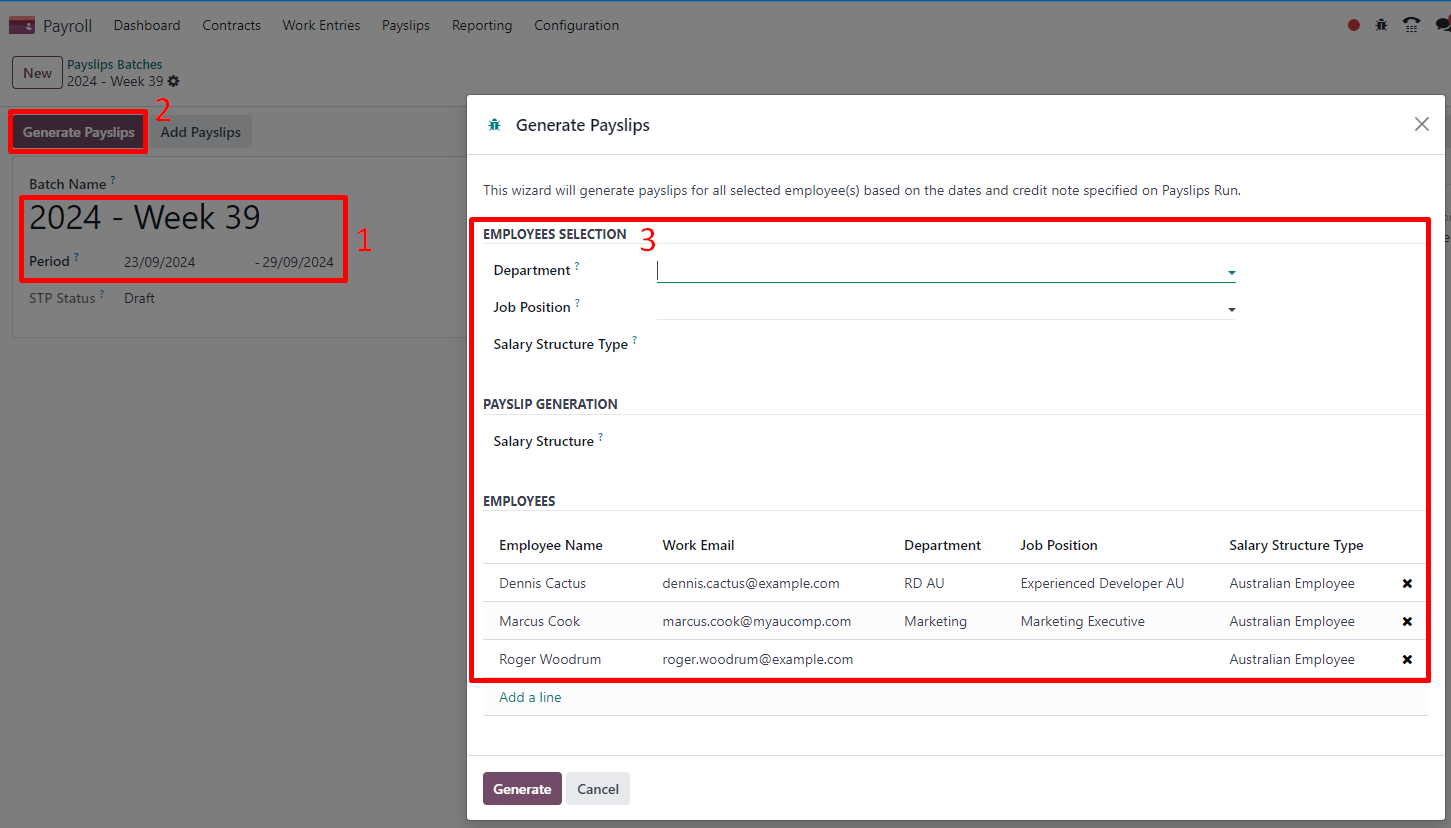

Prepare pay runs¶

常规¶

Pay runs are created by going to . After clicking New, enter a Batch Name, select a Period, and click Generate Payslips.

Employees on a pay run can be filtered down by Department and Job Position. There is no limit to the amount of payslips that can be created in one batch. After clicking Generate, one payslip is created per employee in the Waiting stage, in which they can be reviewed and amended before validation.

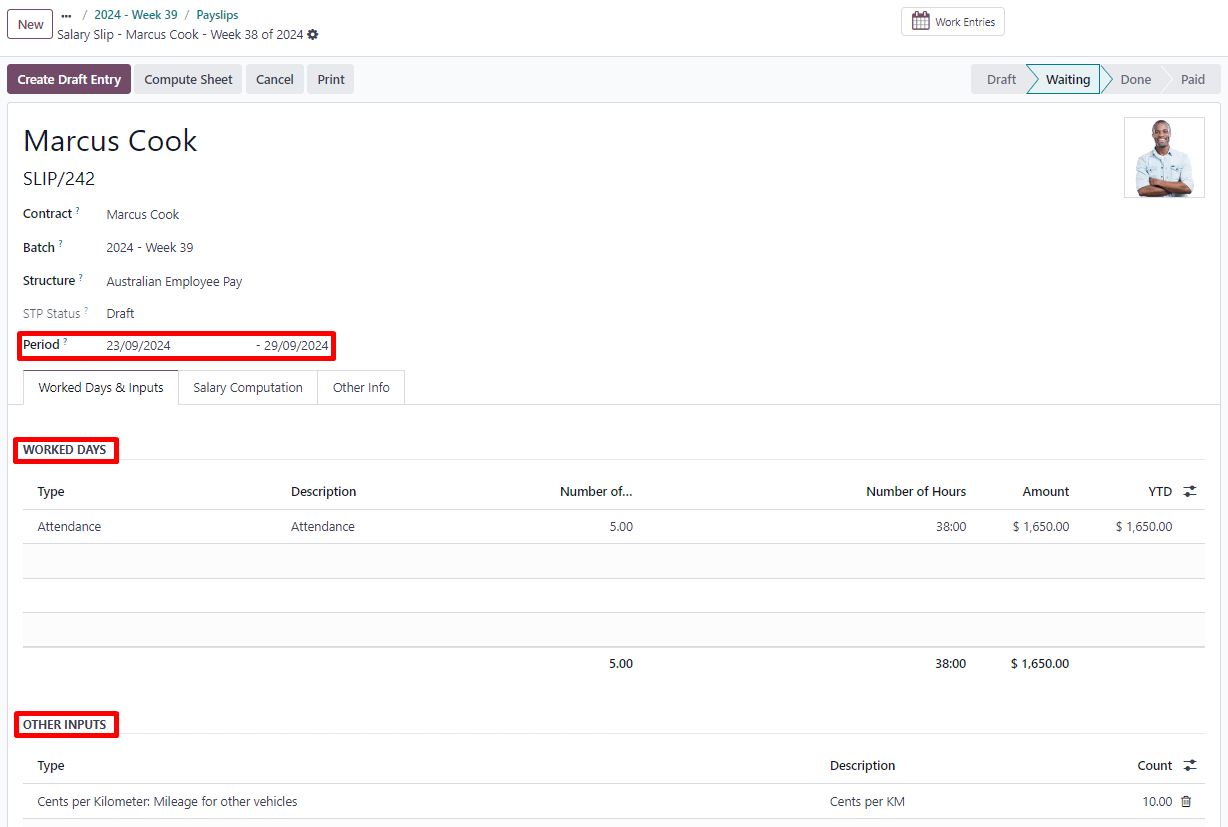

On the payslip form view, there are two types of inputs:

Worked days are computed based on the work entry source set on the employee’s contract. Work entries can be configured according to different types: attendance, overtime, Saturday rate, Sunday rate, public holiday rate, etc.

Other inputs are individual payments or amounts of different types (allowances, lump sums, deductions, termination payments, leaves, etc.) that have little to do with the hours worked during the current pay period. The previously configured salary attachments are simply recurring other inputs attached to a contract.

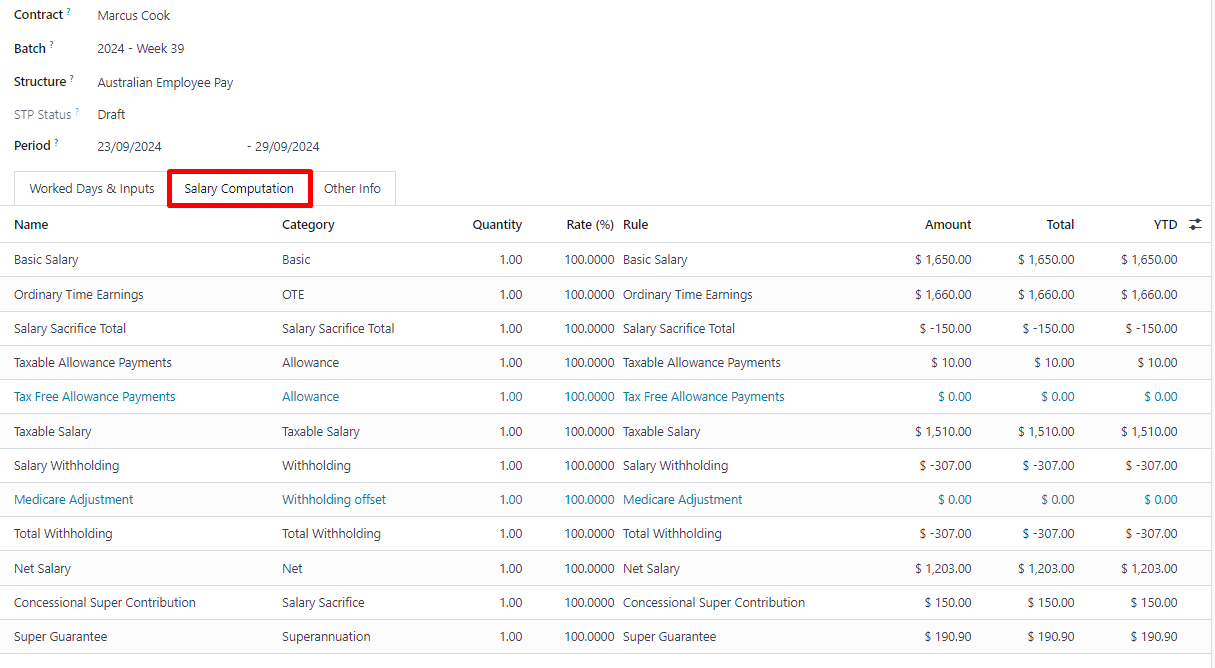

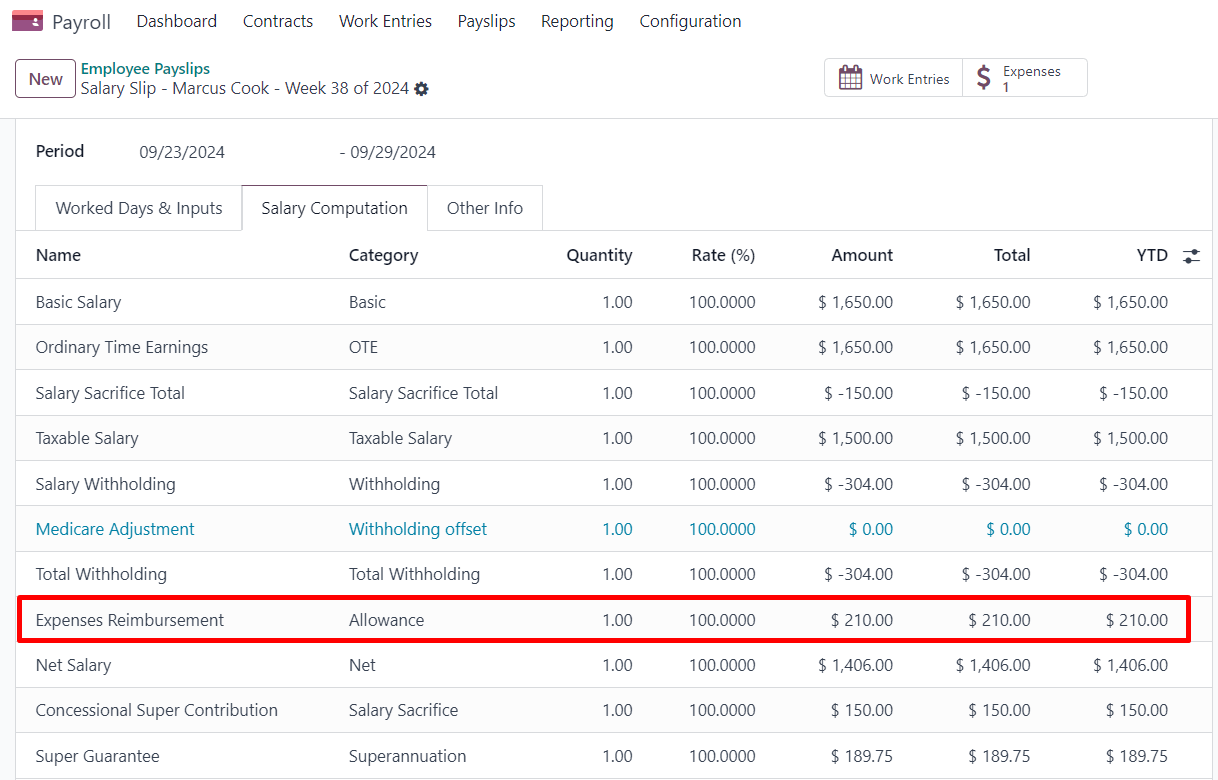

Under the Salary Computation tab, Odoo automatically computes payslip rules based on employees, contracts, worked hours, other input types, and salary attachments.

The salary structure Australian Employee has 35 payslip rules that automatically compute and dynamically display according to the payslip inputs.

Example

The following rules apply for that pay period in the above example:

Basic Salary: pre-sacrifice gross salary

Ordinary Time Earnings: amount to which the super guarantee percentage needs to be applied

Salary Sacrifice Total: includes the $150 sacrificed to superannuation

Taxable Allowance Payments: includes the $10 allowance (cents per KM in this case)

Taxable Salary: gross salary amount minus non-taxable amounts

Salary Withholding and Total Withholding: amounts to be withheld from the taxable salary

Net Salary: the employee’s net wage

Concessional Super Contribution: in this scenario, the amount sacrificed to superannuation, payable to the employee’s super fund in addition to the super guarantee

Super Guarantee: as of 01 July 2024, it is computed as 11.5% of the ordinary time earnings amount

注解

As of Odoo 18, the most recent tax schedule rates (2024-2025) have been updated for all salary rules and computations.

Out-of-cycle¶

In Australia, payslips created without a batch are considered to be out-of-cycle runs. Create them by going to . The same payslip rules apply, but the way these payslips are submitted to the ATO in the frame of Single Touch Payroll (STP) is slightly different.

重要

As of Odoo 18, adding an out-of-cycle payslip to an existing batch is not recommended.

Finalise pay runs¶

Validate payslips¶

Once all payslip data is deemed correct, click Create Draft Entry on the payslip batch. This can also be done payslip by payslip for control reasons.

This has several impacts:

Marking the batch and its payslips as Done.

Creating a draft accounting entry per payslip or one entry for the whole batch, depending on your payroll settings. At this stage, accountants can post entries to affect the balance sheet, P&L report, and BAS report.

Preparing the STP submission (or payroll data to be filed to the ATO as part of STP compliance). This needs to be performed by the STP Responsible user, defined under .

Preparing super contribution lines as part of SuperStream compliance. This needs to be done by the HR Super Send user selected under .

Submit payroll data to the ATO¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2, and this step described above does not submit data yet to the ATO.

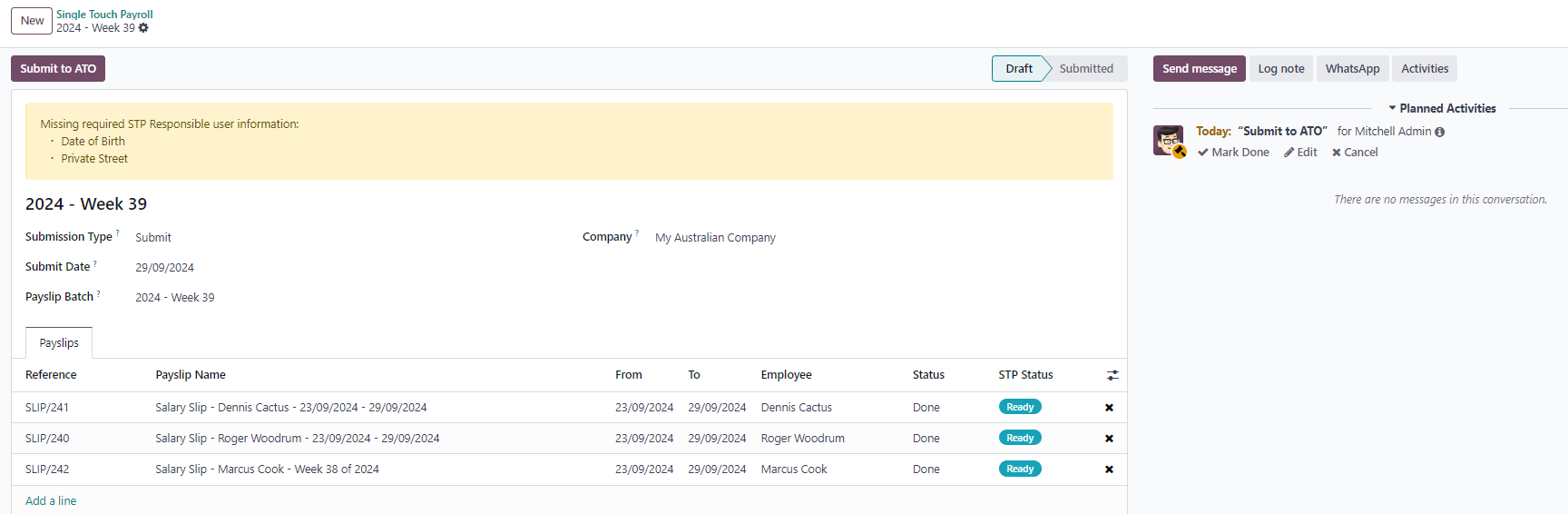

As per ATO requirements, STP submission for a pay run needs to be done on or before the payday. For this reason, submit your STP data to the ATO first before proceeding with payment. To do so, click Submit to ATO on the payslip batch.

On the STP record for this pay run, a few useful information is displayed:

a warning message if important information is missing,

an automatically generated activity for the STP responsible user, and

a summary of payslips contained in this pay run, auditable from this view.

Once the STP record is ready to go, click Submit to ATO, then read and accept the related terms and conditions.

向员工支付薪酬¶

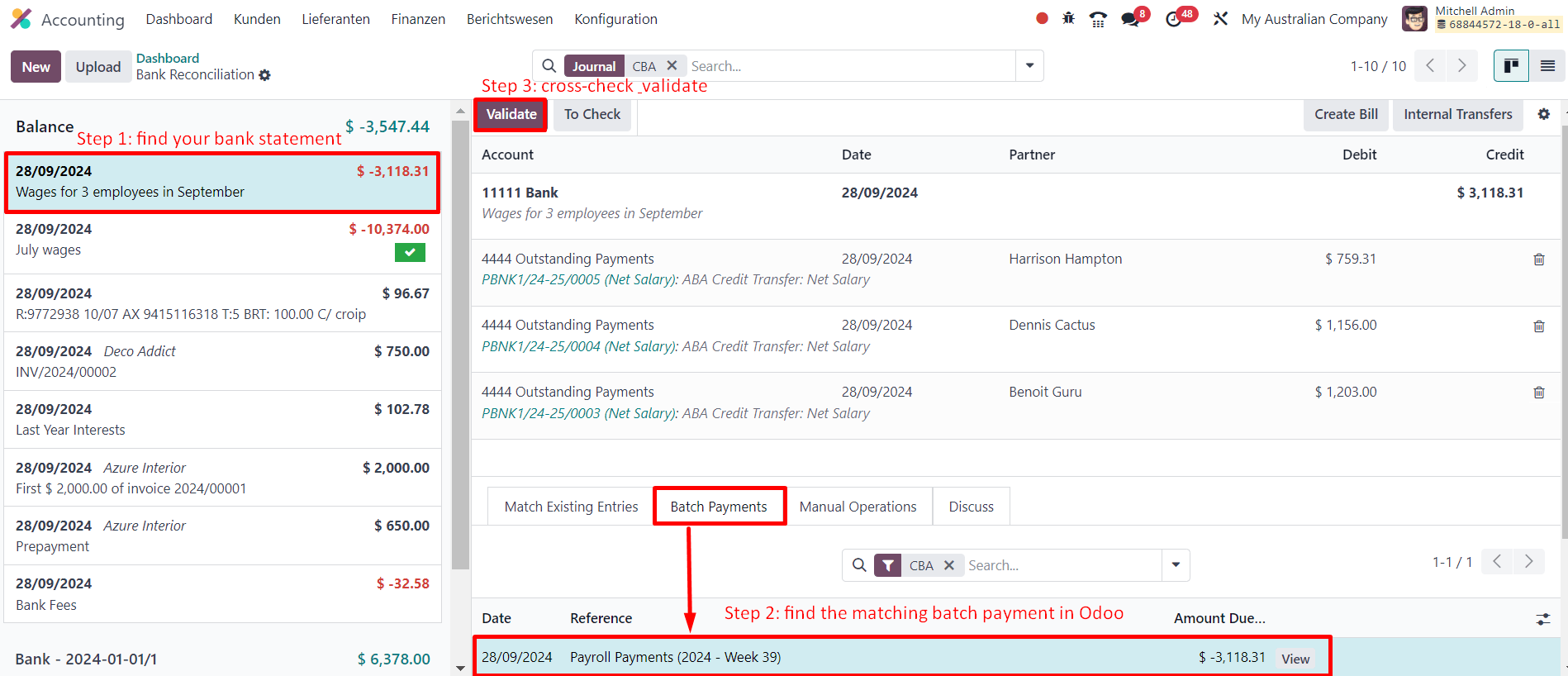

Once the ATO submission is complete, you can proceed to pay your employees. To facilitate the payment matching process, remember to post the payslip-related journal entries prior to validating a payment.

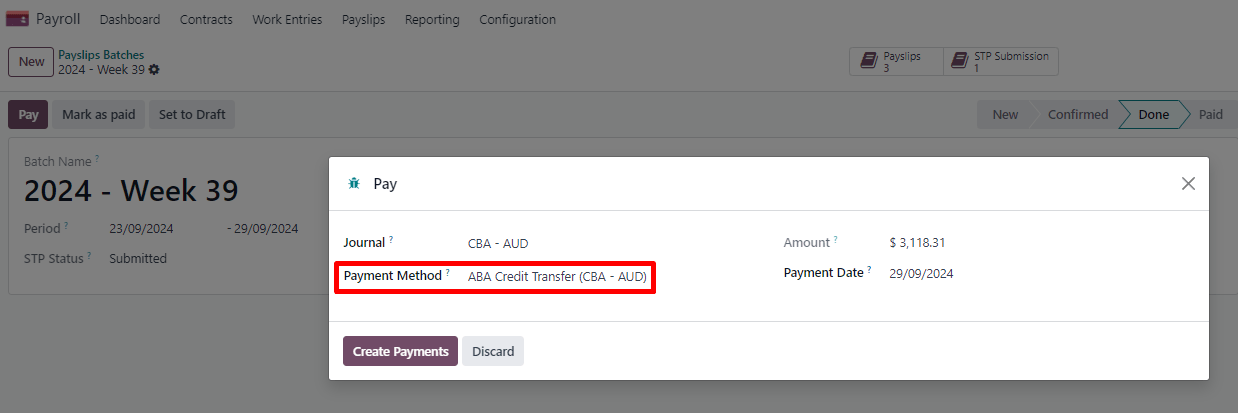

Although you may decide to pay your employees individually, we recommend creating a batch payment from your payslip batch. To do so, click Pay on the payslip batch, and select ABA Credit Transfer as the Payment Method.

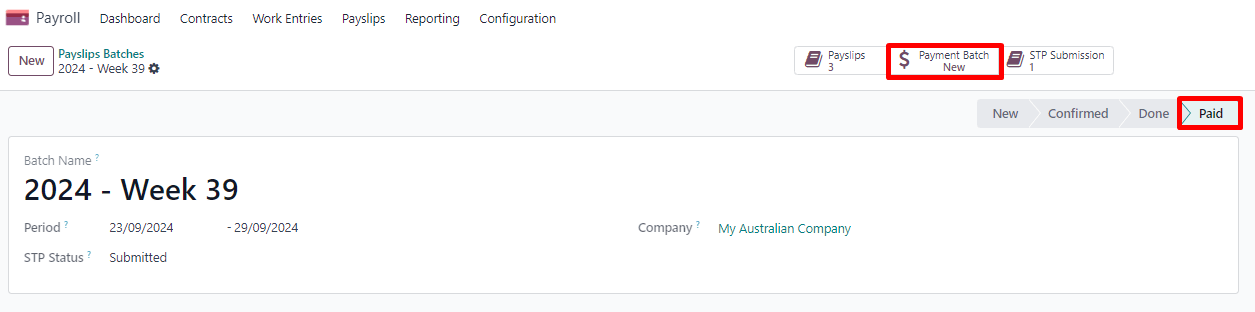

This has two impacts:

Marking the batch and its payslips as Paid.

Creating a Payment Batch linked to the payslip batch.

When receiving the bank statement in Odoo, you can now match the statement line with the batch payment in one click. The payment is not reconciled against the payslip batch, and all individual payslips.

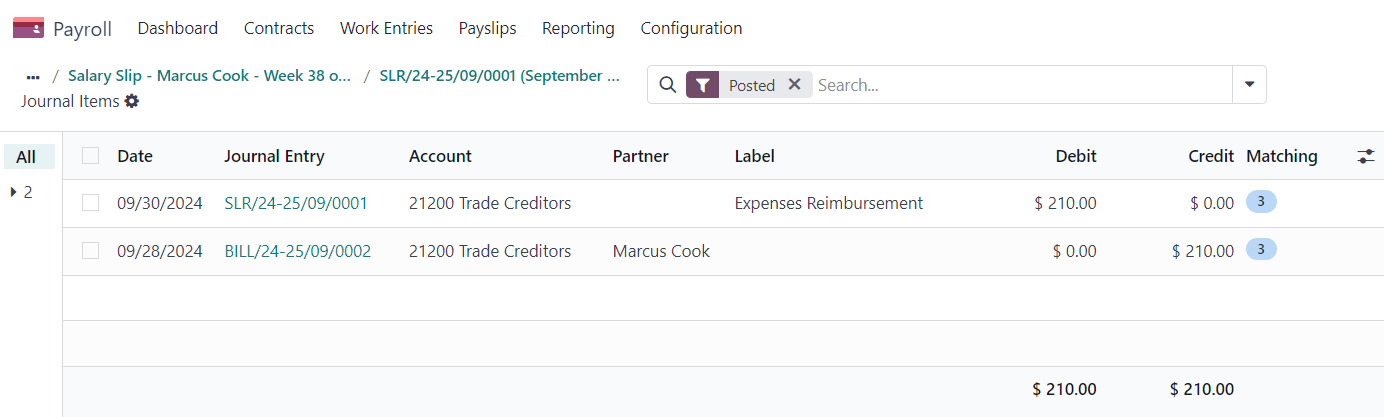

Impact on accounting¶

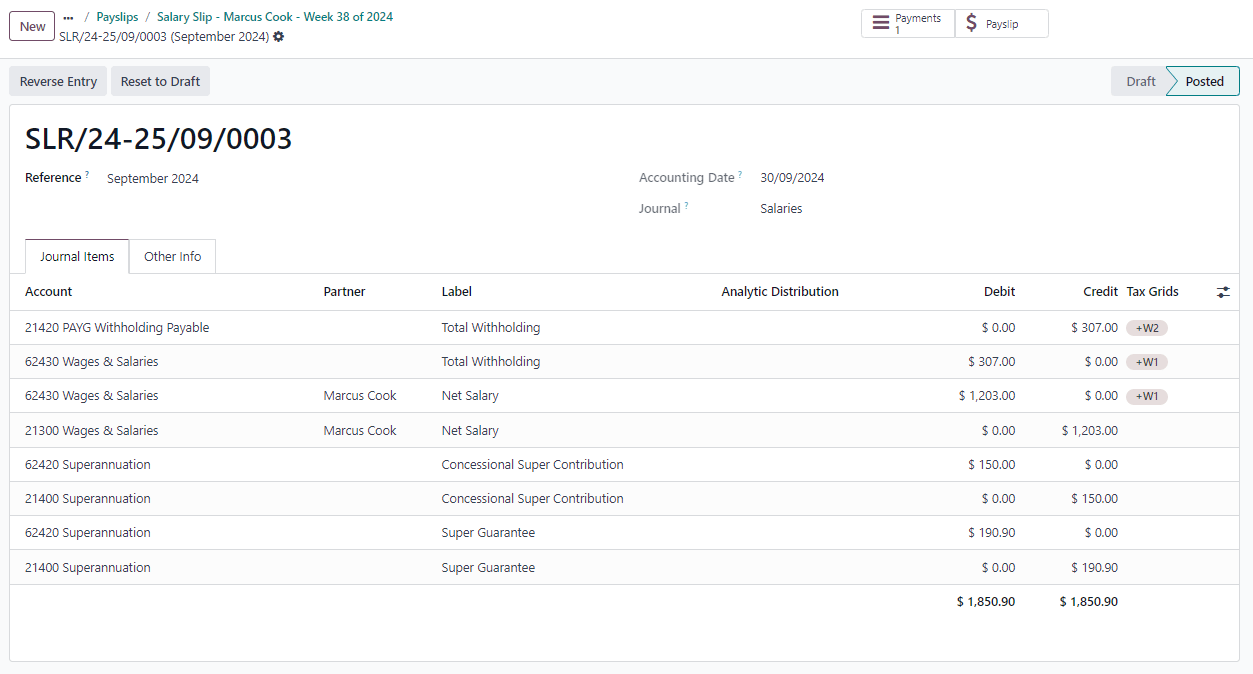

Depending on the employee and contract configuration, the journal entry linked to a payslip will be more or less exhaustive.

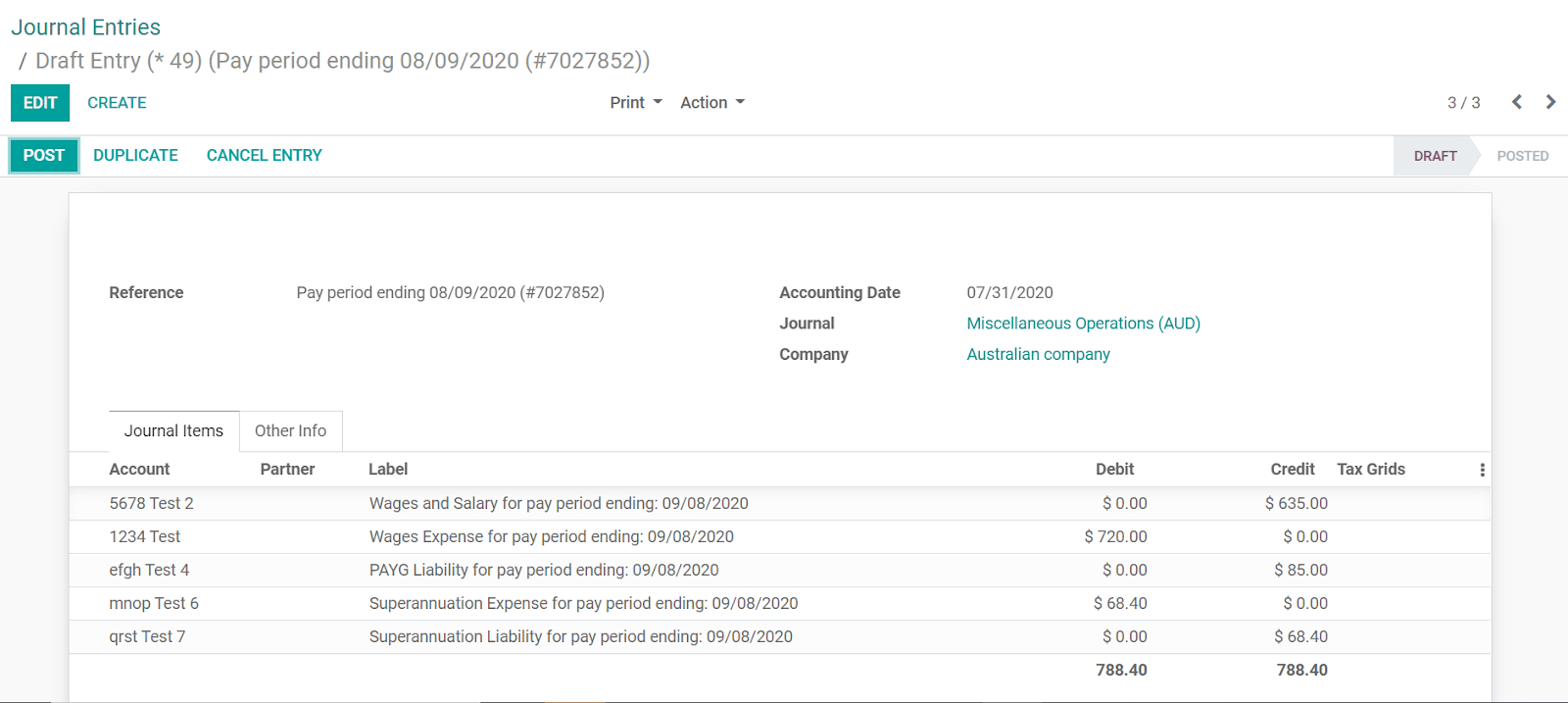

Example

For instance, here is the journal entry generated by the employee Marcus Cook configured above.

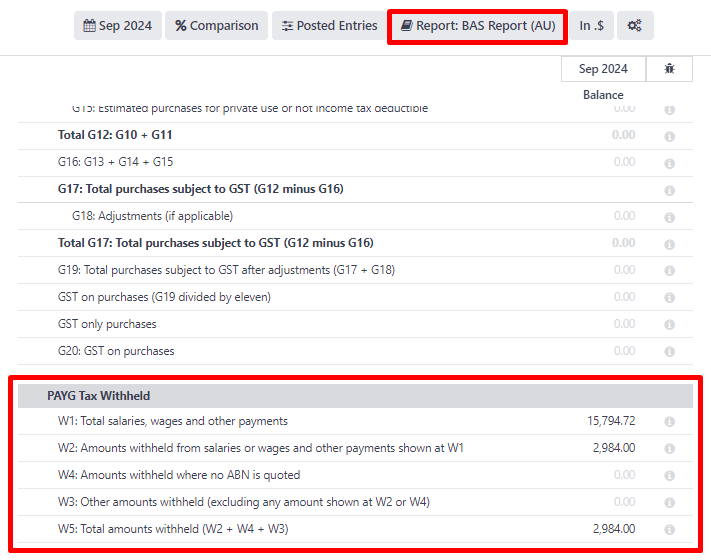

Once posted, predefined accounts will impact the company’s balance sheet (PAYGW, wages, and superannuation liabilities) and profit & loss report (wages and superannuation expenses). In addition, the employee’s gross wage and PAYG withholding will update the BAS report for the relevant period (see Tax Grid: W1 and W2). Accounts can be adjusted to the company’s chart of accounts.

Other payroll flows¶

Paying super contributions¶

重要

Odoo has a partnership with a clearing house to process both superannuation payments and data to the right funds in one click, via direct debit. Odoo is currently in the process of becoming compliant with SuperStream, and an announcement will be made as soon as superannuation contributions can be processed via Odoo’s payroll solution.

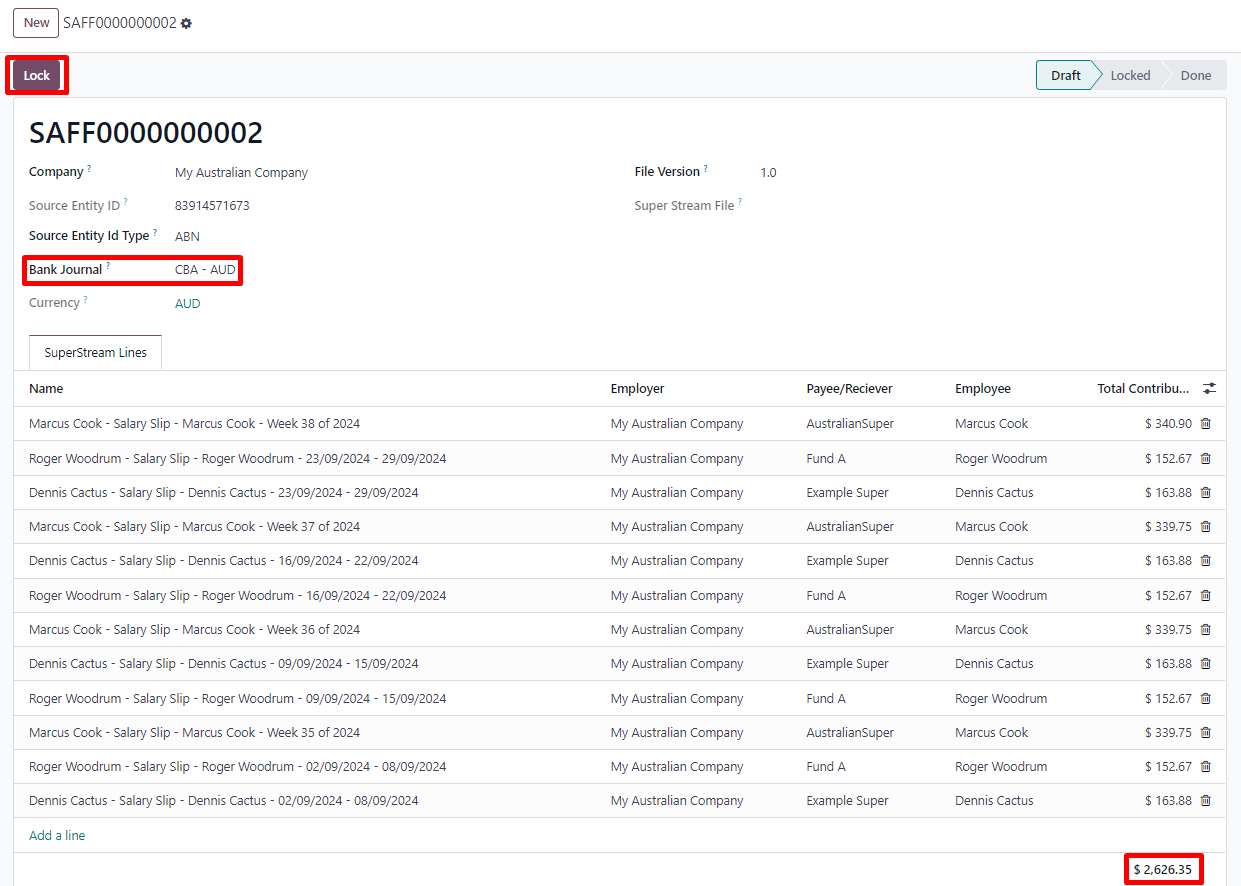

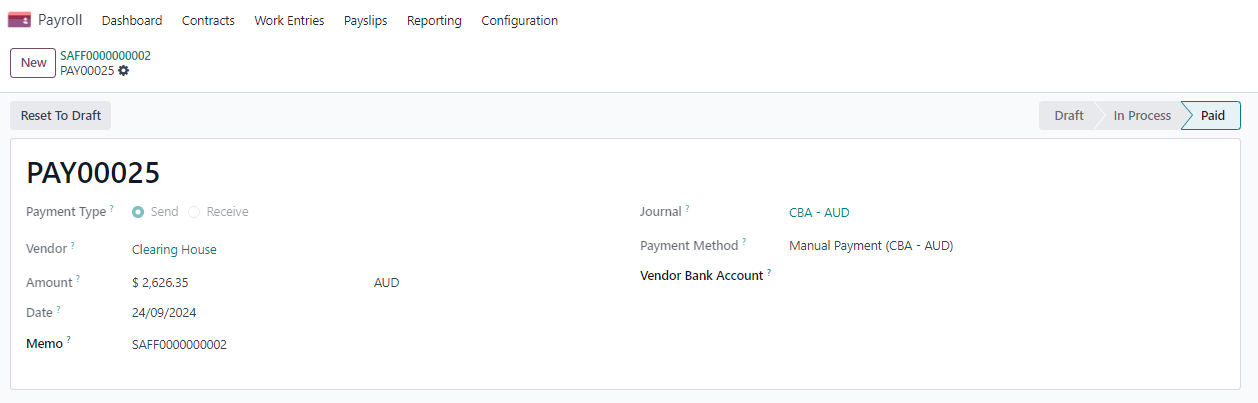

Once a quarter (or more frequently, in preparation for Payday Super), you have to process superannuation payments to your employees’ super funds. To do so, go to .

When ready to pay, add the Bank Journal that will be used to pay the super from, then click Lock to prevent the contributions from subsequent payslips from being added to that file. Instead, a new Super file will be created.

Once the payment has been processed, it can be traced back to the Super file and matched with a bank statement.

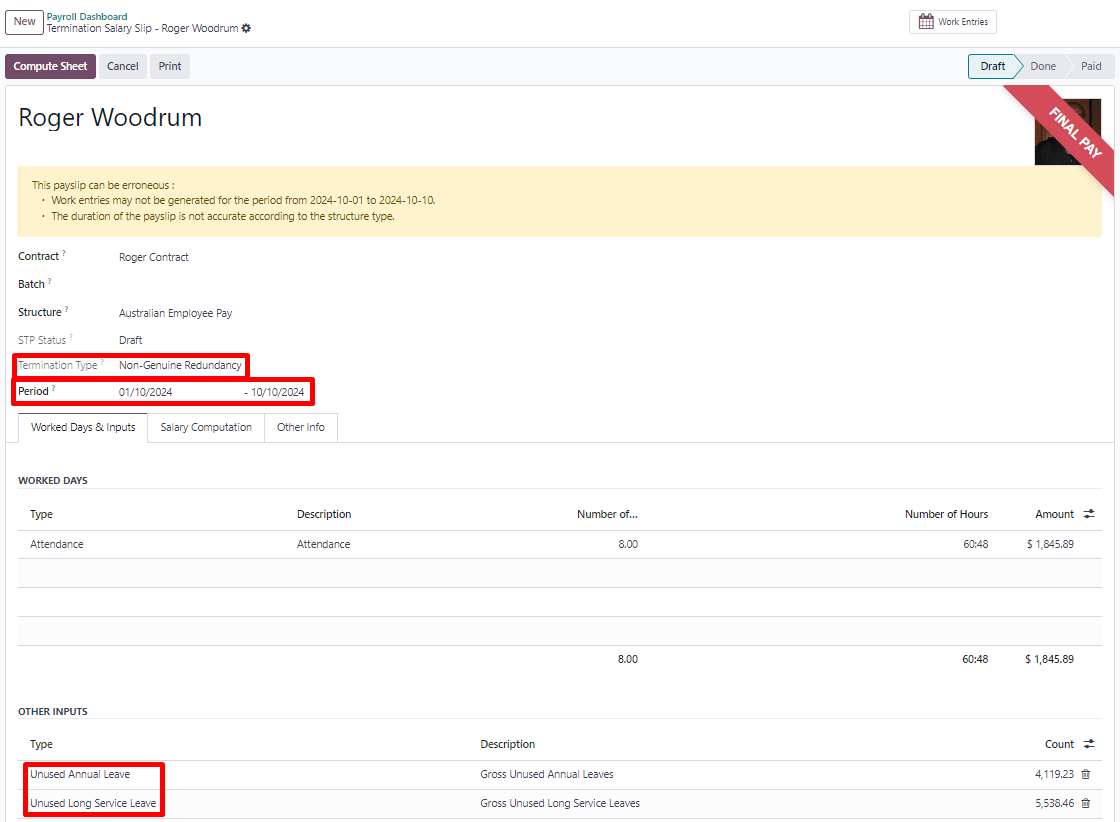

Terminating employees¶

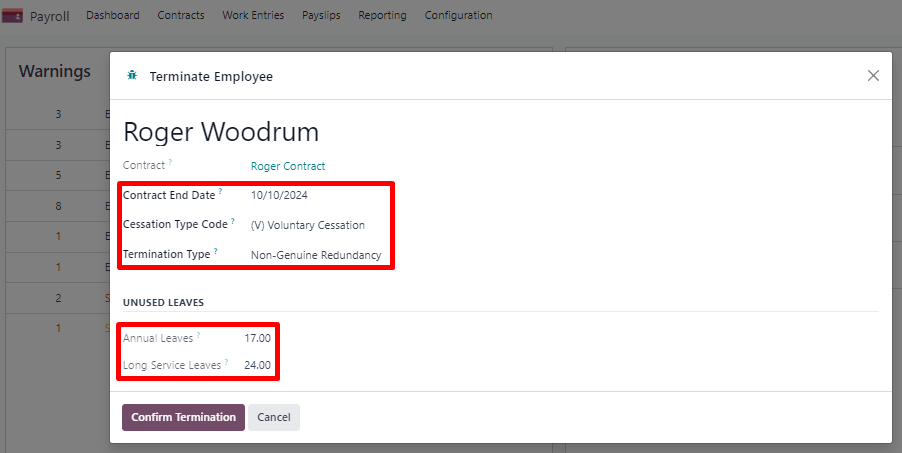

Employees can be terminated by going to .

The following fields must be completed:

Contract End Date: once the termination is validated, this date will be added to the contract automatically, and mark the contract as Expired when the date has been reached.

Cessation Type Code: a mandatory field for the ATO’s STP reporting.

Termination Type: the type of redundancy (genuine or non-genuine) affects the computation of unused annual and long service leave withholding.

The balance of unused annual leaves and long service leaves is displayed for reference.

Confirming the termination creates an out-of-cycle payslip with the tag final pay. It computes the worked days until the contract end date, in addition to the employee’s unused annual and long service leave entitlements.

Odoo automatically computes unused leave entitlements based on the employee’s current hourly rate leave loading (for annual leaves only), and the remaining leave balance. However, these amounts can be manually edited in the Other Inputs table if necessary.

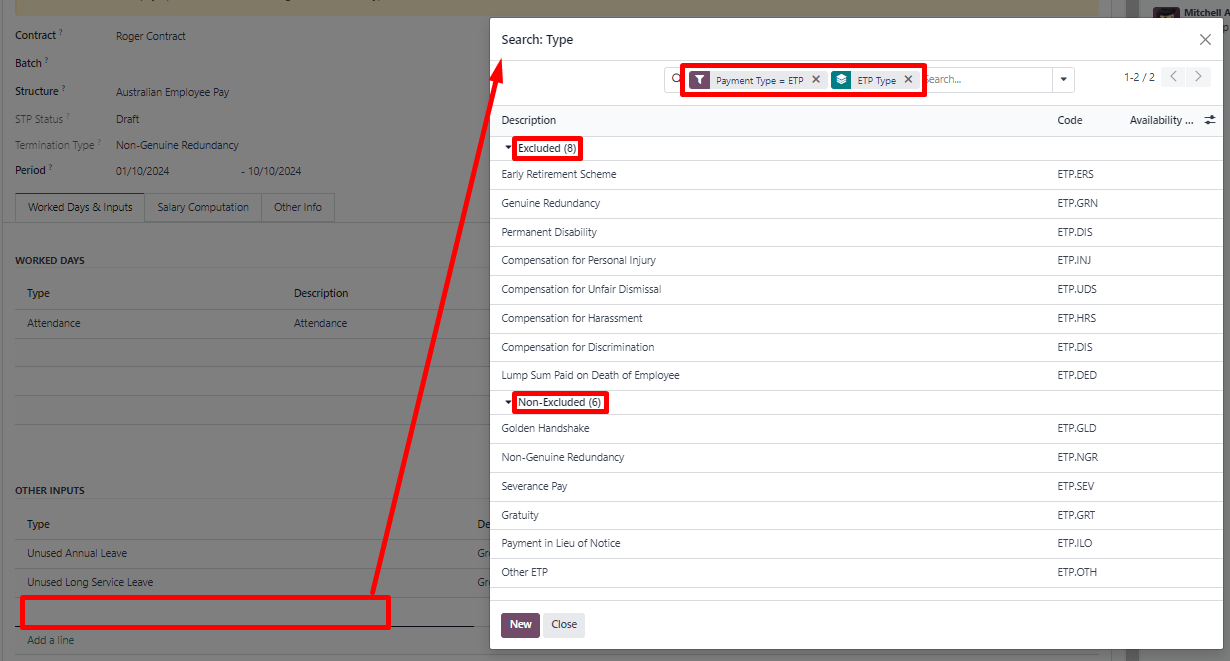

Employment Termination Payments (ETP) can also be added to the Other Inputs table. Odoo has a comprehensive list of excluded and non-excluded ETPs for companies to select from.

注解

Withholding for unused leaves and ETPs is computed according to the ATO’s Schedule 7 and Schedule 11 and updated as of 01 July 2024.

小技巧

Once an employee has been terminated and the last detailed of their employment resolved, you can archive the employee by clicking the (Actions) icon, then Archive on the employee’s form view.

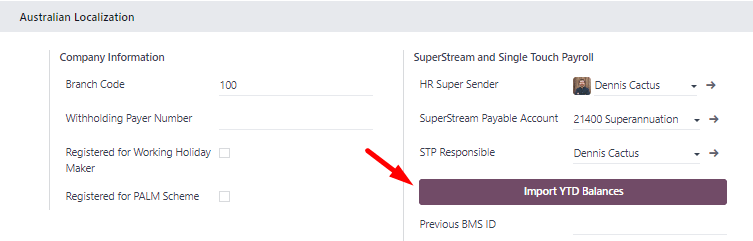

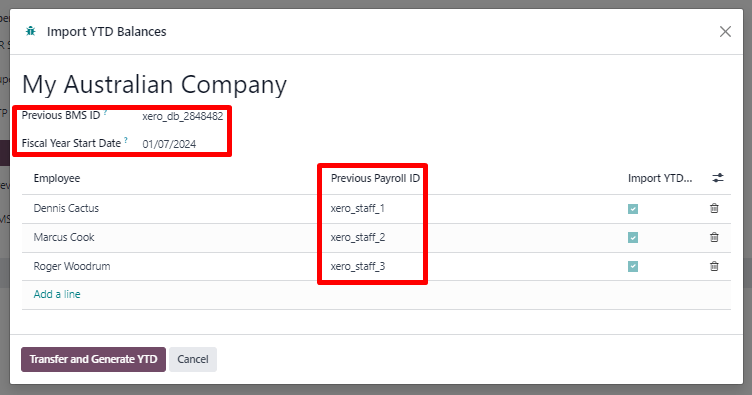

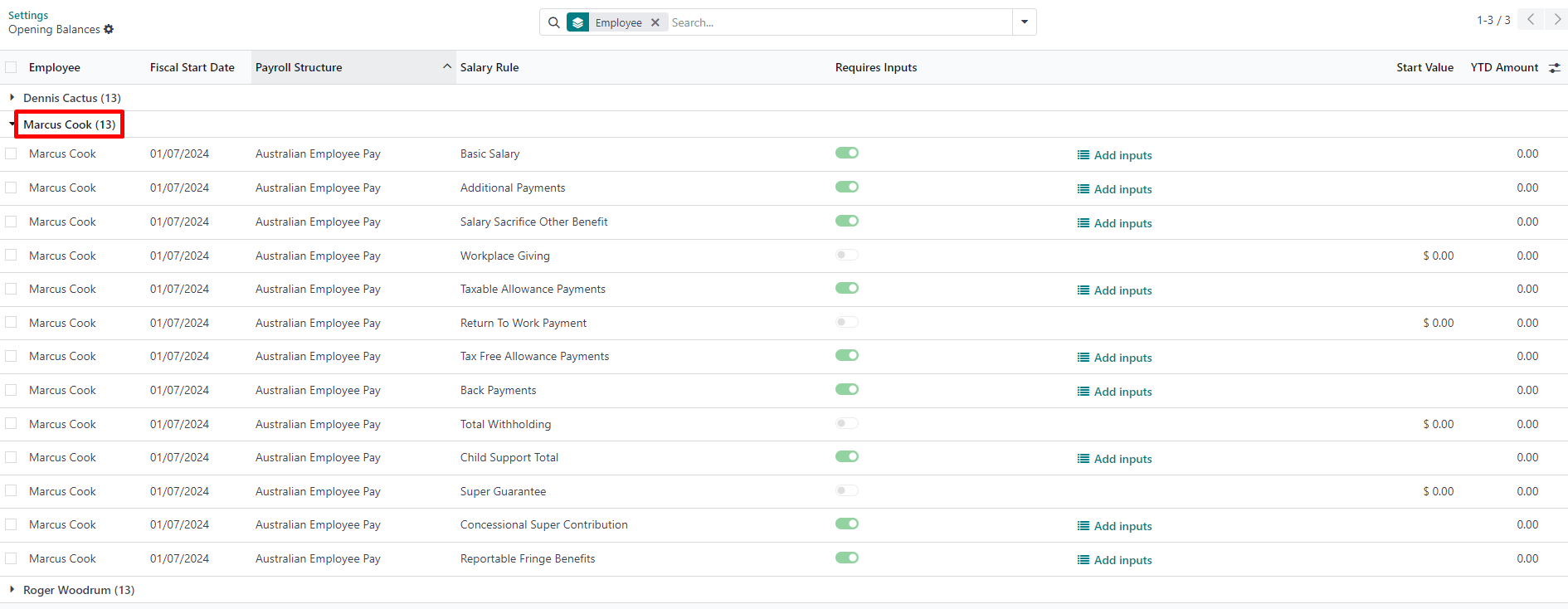

Switching from another STP software to Odoo¶

When switching from another STP-enabled software to Odoo, you might need to maintain the continuity in the YTD values of your employees. Odoo allows importing employees’ YTD values by going to and clicking Import YTD Balances.

For the ATO to recognize the employee records of your previous software and keep a continuity in Odoo, you must enter the:

Previous BMS ID (one per database)

Previous Payroll ID (one per employee)

Ask your previous software provider if you cannot find its BMS ID or your employees’ payroll IDs.

This will give you the opportunity to add your employees’ YTD opening balances in the current fiscal year. The ATO reports on a lot of different types of YTD. These are represented by the 13 following Salary Rules in Odoo.

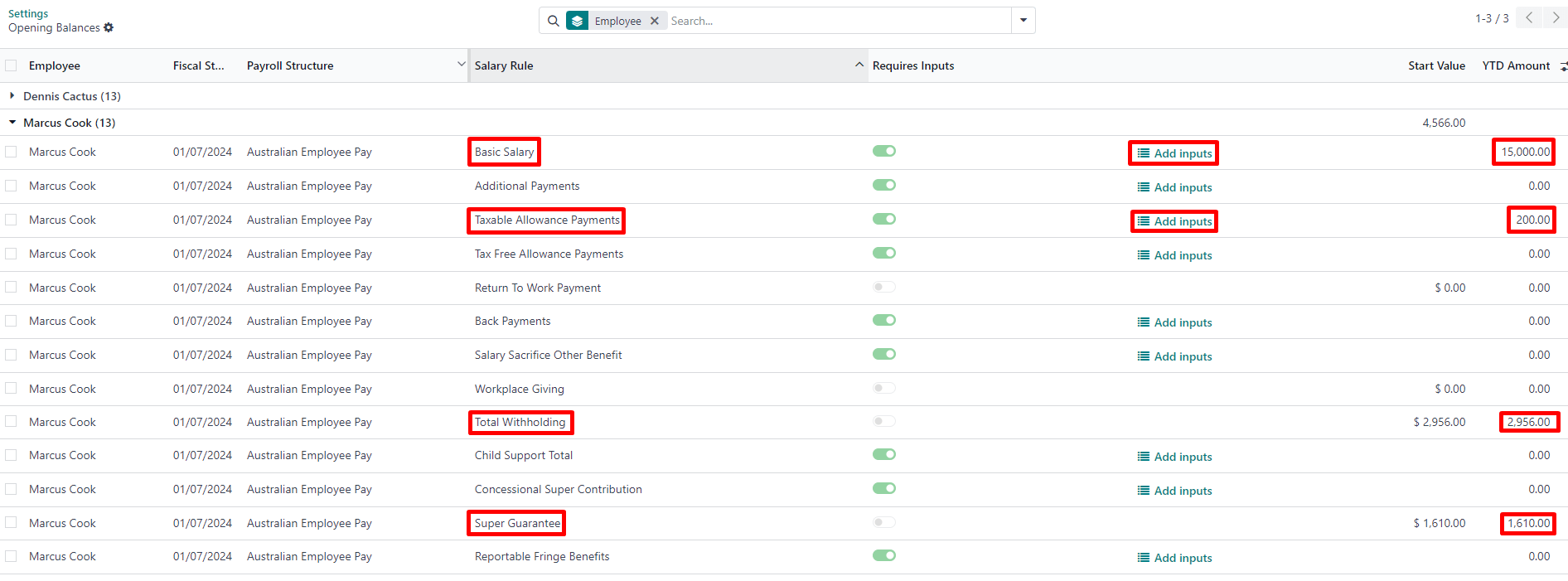

Example

Let us say that the employee Marcus Cook has been transitioned from another STP-enabled software on September 1. Marcus has received two monthly payslips in his previous software (for July and August). Here are the YTD balances Marcus’s company needs to transfer to Odoo:

YTD category |

YTD balance to transfer |

|---|---|

Gross (normal attendance) |

$13,045.45 |

Gross (overtime) |

$1,000 |

Paid leave |

$954.55 |

Laundry allowance |

$200 |

Total withholding |

$2,956 |

Super Guarantee |

$1,610 |

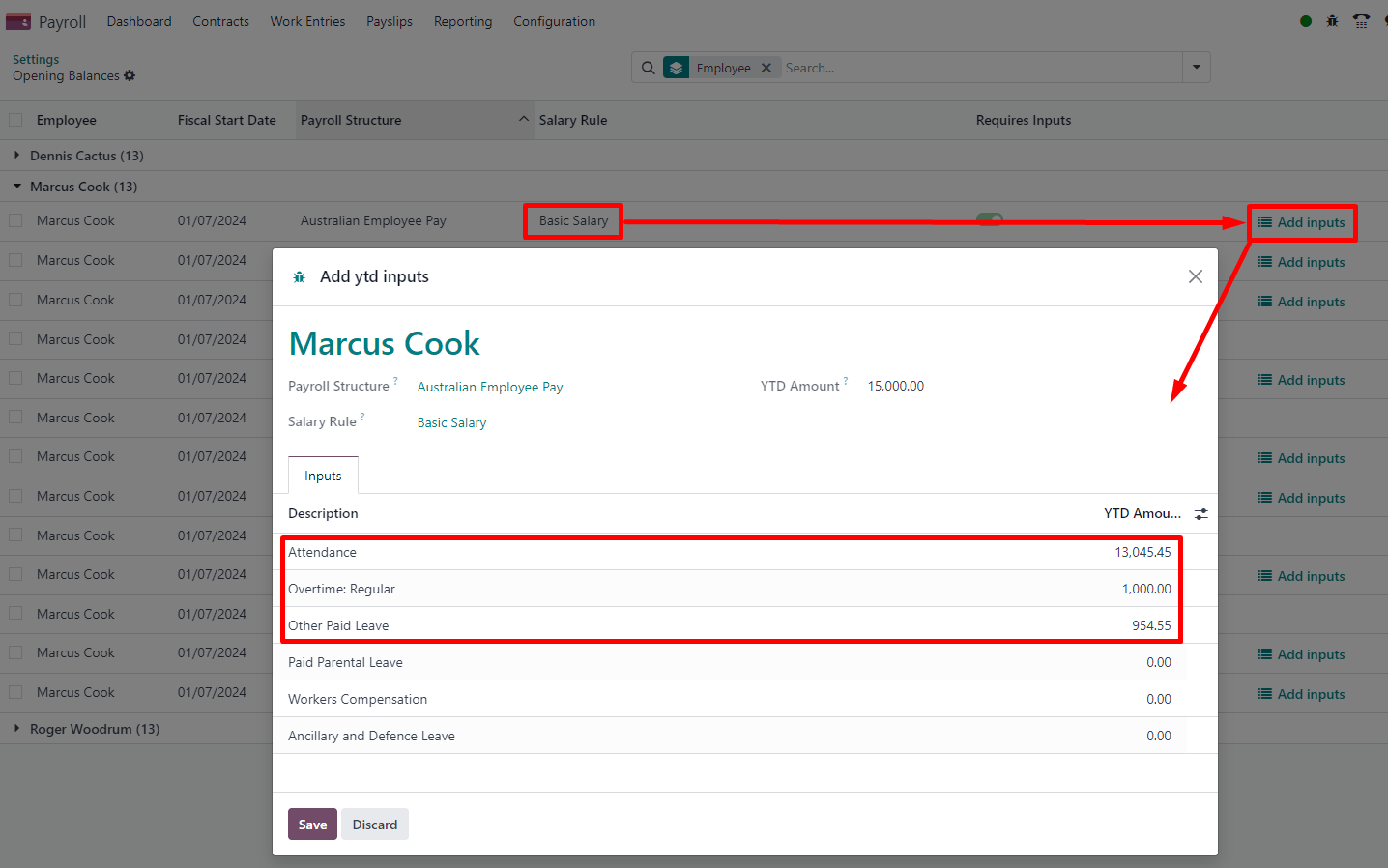

If some YTD balances need to be reported with more granularity to the ATO, you can use the salary rule’s inputs.

Example

For instance, the Basic Salary rule can contain six inputs, and three are necessary in our example: regular gross amounts, overtime, and paid leaves. These are all reported differently in terms of YTD amounts.

The finalized YTD opening balances for Marcus Cook look like the following.

As a result, YTD computations on payslips are based on the employee’s opening balances instead of starting from zero.

STP finalisation¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2, and the finalisation flows described below do not yet submit data to the ATO.

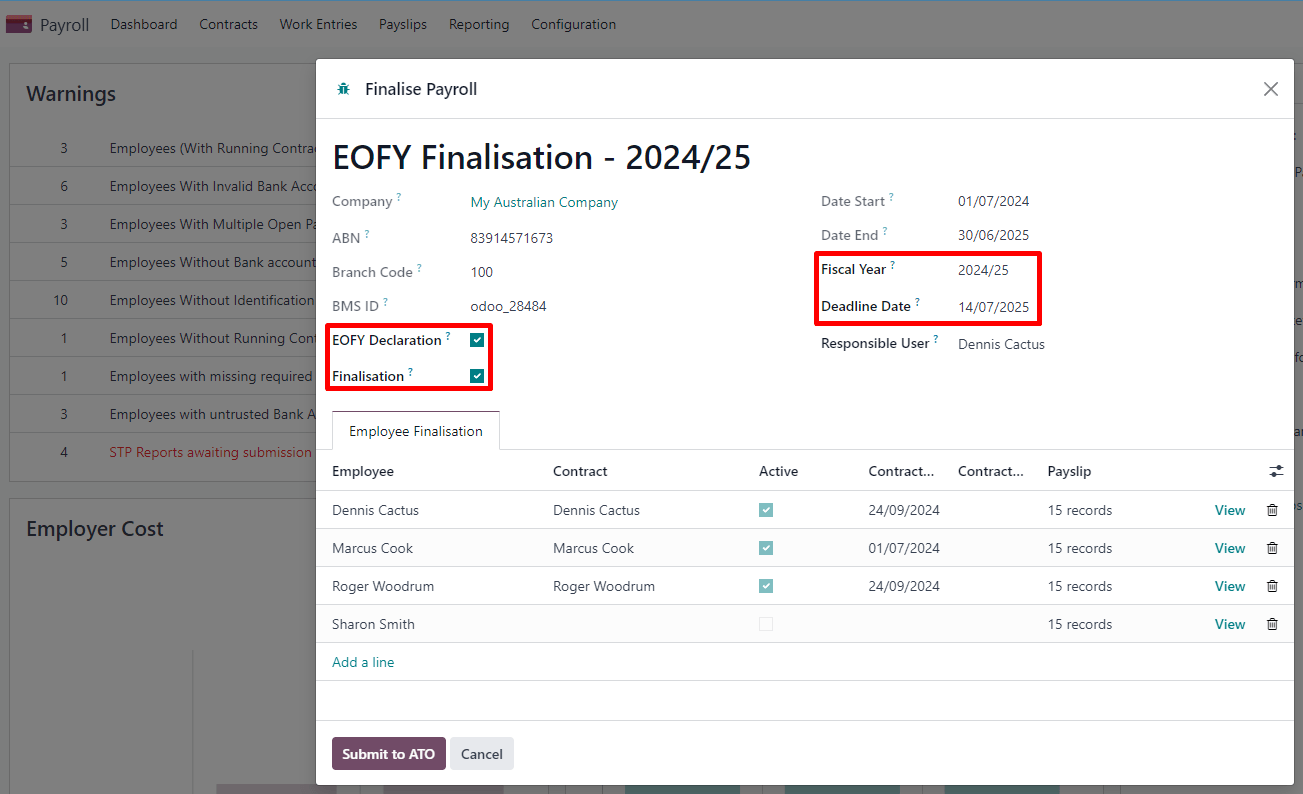

EOFY finalisation¶

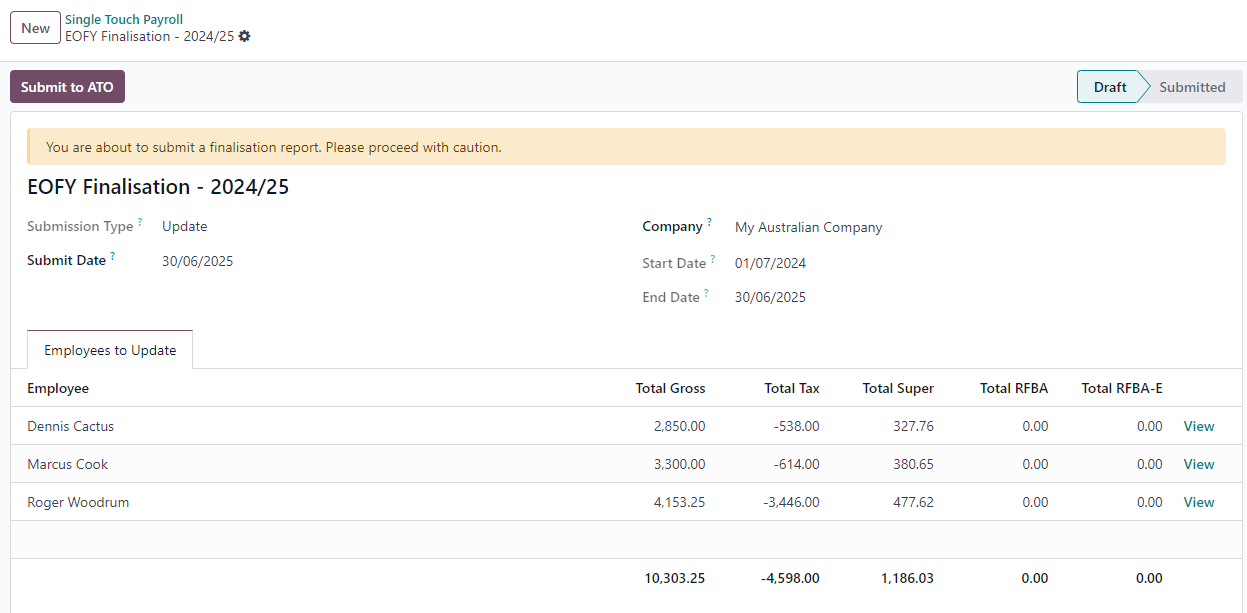

Employers reporting through STP must make a finalization declaration by 14 July each year. To do so, go to .

Both active and terminated employees to finalise are displayed.

From the finalisation form view, you can proceed with a final audit of all employees’ payslips during the relevant financial year. Once ready, click Submit to ATO. When you have made the finalisation declaration, employees will see the status of their payment information change to Tax ready on their online income statement after the end of the financial year.

Individual finalisation¶

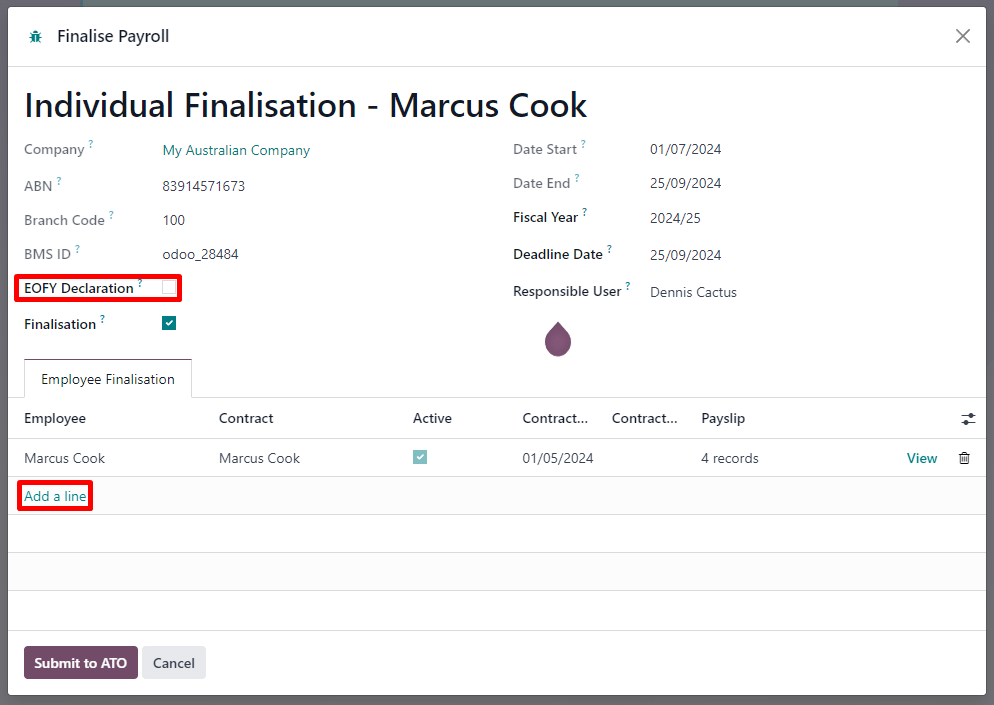

Odoo also allows you to finalise employees individually during the year. This can be useful when:

one-off payments are made after a first finalisation; and

finalisation after termination of employment during the year.

To proceed with an individual finalisation, go to , leave the EOFY Declaration checkbox unticked, and manually add employees to be finalised.

Even if you finalise an employee record partway through the financial year, the ATO will not pre-fill the information into the employee’s tax return until after the end of the financial year.

调整¶

重要

Odoo is currently in the process of becoming compliant with STP Phase 2, and the adjustment flows described below do not yet submit data to the ATO.

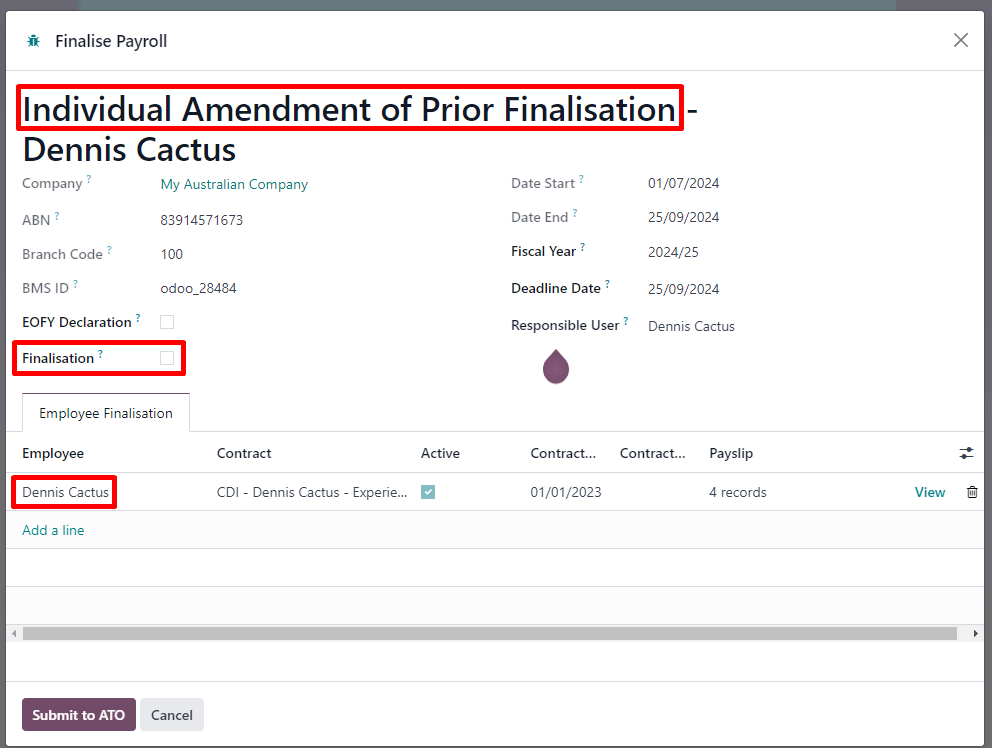

Amend finalisation¶

If you need to amend YTD amounts for an employee after a finalisation declaration was made, it is still possible to remove the finalisation indicator for that employee. To do so, go to , select the employee, and leave the Finalisation checkbox unticked.

When ready, click Submit to ATO to file the finalisation update to the ATO.

Once the correct YTD details are ready for that employee after amendment, finalise that employee again.

注解

The ATO expects employers to correct errors within 14 days of detection or, if your pay cycle is longer than 14 days (e.g., monthly), by the date you would be due to lodge the next regular pay event. Finalisation amendments can be done through STP up to five years after the end of the financial year.

Finalising and amending finalisation for a single employee can also be useful when rehiring an employee within the same financial year.

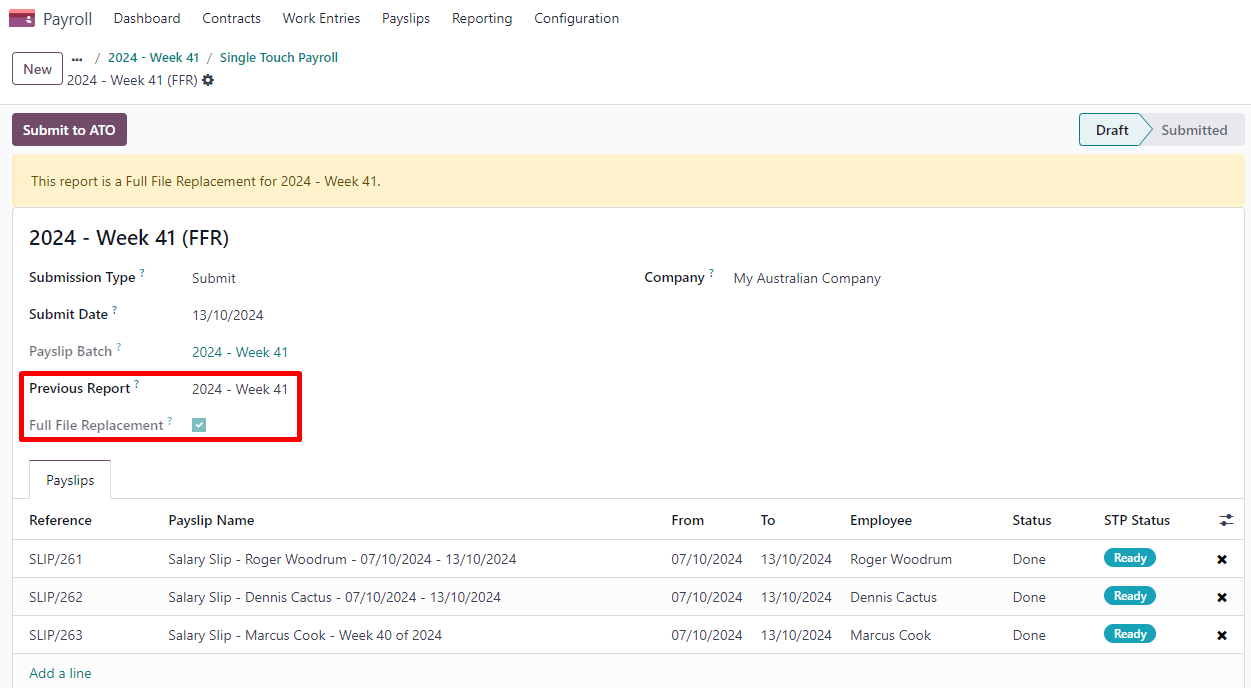

Full file replacements¶

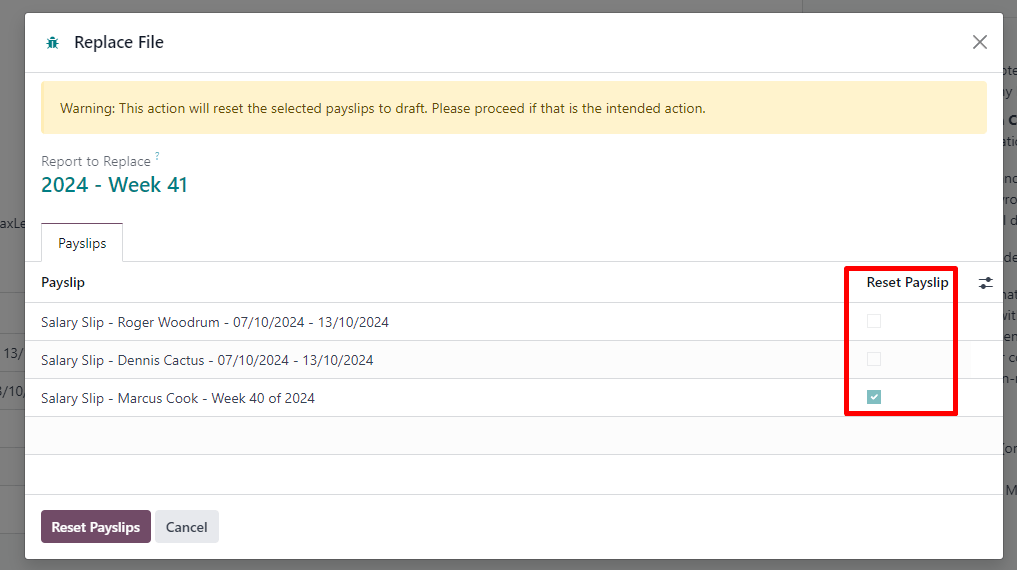

An employer can make full file replacements of pay runs to replace the last lodgement sent to the ATO if it turns out to contain significantly inaccurate data.

To do so, open the last STP submission and click Replace File. Then, select which payslips need to be reset by ticking the Reset Payslip checkbox.

Resetting payslips does not create new payslips or a new pay run, but instead:

The payslips batch is reset from Paid or Done to Confirmed.

The status of the reset payslips revert back to Draft.

The correct payslips remain paid and matched against the original payment.

A new STP submission is created to replace the former one. For traceability purposes, the former STP submission is not deleted but marked as replaced.

First, correct the reset payslips and create their draft entry. Once done, the Submit to ATO reappears on the payslip batch to process the full file replacement.

When ready, submit the pay run to the ATO once again. Please note that full file replacements are only meant as a last resort to amend a substantial amount of erroneous data. When possible, the ATO recommends correcting an incorrect payslips by submitting a correction as part of the next pay run or via update event.

Moreover, it is not possible to submit a second full file replacement of the same submission, and a full file replacement can only be done once every 24 hours.

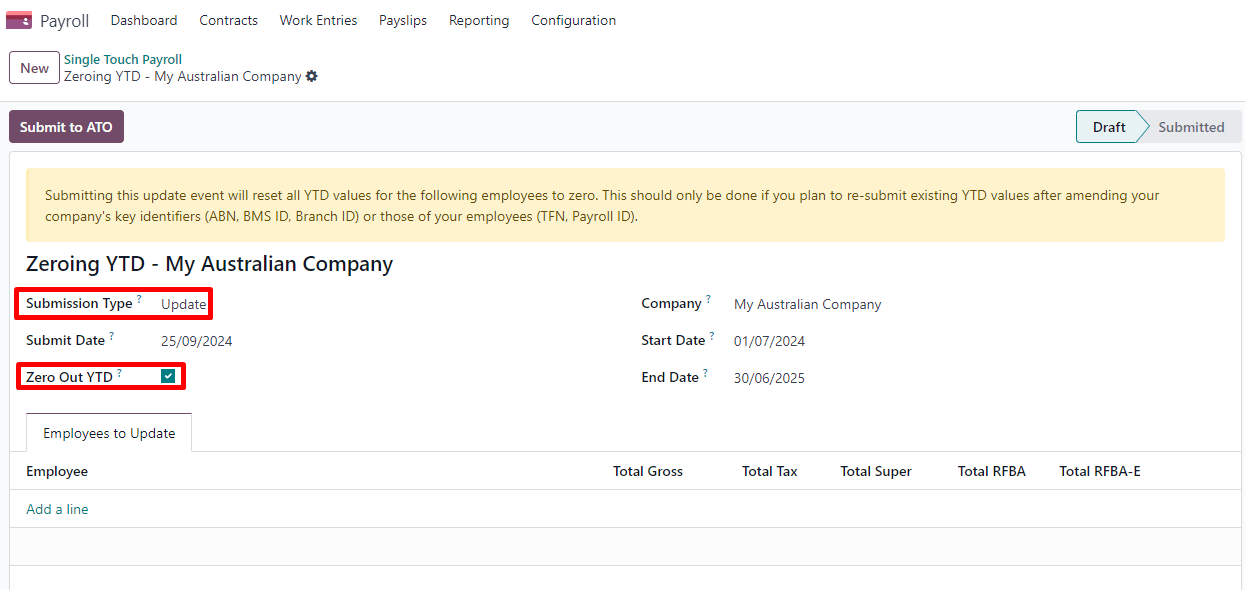

Zero out YTD values¶

In case of a mid-year change of several key identifiers, YTD values need to be zeroed out, and then re-posted with the updated key identifier.

For the following company identifiers, all employees need to be zeroed out:

ABN

Branch Code

BMS ID

For the following employee identifiers, only individual employees can be zeroed out:

TFN

Payroll ID

Before updating any key identifiers, create a new STP submission by going to and:

Change the Submission Type to Update.

Tick the Zero Out YTD checkbox.

Click Add a line to specify which employees.

Click Submit to ATO.

Once that is done, modify the key identifier(s) to amend.

Finally, go back to to create and submit a new Update, this time without ticking the Zero Out YTD checkbox. This will notify the ATO that the previously recorded YTD balances are to be adjusted to the new key identifiers.

Payroll links to other apps¶

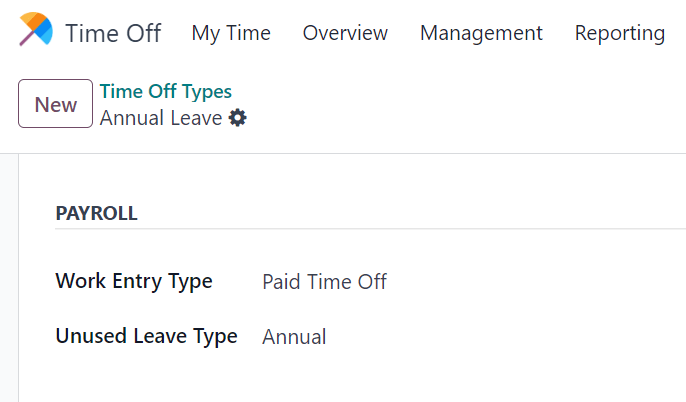

休假¶

The Time Off app is natively integrated with the Payroll app in Odoo. Different types of leaves will populate payslips based on the concept of work entries.

Go to , and for each type, configure the following two fields under the Payroll section:

Work Entry Type: defines which work entry should be selected on the Worked Days table of the payslip.

Unused Leave Type: choose between Annual, Long Service, or Personal Leave. If Personal Leave is selected, the remaining leave balance for this time off type will not show up as an entitlement at the time of termination. Unused leaves of the type Annual will include leave loading if the employee is eligible for it.

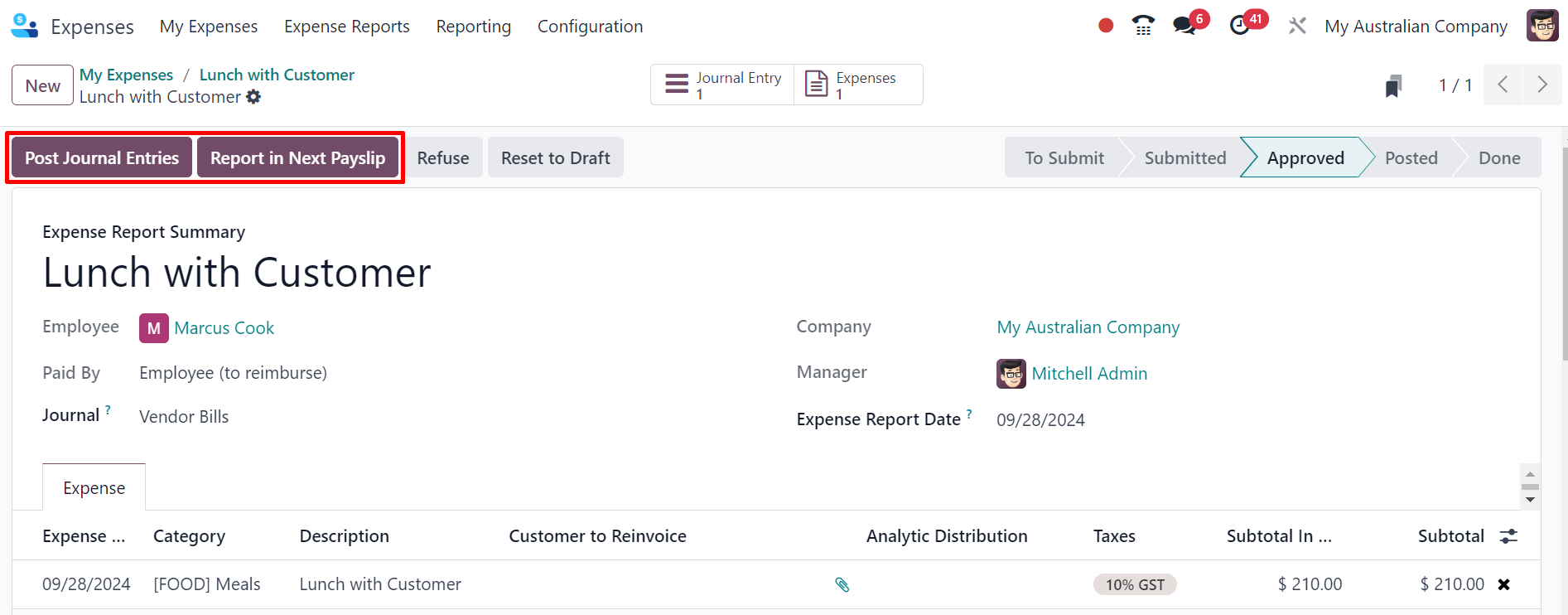

费用¶

The Expenses app is also natively integrated with the Payroll app in Odoo. First of all, go to and enable Reimburse in Payslip.

When an employee on your payroll submits an approved expense to be reimbursed, you can reimburse them using two ways:

If the expense is to be reimbursed outside of a pay run, click Post Journal Entries. The payment must be made manually.

If the expense is to be reimbursed as part of the next pay run, click Report in Next Payslip instead.

After an expense has been added to the next payslip, you can find it in the Other Inputs table. This input type is then computed as an addition to the net salary.

After paying the employee, the payslip’s journal item related to the employee’s reimbursement is automatically matched against the expense’s vendor bill.

高级配置¶

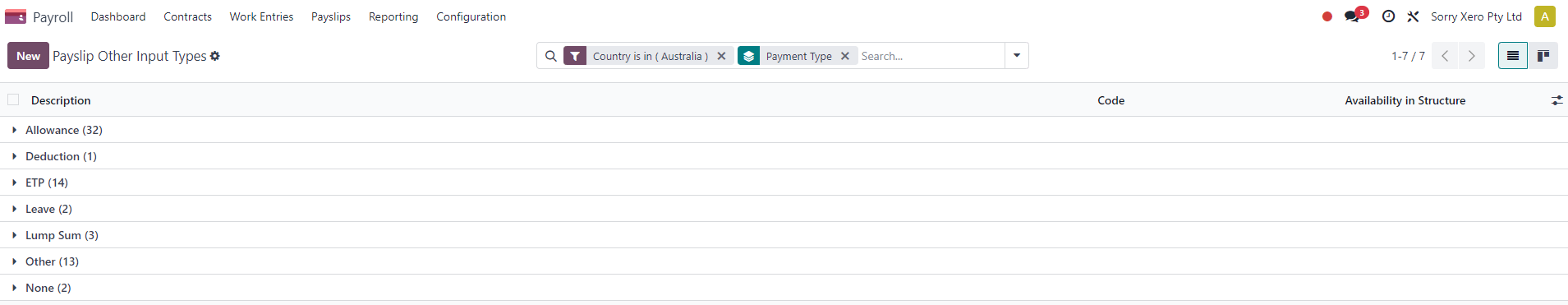

其他输入类型¶

您可以通过 访问其他输入类型。与澳大利亚有关的其他输入类型有 63 种。我们不建议将其他输入类型作为薪资解决方案的一部分,因为它们不能在 STP 框架内使用。您可以将它们存档或删除。

在每种输入类型中,以下字段都很重要:

付款类型 将输入类型分为六类:

津贴:除工资和薪金外,您支付给员工的另一笔款项。其中一些津贴是裁定待遇所规定的:洗衣费、交通费等。

重要

如果您计划使用不同预扣率的津贴(如 *每公里美分* 或 *差旅津贴*),请联系我们,以了解 Odoo 目前是否涵盖您的业务情况。

注解

截至 Odoo 18,一些津贴,如 洗衣:核准制服津贴 由另外两个输入进行管理:一个输入用于存入 ATO 限额内的已付金额,另一个输入用于存入超过 ATO 限额的金额。这是 Odoo 正确计算 PAYGW 所必需的。

有些企业可能需要根据员工情况将津贴报告从 OTE 转移到 薪水和工资。在这种情况下,您必须复制并重新配置现有的其他输入类型。例如, 与工作相关的非费用 津贴默认为 OTE。

扣除:工会费和子女抚养费扣款被视为扣款。

ETP:终止雇用付款。这些款项要么被视为除外款项,要么被视为非除外款项(见`ATO关于ETP组成部分税收的网页<https://www.ato.gov.au/individuals-and-families/jobs-and-employment-types/working-as-an-employee/leaving-your-job/employment-termination-payments-for-employees/how-etp-components-are-taxed>`_)。

休假:与休假相关的其他输入,与单个发薪期无关(一次性支付、在职期间兑现假期、未使用的假期等)。

一次性支付:重返工作岗位和一次性支付 E(用于支付背债)属于这一类。

其他:其他支付方式,有自己的特定逻辑。

PAYGW 处理 影响 Odoo 如何预扣该输入类型的税款:常规、无现收现付预扣税 和 :guilabel:`仅超额`(用于津贴)。

Superannuation Treatment: OTE, Salary & Wages, and Not Salary & Wages.

STP Code: only visible in developer mode, this field tells Odoo how to report the gross value of this payment to the ATO. We do not recommend changing the value of this field if it was already set by default.

Grouping other input types by Payment Type can help you understand the different scenarios in which these inputs can be used.

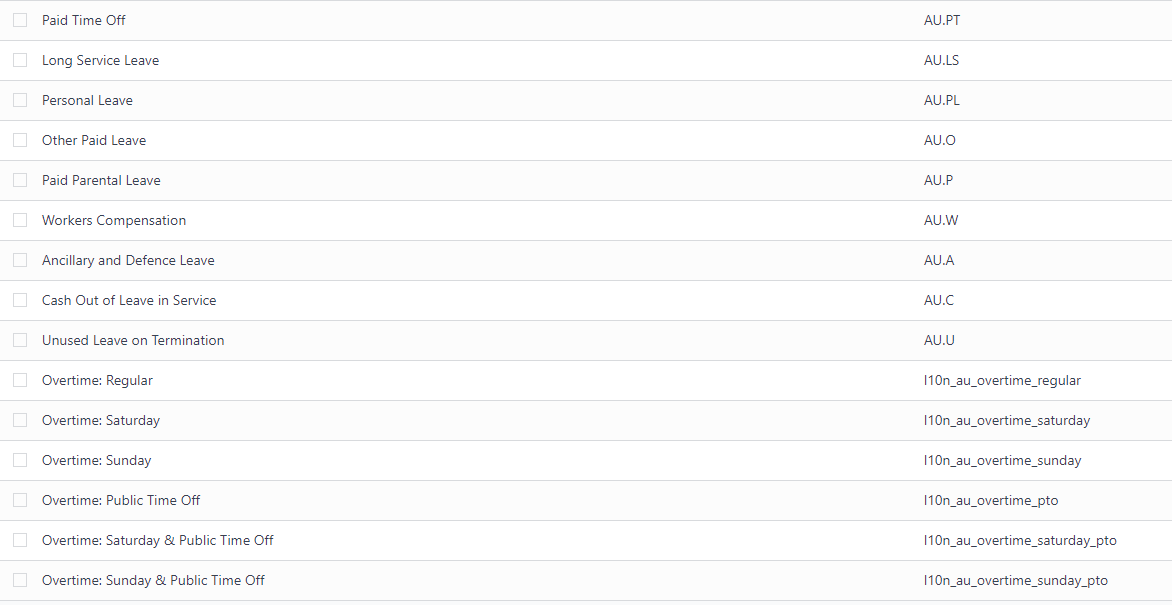

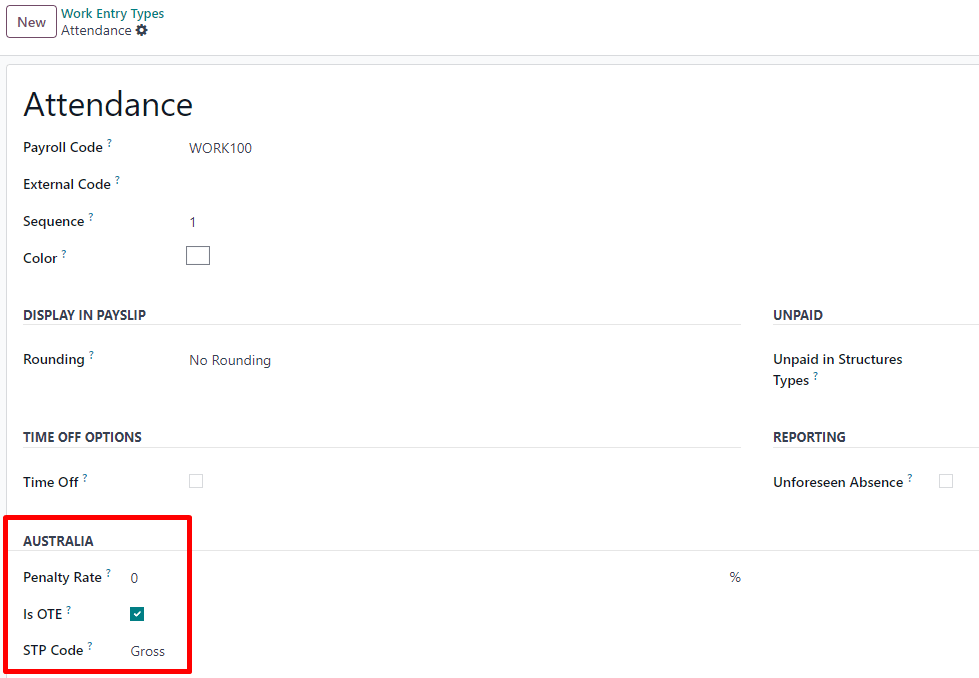

工作条目类型¶

A work entry type is a type of attendance for employees (e.g., attendance, paid leave, overtime, etc.). A few work entry types are created by default in every Australian database.

Before using Odoo’s payroll solution for Australia, it is recommended you trim work entry types to keep the ones you need only by going to

For each type, make sure to configure the following fields for Australia:

Is OTE: determines whether time spent in this category can be considered ordinary time earnings, meaning that the superannuation guarantee rate will apply (e.g., regular attendance, paid leave, etc.).

罚款率:用于确定适用于该类别时间的罚款百分比。重要的是,您应根据工作类型(如周六费率、周日费率、加班费率等)配置适用于您所在省/州或行业的罚款率。

STP 代码:仅在 开发者模式 中可见,此字段告诉 Odoo 如何向 ATO 报告在此类别中花费的时间。如果该字段已默认设置,我们不建议更改其值。

当前限制¶

从 Odoo 18 开始,我们不建议公司在以下业务流程中使用薪酬管理应用程序:

收入流类型:国外就业收入

税收待遇类别:演员和表演者

身故抚恤金报告

WPN 的报告义务(而不是 ABN)

预扣率不同的津贴(如*每公里美分*的津贴和*差旅津贴*)。

如果您想确定 Odoo 是否符合您在澳大利亚的薪资要求,请联系我们。

就业英雄整合¶

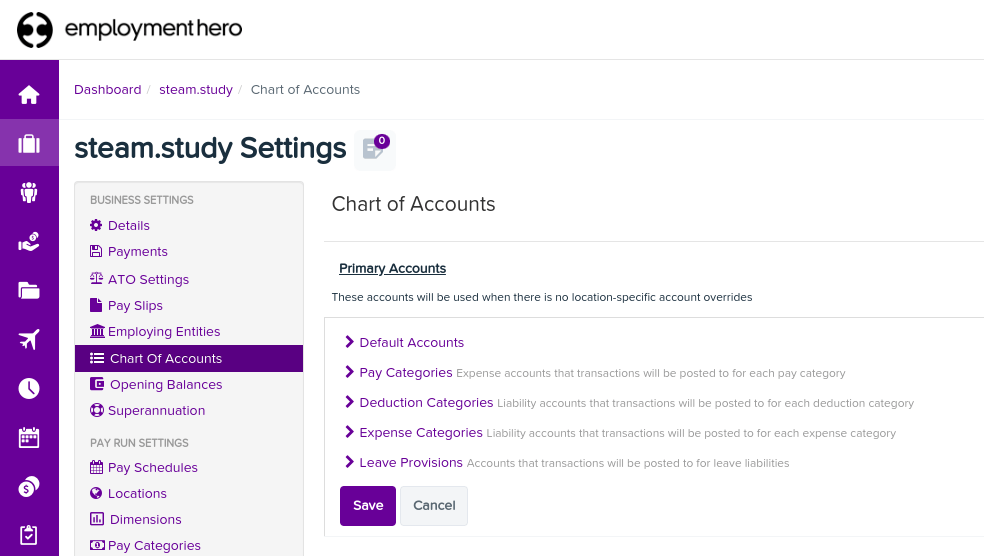

如果您的企业已经开始使用就业英雄,您可以使用该连接器作为替代薪资解决方案。就业英雄模块可将工资单会计分录(如支出、社会费用、负债、税金)从 就业英雄自动同步到 Odoo。薪酬管理仍在就业英雄中完成;Odoo 仅记录日记账分录。

配置¶

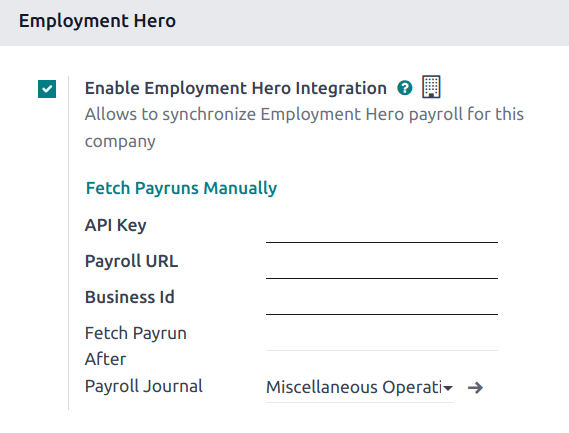

安装 就业英雄工资单模块 (

l10n_employment_hero)。通过 配置就业英雄 API。勾选 启用就业英雄整合 复选框后,将显示更多字段。

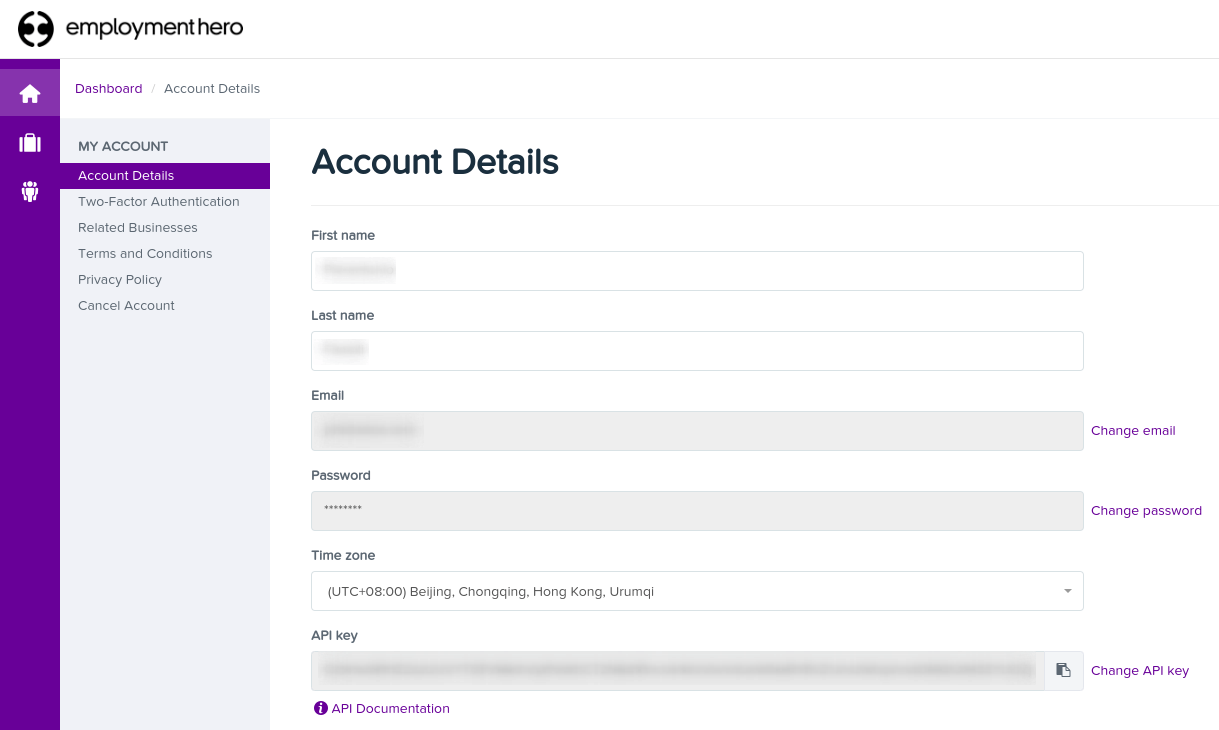

在就业英雄平台的 我的账户 部分找到 API 密钥。

工资单 URL 已预填为

https://keypay.yourpayroll.com.au。警告

不要更改预先填写的 工资单 URL。

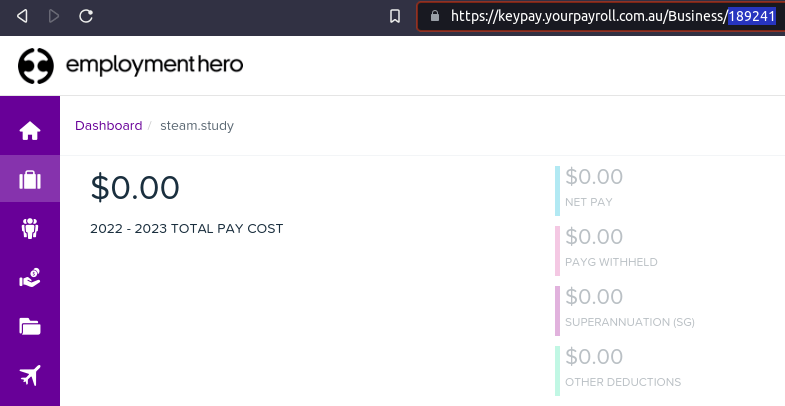

在就业英雄URL中查找 企业 ID`(例如,`189241)。

选择任何 Odoo 日记账作为 薪酬管理日记账 来发布工资单条目。

进入 配置税金。为就业英雄工资单条目创建必要的税项。在 字段中填写匹配就业英雄税的税号。

The API explained¶

该应用程序接口将日记账条目从 Employment Hero 同步到 Odoo,并将其保留在草稿模式。参考资料包括括号中的 Employment Hero 工资单条目 ID,方便用户在 Employment Hero 和 Odoo 中检索相同的记录。

By default, the synchronization happens once per week. It is possible to fetch the records manually by going to and, in the Employment Hero, clicking Fetch Payruns Manually.

Employment Hero payslip entries also work based on double-entry bookkeeping. The accounts used by Employment Hero are defined in the Payroll settings section.

For the API to work, you must create the same accounts as the default accounts of your Employment Hero business (same name and same code) in Odoo. You also need to choose the correct account types in Odoo to generate accurate financial reports.